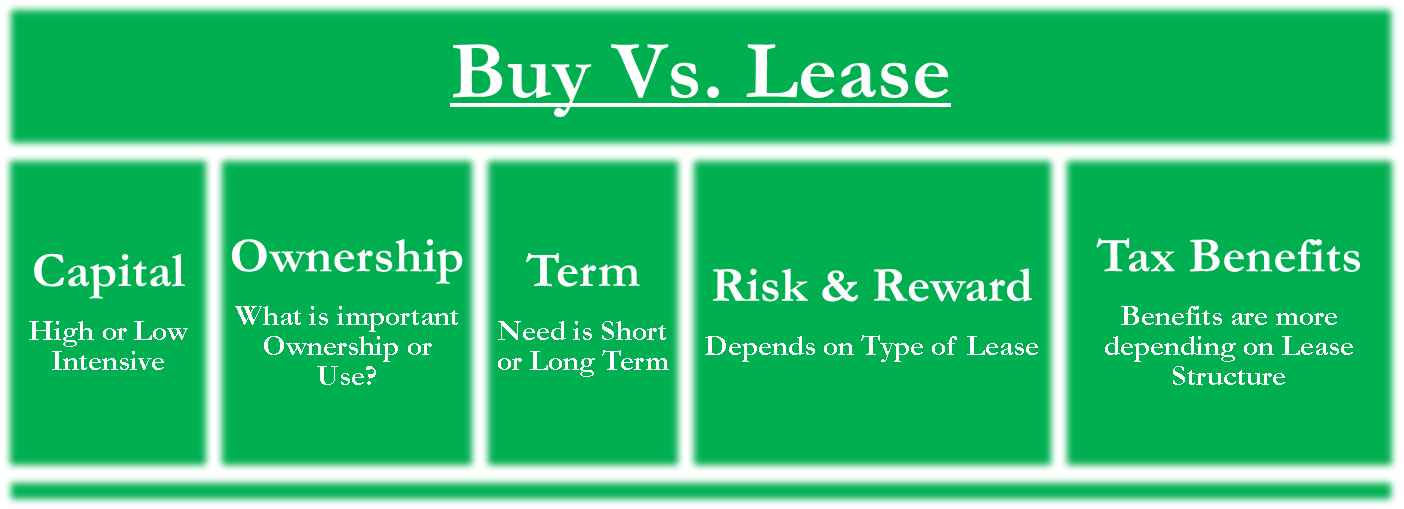

Buy vs Lease dilemma is faced by most entrepreneurs. The decision on whether to buy or lease is dependent on a number of factors such as the duration for which such an asset would be required, the returns that the business will generate on the asset, the type of asset and related technological developments, etc.

This difference is especially important when businesses look at capital-intensive assets such as property, machinery, land, etc.

Buy Vs. Lease an Asset

Capital

- Purchasing (Buying): Purchasing requires more capital (cash reserve or lender support) as you look to purchase the asset by paying its full value.

- Leasing: Initial capital requirement under leasing contracts is limited, and monthly payments also account for a smaller amount.

Ownership

- Purchasing (Buying): When you buy equipment, you are the ultimate owner and are responsible for its maintenance, etc.

- Leasing: Under leasing, the lessee is not the asset owner. He obtains the right to use the asset for a fixed term under pre-defined lease payments.

Term

- Purchasing (Buying): Buying decision is not related to the term of the asset as the owner can use it till the end of its useful life. An asset that is bought can be replaced at any time.

- Leasing: Leasing agreements are usually run for a fixed term, and at the end of the term, the lessee must either purchase the asset or return it to the lessor. Most lease contracts cannot be terminated before the end of the term.

Risk & Rewards

- Purchasing (Buying): Given that the ownership lies with the purchaser, the buyer is responsible for all risks and rewards associated with the asset. Hence, buying an asset should be avoided in an industry or segment where there are frequent technological innovations.

- Leasing: Under an operating lease, all the rewards associated with the asset remain with the lessor, whereas most of the risks and rewards stay with the lessee under a finance lease.

Tax Benefits

- Purchasing (Buying): Purchasing an asset will bring you a limited tax benefit. If the asset is funded using existing cash reserves, there is likely no tax benefit at all. For a debt-funded asset purchase, the owner will be able to claim tax benefit on interest on such debt. The principal amount is not deductible, though.

- Leasing: Under a lease contract, all the lease payments are fully tax-deductible. This will include any lease rental payment plus the interest on any outstanding lease amount. Thus from a taxation perspective, leasing is much more beneficial.

There can be more factors that are important while considering a decision, such as a buy vs lease. These factors could be different for different situations, circumstances, etc. It is ideal for taking all other factors into consideration before making decisions. You can share the factors in the comments below which you think are important and not considered here.