Definition of Balloon Payment

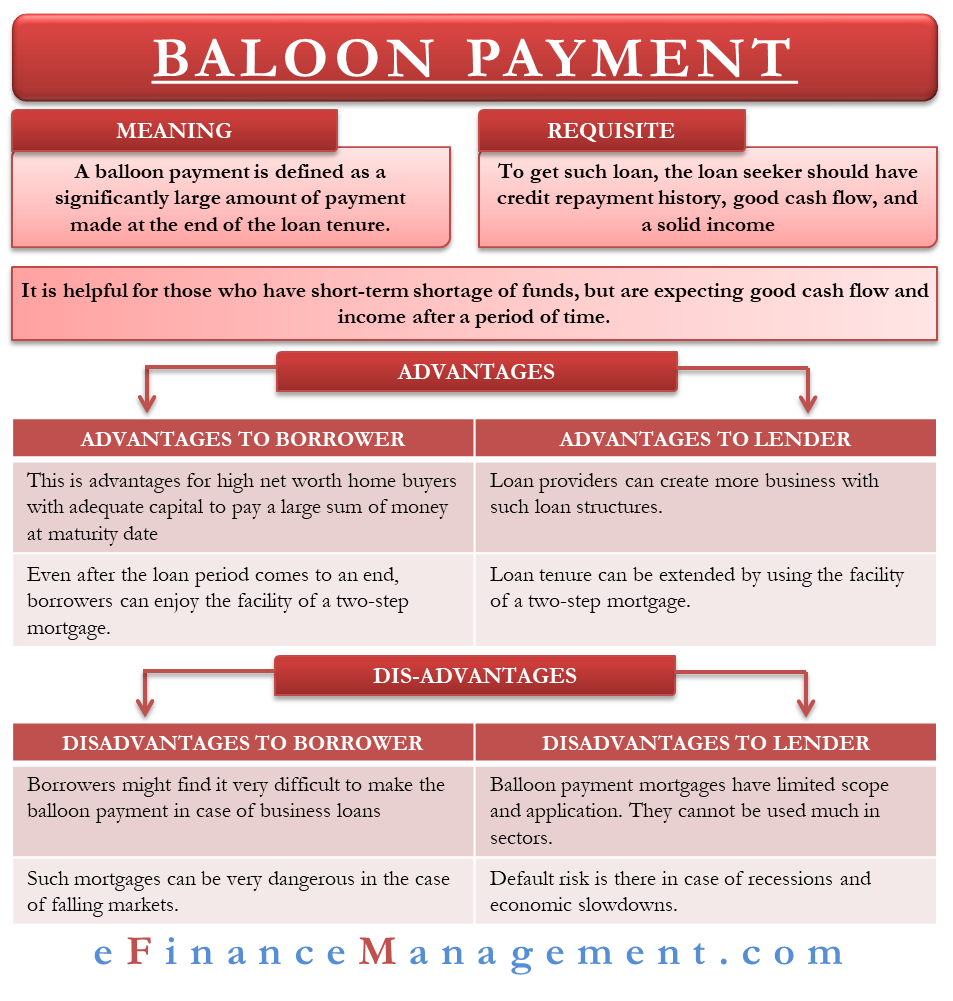

A balloon payment is defined as a significantly large amount of payment made at the end of the loan tenure. Most part of the principal amount is paid in one sum when the loan period comes to an end. It is called a Balloon Payment because of its meaning of a large sum of payment. This is generally at least twice as large as regular payments made during the period of loan repayment.

In most cases, these loans are interest-only during the loan period, and the entire principal amount becomes due at the end of the loan term in one go. One example of such type of loan is a bullet loan. Such loans are tailor-made for people with fluctuating incomes looking for short-term finance.

Requisites for Balloon Payment Loan

People with an excellent credit repayment history, good cash flow, and a solid income base generally get these loans. A major portion of the loan is to be repaid at the end of the loan tenure, and hence there is repayment risk. Such loans are more common in commercial real estate financing, auto financing, and business financing. Most homeowners are not in a state to make a large balloon payment at the end of the loan tenure, and hence such loans are not very common in residential real estate financing.

Need and Relevance

Balloon Payment structured loans can be very helpful for companies or individuals who have a short-term shortage of funds but are expecting good cash flow and income after a period of time. In the commercial real estate segment, such financing can be very advantageous. The borrower can continue paying the interest amount and repay the principal amount in the form of balloon payment by selling off the property for which the loan was taken.

Also Read: Bullet Loan

Advantages of Balloon Payment Structure

Such Loan structures are advantageous, both for the borrowers as well as the lenders. Few advantages from borrowers’ point of view are-

- High net worth home buyers with adequate capital to pay a large sum of money at the maturity date can use balloon mortgages. They can finance their homes with low mortgage payments for some time, making only the interest payments for a few years and defer paying the principal amount.

- Even after the loan period comes to an end, borrowers can enjoy the facility of a two-step mortgage. This facility depends on factors such as the borrower’s payment track record over the mortgage period, the steadiness of his current source of income, etc. The lender will refinance into a new mortgage, generally at the current market interest rate. Borrowers get an opportunity to delay the final lump sum payment for a few more years and comfortably repay the loan when the new mortgage expires.

A few advantages from the lenders’ point of view are-

- Loan providers can create more business with such loan structures. Borrowers can be lured to take more of such loans as they can repay a major chunk of the loan amount at the end of the loan term.

- Loan tenure can be extended by using the facility of a two-step mortgage. This means more interest income for the lender.

Limitations of Balloon Payment Structure

Such loan structures have a few limitations too. From the borrowers’ point of view, a few of the disadvantages are-

- Borrowers might find it very difficult to make the balloon payment in case of business loans or even auto loans. In all such cases, the borrowers may not meet the lump sum payment requirements. The loan provider may eventually seize its assets.

- Such mortgages can be very dangerous in the case of falling markets. The borrowers might have anticipated a good increase in their real estate market value. It might not be the case at the end of their loan term. In the case of falling housing markets, properties might fetch low sale values. This would result in default in a balloon payment due and seizure of their assets.

Few limitations from lenders’ point of view are-

- Balloon payment mortgages have limited scope and application. They cannot be used much in sectors such as residential real estate financing as the risk of default is high. Borrowers might not be able to make a lump sum payment of a major loan portion in one go at the end of the loan term. This would result in the default of the loan.

- Similar default risk is there in case of recessions and economic slowdowns. In such situations, borrowers might not be in a position to make the balloon payment. Assets against which loan was provided might have devalued in such slowdowns. Lenders would be at a loss even if they go for the realization of their loans by selling off the security.

Conclusion

The Balloon Payment structure is very lucrative and useful for buyers, but such loans come with high risk too. Loan providers face a constant risk of their loans turning bad. Forced restructuring and conversion of their loans into new mortgages can also happen. Borrowers might not be in a position to make the balloon payment on the due date. On the other hand, borrowers can lose their collateral provided as security. The loan provider may seize or even sell off the collateral. Utmost care should be taken to give such loans. Proper background checks of the borrower, a sound financial base, and good credentials are necessary.