Meaning of Mortgaged Debentures

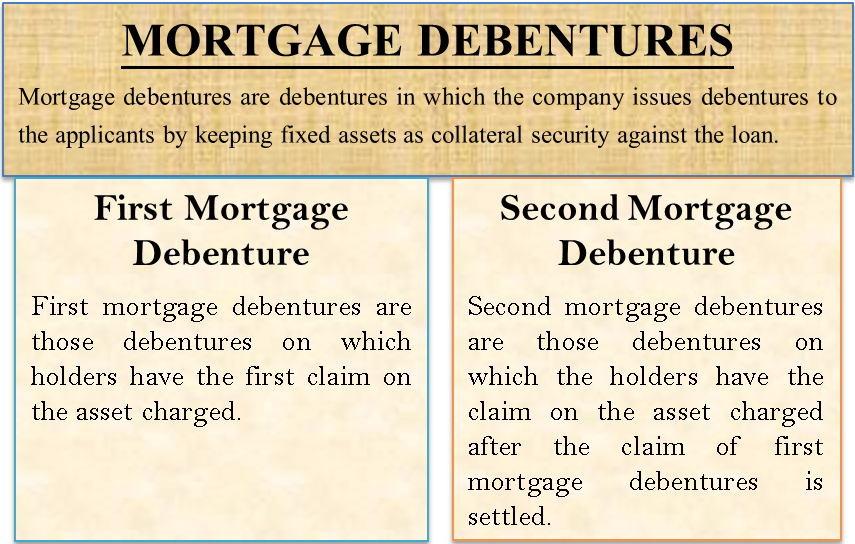

Mortgaged debentures are the types of debentures in which the company issues debentures to the applicants by keeping fixed assets as collateral security against the loan. The business issues mortgage debentures in order to purchase the fixed assets or support routine operations.

Individuals and financial institutions are always more interested in buying mortgage debentures than other corporate bonds issued by the company. This is because when the company issues this debenture, the chances of default in the payment are very low. In addition, these mortgage debentures are secured against the company’s fixed assets, providing the investors further assurance.

Secured and Unsecured Debentures

Secured debentures are also termed mortgage debentures.

These debentures have some assets of the company as collateral security. Since the applicant’s investment is protected against the company’s assets, it is called a secured debenture.

On non-payment of the amount at the time of redemption of secured debentures by the company, the applicants have the right to claim their due amount by selling the secured assets. On the other hand, unsecured debentures are not secured by any asset of the company. These debentures are issued solely on the credibility of the issuer.

Also Read: Characteristics of Debenture

Further, they are of two types:

First Mortgage Debentures

First mortgage debentures are those debentures on which holders have the first claim on the asset charged.

Second Mortgage Debentures

Second mortgage debentures are those debentures on which the holders have the claim on the asset charged after the claim of the first mortgage debentures is settled.

Conclusion

Mortgage debentures have been gaining popularity among investors in recent times. The investors feel secure about the money they invest in mortgage debentures. The companies who see growth opportunities are tapping the market by issuing these debentures as it attracts investors instantly. Thus, we can say that mortgage debentures have wide acceptance among the investors, and it fulfills the organization’s financial needs easily.

Quiz on Mortgaged Debentures

Let’s take a quick test on the topic you have read here.

This is a very informative article about mortgage debentures. But the thing is people do not consider it during the time of mortgaging because they do not know about it. Hence security against the loan is very important. Thus I am sure this is going to help all those who just reached on it.