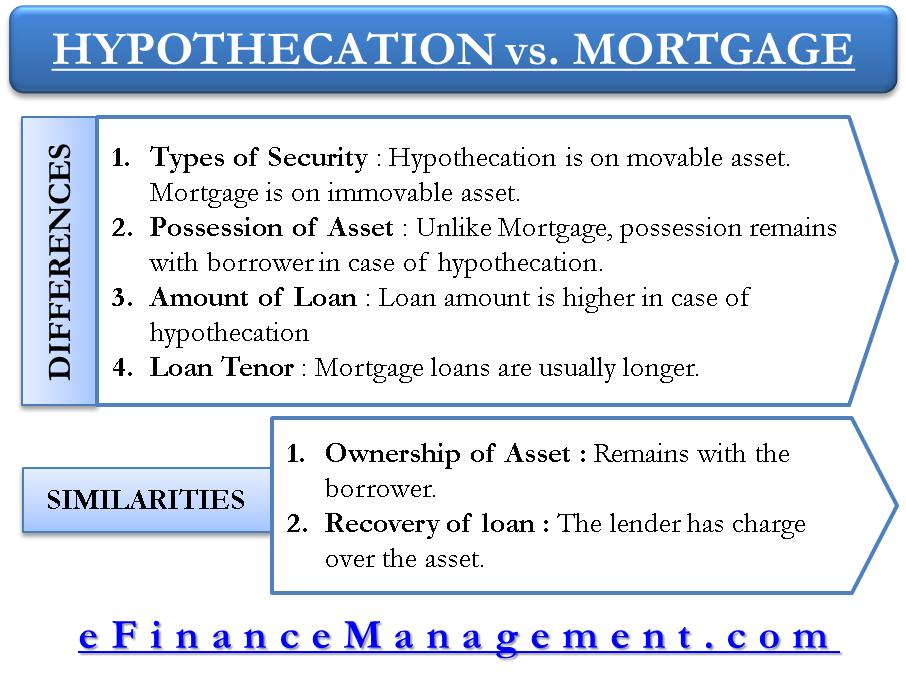

Mortgage and hypothecation are generally used to explain charges on assets secured for any loan. In both cases, the ownership lies with the borrower, which is the prime similarity between the two. However, these two mainly differ in the nature of asset secured, loan tenor, possession of the asset, and loan amount. Let us see in detail mortgage vs hypothecation.

Difference between Mortgage Vs Hypothecation

Type of Security

Hypothecation is a charge created by a movable asset. The asset under hypothecation is usually a movable asset like a vehicle, stocks, accounts receivables, small machines, etc. A mortgage is a charge created over immovable property, which may include land, buildings, factory premise, godown /warehouse, anything that is attached to the earth, or something permanently fastened to anything that is attached to the earth. One needs to note that crops though attached to the earth, cannot be included as “mortgaged” as they can be easily detached and sold.

Possession of the Asset

In the case of hypothecation, the possession of the asset remains with the borrower. In the case of a mortgage, the ownership is usually with the borrower but may not always be the case. It depends on the kind of mortgage created at the time of loan approval.

The Amount of the Loan

The amount of loan given against mortgage is usually higher than the amount of loan given just for hypothecation. For hypothecation against inventory, debtors, and the vehicle generally, the amount is generally smaller, while the value of houses, land, and building, etc., are usually of higher value, therefore attracting higher loan amount. Certain loans like “Working Capital” loans are a combination of financing against hypothecation of immovable assets like debtors and stock and mortgage of property.

Also Read: Hypothecation

Loan Tenor

Mortgage loans are usually of longer tenor (unless specific project/machinery which has a short definite life) than loans against hypothecation. For example Tenor of a vehicle, the loan is generally shorter than the tenor of a home mortgage loan. Also, loans given against stock, debtors are of the shorter period (renewable after a year or half-year) compared to a mortgage loan (usually of 10-20 years).

Similarities between Mortgage Vs Hypothecation

Ownership of the Asset

In both cases, the ownership of the asset remains with the borrower, with the first right being that of the lender until the time the loan is repaid. In a case of default, the lender may sell off the asset to recover the loan.

Recovery of Loan

In either case (mortgage or hypothecation), the lender has a charge over the assets. Hence, a lender can recover the loss by selling the asset, in the case of default.

Continue reading – Pledge vs Hypothecation vs Lien vs Mortgage vs Assignment.

Nice xplanation Sir

Quite Helpful and easy to understand site. Thank you for taking efforts. 🙂

Hi Priya,

Thanks for your kind words.

Keep sharing your experience with us.