What is Asset Financing?

Asset financing refers to the process of obtaining funds for purchasing or acquiring assets, such as equipment, machinery, vehicles, or real estate. Just as business owners provide equity in their business to the lenders for obtaining funds through equity financing, in asset financing, the asset itself acts as collateral for the financing.

It is a source of finance in which the business borrows money for purchasing assets. The payment obligation and the ownership rights of the borrower change depending on the method of asset financing.

Difference between Asset Financing and Loan

Asset financing is a type of loan that specifically involves the use of an asset as collateral to acquire that asset, while traditional loans are not tied to a specific asset. Instead, the borrower receives funds from the lender and is free to use them as they see fit.

Under asset financing, the lending is not in the form of a conventional loan where the lender gives one single payment to the borrower. Instead, the payment is spread over a period of time. This is a useful way to acquire assets without tying up large amounts of capital.

Also Read: Sources of Debt Financing

Types of Asset Financing

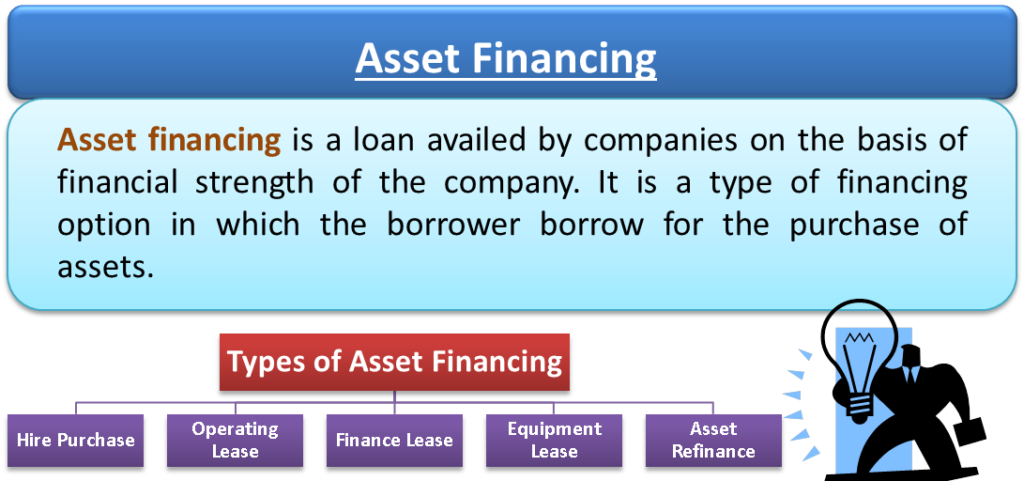

The following are the five types of asset financing:

Advantages of Asset Financing

The following are the various advantages and reasons why businesses prefer asset financing:

Resolve Liquidity Crunch Issues

With technology and innovations growing in every field, businesses constantly need money to purchase new assets. Asset financing allows businesses to acquire the assets they need to operate or grow their business without tying up large amounts of their own capital or cash reserves.

Capital expenditure for buying costly assets can lead to cash flow problems resulting in a shortage of working capital. A working capital crunch can hamper the regular functioning of the business. This is where the role of asset financing becomes important.

Tax Benefits

Asset financing also offers tax benefits for businesses, as the interest payments on the loan are tax-deductible.

Disadvantages of Asset Financing

The following are the disadvantages:

Risk of Technology Obsolescence

Banks and other financial institutions act as lenders in this financing. This is relatively safer for banks and other financial institutions than giving a conventional loan to borrowers. In this financing, the lending institutions’ finance is secured by the value of the asset financed. Moreover, the finance value is even secured through collateral security in most cases. If the borrower fails to repay the borrowed money, the lender can seize the asset and sell the same in the open market to recover the money.

But the major concern for financial institutions is that when the asset is sold in the secondary market after its seizure, the risk of a decline in the asset’s value always looms over its head. To overcome the risk, financial institutions finance the asset considering that the contingent claim is going to arise on the asset, and accordingly, they frame the lending terms.

Also Read: Financing Policy

Restrict further Borrowings

Since the asset is already acting as collateral, it cannot be used as security for further borrowings.

Conclusion

Asset financing is a boon to the business. If a business is willing to expand, it is a perfect solution for its financial needs. Companies now don’t need massive cash in hand before purchasing any new asset; instead, they can just fund it via asset financing. This is beneficial for the borrowers and the financial institutions who lend the money, as they get regular interest, and their risk is covered with assets kept as collateral security.

This is an excellent blog. A great read. I will definitely be back.