What are a Loan and a Line of Credit?

A loan is a financial arrangement between an individual or a business and a bank or a financial institution. The loan provider or the lender issues a specific sum of money to the loan taker or the borrower. The money is given in return for interest payment for the use of funds. A line of credit is also a similar financial arrangement between an individual or business and a financial institution. They also charge interest for the money they grant for use. Although these two facilities sound similar, there are a number of differences between a loan and a line of credit.

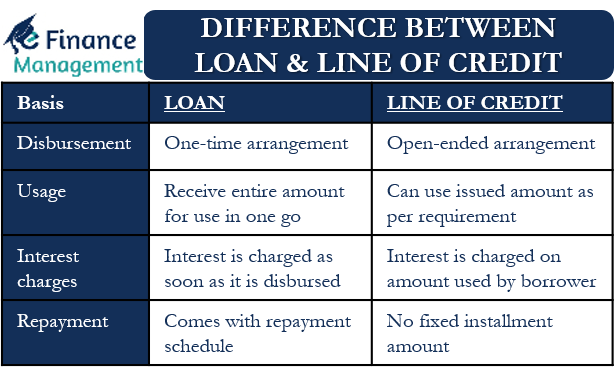

Differences between a Loan and a Line of Credit

Disbursement and Usage

Loans and lines of credit primarily differ in their disbursement and usage style. Banks issue a loan in lump sum amounts. It is a one-time arrangement, and the issue does not repeat. For example, if a business takes a loan for US$ 10000, it will receive the entire amount for use in one go at the start of the loan arrangement. Also, loans generally cater to the specialized need of the borrower. The loan can be for special purposes like buying a home, or a car, or machinery, etc. In the case of project loans etc., the disbursement of loans can be in installments. And it is as per the progress of the project and as outlined at the time of sanction of the loan. Once the full amount of the loan is availed, then no further disbursement happens, even if there is a partial repayment.

On the other hand, the amount that a person or business gets as a line of credit is not a one-time arrangement. It is an open-ended arrangement with a revolving limit, similar to credit cards. The borrower can use the entire issue amount in one go or use it in parts, as per his requirement. Secondly, the maximum limit of utilization is fixed. However, unlike a loan, this limit gets reset every time when partial repayment happens.

Example

For example, suppose a bank issues a line of credit for US$ 10000. A borrower can use US$2000 at a time and then the balance amount at some later date. He may not use the balance amount at all if the need does not arise. Also, if he repays the amount he has used to date to the bank, he becomes eligible to withdraw again and use the full US$10000, which is his limit.

Also, the borrower is free to use the amount sanctioned as the line of credit for purchasing anything of his choice. He is not under any obligation to buy a pre-determined product or service, like in a loan. Hence, funds usage in a line of credit is much more flexible.

Interest Charges

Banks start charging interest on a personal loan or any loans for that matter as soon as it is disbursed. Except where the loan disbursement happens in installments, the interest is charged on the entire loan amount. Continuing with the above example of a loan of US $10000, a bank will start charging interest on the entire US $10000 right from the start of the loan tenure. Because the bank will transfer or credit the loan amount to the borrower’s account. And whether the borrower has used it or not is of no relevance.

Unlike loans, banks charge interest only on the amount a borrower uses in case of a line of credit. As in the above example, the bank will charge interest only on US$ 2000, that too when this amount is actually withdrawn. They will not charge interest on the entire US$ 10000. Also, the borrower need not pay any interest to the bank from the day he repays back the amount that he had withdrawn. Therefore a line of credit can be very useful as an emergency fund from which one can draw only if it is essential. Because of this flexibility, banks generally charge a higher interest rate on a line of credit than a loan.

Repayment

Loans generally come with a repayment schedule, with a fixed installment amount that one has to pay back. This repayment usually happens monthly, on a pre-decided date. The amount that one pays back is a mix of the principal amount and interest on the loan. The credit arrangement with the lender comes to an end once the borrower repays all his installments. The only way to extend this facility is to apply for a new loan. Also, the loan tenure is usually longer than that in a line of credit.

Also Read: Letter of Credit Vs. Line of Credit

There is no fixed installment amount in the case of a line of credit. Repayment has to be done only when the borrower actually uses some amount. They need to make a minimum monthly payment, which is a mix of the principal sum and interest amount. Generally, a line of credit arrangement requires an annual renewal, which is not the case with a loan arrangement.

Which one is better: A Loan or a Line of Credit?

Borrowers often face the difficult question of which facility to use while borrowing from a bank or a financial institution- a loan or line of credit. Though there are many differences between the two facilities, as discussed above, there are a number of similarities too. Both the facilities lend money to an individual or a business on the basis of their credit score, past borrowing and repayment history, etc. Both the facilities usually require the borrower to furnish security against the loan. The lender has the right to seize the security in case of a default in repayment by the borrower. They charge interest on the sum issued. Whenever a borrower pays back money to the lending institution by way of an installment, he is paying back a portion of the principal amount, and the balance is the interest amount in both cases.

Loans

Even with the above similarities, the basic structures of both arrangements differ. If an individual wants a credit facility for a specific purpose, such as buying machinery, or land, or a house, a loan arrangement will be the best for him. The loan amount will be towards a specific investment and cannot be of use for other purposes. This restricts the wasteful expenditure of borrowed money. Also, there is a fixed repayment schedule that the borrower knows in advance. Hence, it becomes much easier to plan and budget for its repayment. Moreover, the tenure normally for a loan is longer. Therefore the repayment burden is less and equitably distributed over the loan tenure.

Line of Credit

A line of credit is a better option for those who want a flexible credit arrangement with the bank. They do not need a credit facility to make any specific investment. Their line of work may require ad-hoc funds, like in the case of a supply business where the seller may want to buy more from a manufacturer even before he receives the due payment from his customers. He may use his line of credit and repay the amount as soon as he receives his payments from the customers. In this case, he will save on his interest costs and will have to pay interest only for the time he actually uses the bank money.

Therefore, a borrower should carefully assess what his actual need is before taking either of the two facilities. He should look into the pros and cons of both of them and judicially make his choice according to his need. Tenure of the facility, interest cost, clarity about the required quantum, etc., is the key factors that would guide the final decision.