There are various options available in a business to finance its assets. It may be an operating lease, financial lease, installment sale, and a host of others. However, the financial and accounting implications should be taken into account in making decisions. Leasing is a practice that allows a person to use the asset for an agreed period of time against payment of lease rentals. At the end of the term, the lessor can sell the asset to a lessee or terminate/extend the agreement as per mutual consent. Let us see in detail lease finance vs installment sale.

Majorly, there are two types of lease transactions:

Financial Lease

A finance/capital lease is long-term in nature and is continued till the economic life of the asset. The cumulative lease rental payments throughout the contract are greater than the asset’s initial cost. Examples are: Taking a building or factory on a lease.

Operating Lease

This type of lease is short-term in nature and is generally for a specific period that is much less than the asset’s economic life. The total lease rentals during the leased period do not exceed the cost of the leased asset. Hiring a car, for instance, is an example of an operating lease.

An installment sale is one of the finance facilities to buy vehicles or other assets in exchange for a specified series of payments. The ownership transfers at the end of the credit agreement. It may or may not include interest and carries certain tax advantages i.e.

It can be used for all types of properties, except:

- Securities are traded in exchange markets.

- Property for sale in the ordinary course.

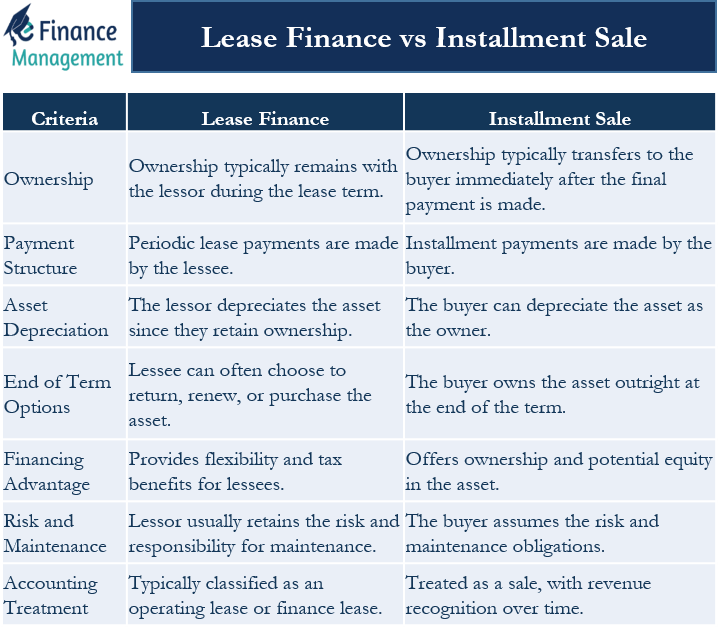

Lease Finance vs Installment Sale

Nature

An installment sale is a sale, whereas lease financing is a type of rental contract with a purchase option between the two parties.

Ownership of the Asset

In lease finance, the lessor retains ownership of the asset throughout the lease term. while the lessee merely has the right to use the asset. In contrast, an installment sale involves the transfer of ownership from the seller to the buyer, typically after the final payment is made.

Transfer of Risks and Rewards

In lease finance, the lessor generally bears the risks and rewards associated with the asset, such as changes in its value or maintenance costs. The lessee is primarily responsible for making lease payments and using the asset. In an installment sale, once the buyer takes possession of the asset, they typically assume both the risks and rewards of ownership.

Nature of Payments

In lease finance, the lessee makes regular lease payments to the lessor for the use of the asset during the lease term. These payments may include factors like rent, interest, and sometimes maintenance fees. In an installment sale, the buyer makes periodic installment payments to the seller, typically comprising both principal and interest, until the full purchase price is paid.

Tax Benefits

The total deduction for taxation purposes is the same for leasing and installment sale. However, in the case of leasing, it takes twice as long to write off the asset as compared to an installment sale. The lessor claims the depreciation in lease financing whereas, in an installment sale, the user claims the depreciation.

Also Read: Lease Finance vs. Term Loan

End-of-Term Options

At the end of a lease finance agreement, the lessee may have several options. They could return the asset to the lessor, extend the lease term, or have the option to purchase the asset at a predetermined price (in the case of a finance lease). In an installment sale, once all payments are made, the buyer becomes the outright owner of the asset without any further obligations to the seller.

Balance Sheet Appearance

In operating lease financing, the asset’s value is not included in the financial statements since the lessee is not the owner. Whereas in the case of the installment sale, the installments are capitalized, i.e., the asset appears on the asset side of the balance sheet, and a corresponding liability against such asset appears on the liability side.

Duration

Generally, leasing is suitable for longer periods and assets like land, property, heavy vehicles, and huge plant and machinery. An installment sale is made for short periods and assets like light-moving vehicles, electrical items, small machinery, etc.

Maintenance Support of the Asset

In the case of operating lease financing, the repairs and maintenance of the asset are borne by the lessor, and in the case of the financial lease, it is borne by the lessee. In an installment sale, the responsibility lies with the user.

Reduced Initial Cash Outlay

Since there is no immediate purchase of an asset in an installment sale, the cash flow is limited up to the margin money, i.e., the down payment or the deposit as it is so called, in addition to the periodic installments. In the case of lease financing, the monthly rentals are the only cash flows during the entire useful life of the asset.

Conclusion

It is, therefore, necessary to know the consequences while dealing with lease transactions and installment sales. The person should analyze the options with a different outlook. The economic viability of the transactions, along with the entries in financial statements, shall be according to the specified acts and rules. Also, the income tax consequences, as well as the VAT consequences, should not be overlooked.