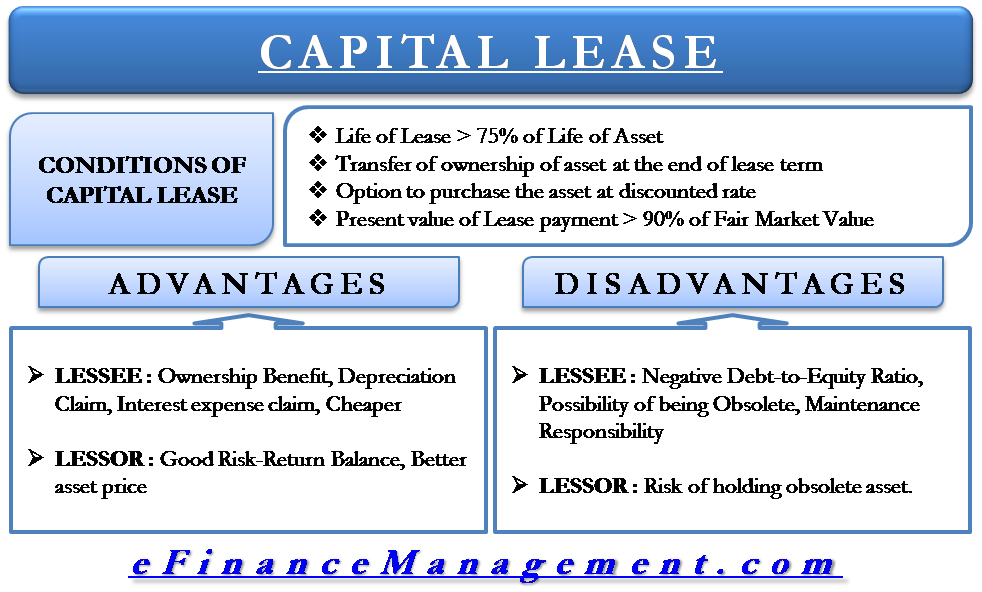

A capital lease is a type of lease agreement where the lessee is treated as the owner of the asset being leased. It is a long-term arrangement in which the lessee assumes the risks and benefits of ownership, typically used to finance the acquisition of expensive assets. Unlike an operating lease, a capital lease appears on the lessee’s balance sheet as a liability and the leased asset as an owned asset.

Advantages of Capital Lease

Let us learn about the advantages of the capital lease for both the lessor and lessee.

For the Lessee

The following are the advantages for the lessee.

Ownership Benefit

A capital lease is embedded with benefits that the lessee might get had he purchased the leased asset. The lessee can use the asset for more than 75% of its life. Furthermore, at the end of the term, the lessee gets an option to purchase the asset at a bargain price. In a nutshell, most of the ownership benefits of the lease go to the lessee.

Claim to Depreciation

As the capital lease involves a transfer of ownership rights to the lessee, the lessee can show the leased asset on their balance sheet and claim depreciation for the asset. As depreciation is an expense for the company, claiming it reduces the profit of the lessee’s company. This, in turn, reduces the taxes that the lessee has to pay.

Claim to Interest Expense

The lessee is not paying for the asset in question; the lessor makes the payment for the asset. Over and above the principal, the lessor charges an interest over the years for the money he has invested in the asset. As the lessee is paying this interest, he can show this interest expense as an expense in his income statement. This, in turn, reduces the profit and the tax liability of the lessee.

Also Read: Finance / Capital Lease

Cheaper

When a company wants to buy or lease an asset and doesn’t have the cash for it, it usually has to ask for a loan from the bank or raise funds from the market. The capital lease is the answer to a lot of questions in this case. The lessor funds the assets in a capital lease. Furthermore, the interest rate for capital lease funding is comparatively cheaper than a bank loan.

