Capital Lease Accounting

Capital lease accounting relates to the treatment of assets taken on lease by a business under a capital lease agreement with a lessor. In a capital lease, the asset(s) taken on the lease is recorded as an asset on the balance sheet.

Capital Lease Accounting Process

As discussed above, broadly, such an asset has to be given the accounting treatment as an owned and financed asset. For that, one needs to take the following steps before making the actual journal entries in the books of account:

Capital Lease Accounting Process

- Check Capital Lease Criteria

First of all, one needs to categorically understand by going through the lease agreement whether the arrangement meets all the criteria of being termed a Capital Lease.

- Value of Asset in Balance Sheet

To book the asset and create a liability for the same in the books, you need to put a value on the asset.

It is determined by calculating the Present Value of all the lease payments to be made over the lease period. - The bifurcation between Principal and Interest Amount

As we know, the regular lease rental consists of two parts – lease rental towards assets value or, say, towards the principal and the interest portion. Hence, one needs to segregate these two portions from the monthly lease rental.

The first potion will be posted to the lease liability account, which will, over the years, reduce the lease liability.

The interest portion will flow to the profit and loss account at the end of the year. - Depreciation Treatment

Finally, each year’s depreciation needs to be calculated and recorded for the asset. This will also flow to the profit and loss account every year.

Thus, all these steps will mean all the interest and depreciation will flow to the profit and loss account, and the company can take tax advantage of that. Moreover, the lease liability account will become zero at the end of the lease term. And the asset will mostly stand on the balance sheet, either fully depreciated or with a nominal depreciated value.

Now let’s understand these steps and accounting entries with an example.