For the Lessor

The following are the advantages of a capital lease to the lessor:

Good Risk-Return Balance on Investment

Whenever any lessor gets into a capital lease agreement, its main motivation is to make money out of it. These lessors are usually people or companies with a lot of free cash lying around, and they want to make money through good investments. The capital lease is one of the best forms of investment because the returns are usually higher than debt market instruments such as debenture, bonds, and commercial papers. On the other hand, the risk involved is much less than high-risk high-return instruments such as equity. Therefore one can say that a capital lease is a form of investment where risk is measured, whereas return is high.

Better Asset Price

A lot of companies are solely involved in the business of leasing. They get into different types of lease agreements with multiple lessees. These companies also have special purchase arrangements with manufacturers. When such lessors decide to buy an asset to lease, they get the asset at a price cheaper than the market price.

Disadvantages of Capital Lease

Let us learn about the disadvantages of the capital lease for both the lessor and lessee.

For the Lessee

The following are the disadvantages of a capital lease to the lessee:

Negative Debt-to-Equity Ratio

When getting into a capital lease agreement, the lessee is creating a lot of debt in its balance sheet that has to be repaid in the form of part of lease payments. This increase in debt increases the debt to equity ratio of the lessee’s company. Investors view a high debt-to-equity ratio in a bad light. For the lessee, this may result in problems to raise further capital in the future.

Also Read: Capital Lease Criteria

The Possibility of being Obsolete

Let’s understand this with an example. Suppose. In 1995, a company buys 10 computers with Intel Pentium second-generation processor (the latest and the most happening processor at the time) through the capital lease of 7 years. In 1997 Intel introduced the Pentium-II processor; in 1999, it introduced the Pentium-III processor. The lessee cannot upgrade his computers because there are still 2 years remaining for the lease to expire. By this example, we understand that when the asset is a fast-changing technology or something similar, then there are high chances that the lessee will be stuck with an obsolete asset during the time of lease.

Maintenance Responsibilities

The responsibility for maintenance and repair of the asset lies on the lessee. This may not seem like much of a disadvantage at first go, but if we count the costs – regular maintenance, insurance cost, minor repairs, downtime cost, etc. the expenses escalate pretty fast. An even worse situation can be for assets such as trucks. For example, if a leased truck is met with an accident during the lease period, the lessee has to pay a high cost of repair. The lessee hadn’t taken this cost into account when leasing the truck.

For the Lessor

The following are the disadvantages of a capital lease to the lessor:

Risk of Holding Obsolete Assets

A major disadvantage of a capital lease to the lessor is that the lessee refuses to buy the asset at the end of the lease period and is stuck with an obsolete asset. Let’s take our previous example of a lessor leasing 10 computers with Intel Pentium second-generation processor in the year 1995 through a capital lease of 7 years. Now by the end of the lease term, Intel had introduced the Pentium 4 processor. Due to obvious reasons, the lessee doesn’t want to exercise it bargain purchase option at the end of the lease. Now the lessor has 10 obsolete computers at hand and no use for them.

In such cases, the lessor is definitely not making any losses; it has recovered all its investment and some amount of profit during lease payments; however, it is a drawback nonetheless. This is a classic case of loss of profit.

can you pl state a disadvantage of capitalizing a finance leased asset, is it off balance sheet financing is not possible thereafter,thanks

Dear Himanshu, good question. Let’s take it one by one.

1. Every company has an option either to go for direct purchase or lease. The decision is based on several factors and convenience. So the decision to go with the leasing has already been taken with so much of discussion and understanding.

2. Once that decision is taken, the lease arrangement has gone into then how come that be converted as a purchase transaction and bring back the assets on the balance sheet. More so, when under the lease the ownership is with the Lessor, then how come there be two owners of the same asset.

3. For the sake of discussions, for a moment even if we assume that you want to do it, but what you will achieve out of it:

(I) If you think by capitalizing and bringing the asset on the balance sheet you will be able to improve the assets available and thus more collateral then this will not be so. Because you have to bring back the equivalent liability also. (II) So asset and liability both will improve and it may jeopardize the existing debt-equity ratio as well as the debt servicing ratio.

I hope this satisfies your query. Thanks once again for the query.