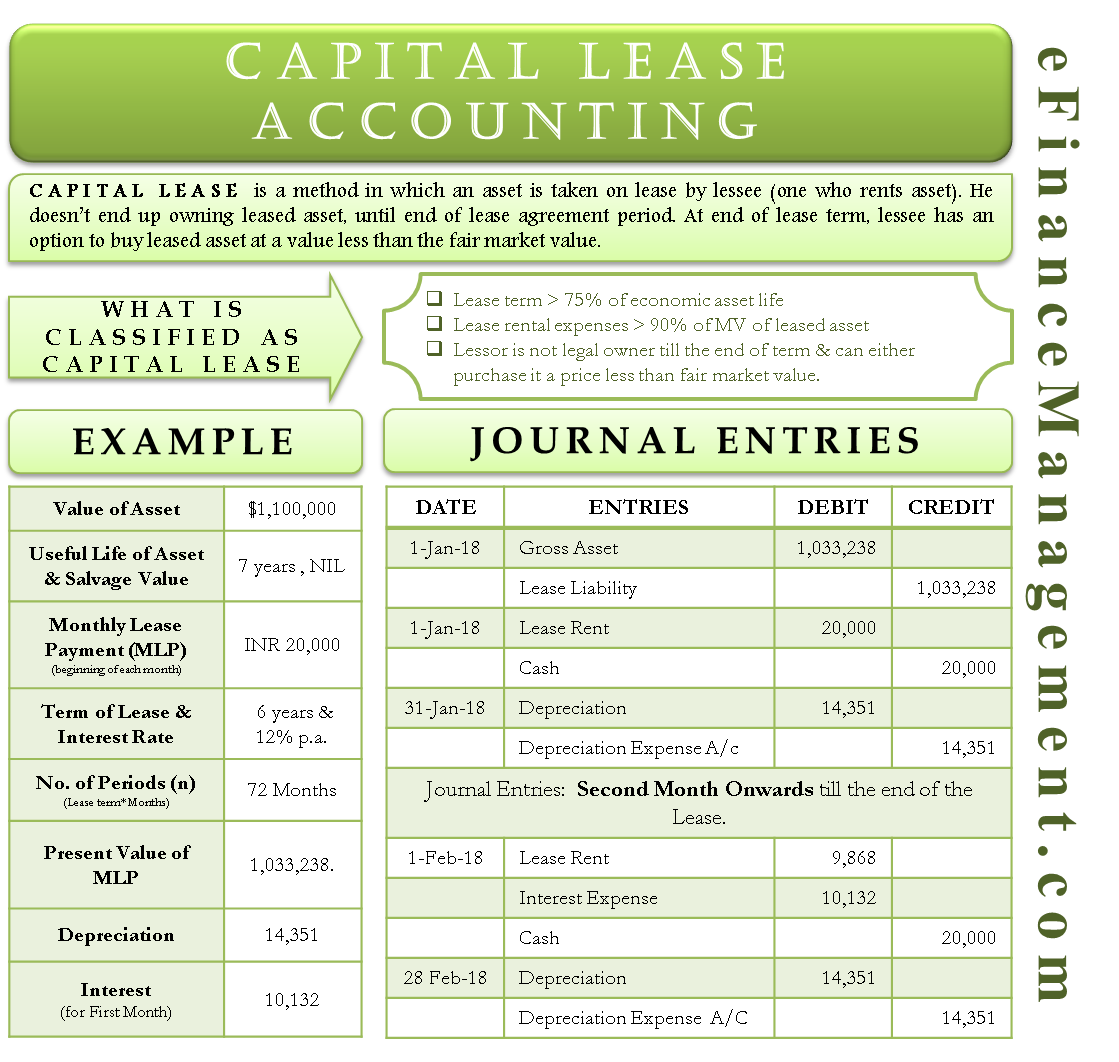

Example – Capital Lease Accounting

Let’s say that Company A entered into a capital lease contract to lease out an airplane with Company B on January 1, 2018. The agreement is to lease the airplane worth $1,100,000 for 6 years. The airplane’s useful life is 7 years. The contract specifies the lease payment of $20,000 should be made at the beginning of each month for 6 years. There is no salvage value at the end of the lease period. The lessee will choose to buy the asset at the end of the lease period at a value less than the fair market value.

| Assumptions | Details |

| Monthly Lease Payment Amount (MLP) | $ 20,000 |

| Term of Lease | 6 Years |

| Rate of Interest | 12% Annually |

Let’s first test whether the transaction falls under Capital Lease Criteria:

Test the Lease on Capital Lease Criteria

Criteria 1: Lease Period

The lease period covers 86% (6/7 Years) of the asset’s useful life. It satisfies the criterion of 75%.

Criteria 2: Present Value

Since the lease payment is made at the beginning of each month, the present value of the monthly lease rentals is calculated accordingly. #1,033,238 i.e. 94% (1,033,238 / 1,100,000) of the current value of the asset, which is more than 90%. See the calculation below:

Also Read: Capital Lease Obligation

# Present Value of the airplane = MLP + MLP* (1- (1 + Monthly Interest Rate)^(- No. of Periods+1))/Monthly Interest Rate

PV of the airplane = 20000 + 20000* (1 – (1 + 1%)^(- 72 + 1)) / 1% = 1033237.91 ~ $1,033,238.

Monthly Interest Rate = 12% Annually / 12 Months = 1% Monthly

No. of Periods = 6 Years * 12 Months = 72 Periods

Now, if the payment of the lease is to have been made at the end of each month, then the formula would have been;

Present Value of the airplane = MLP* (1 – (1 + Monthly Interest Rate)^(- No. of Periods))/Monthly Interest Rate

PV of the airplane = 20000* (1 – (1 + 1%)^(-72)) / 1% = 1023007.83 ~ $1,023,008

Criteria 3: Option to Buy

Yes, as per the contract, this option is also present.

Before proceeding with the Journal Entries, let’s do some preparatory calculations required before recording journal entries.

Steps to Capital Lease Accounting

We should follow certain steps one by one to accurately account for the capital lease.

Step 1: Calculate Present Value

As we have already calculated under the capital lease criteria test, our present value is 1,033,238.

Step 2: Calculate Interest Expense

Here, because the lease payment is to be made at the beginning of each month, the Interest for January 2018 is not made, as the Asset has not been used yet by the Lessee. So, the first installment or lease rental will begin on January 1, 2018. Principal Amount for Interest Calculation = Total Asset Value less Lease Rental Paid = 1033238 – 20000 = 1013238.

Considering the second alternative, if the payment is to be made at the end of each month, the first month’s interest is also to be taken into consideration, as the Asset is used for the whole month. The first installment or lease rental would begin from January 31, 2018, until January 31, 2024. Hence, the Principal Amount for Interest Calculation = Total Asset Value = 1033238.

Interest Rate = 1% for the month.

Interest Expense = 1013238* 1% = 10132.38 ~ 10132

Step 3: Calculate Lease Liability Reduction

We know that the total monthly lease rental payment is $20,000, and the Interest Cost, as assessed above, is 10132. Net liability reduction in the second month onwards will be equal to:

MLP Less Interest Exp. = 20000 – 10132 = 9868

The detailed calculation can be seen in the monthly table below.

Step 4: Calculate Depreciation

The value of the airplane is 1033238 for 72 months. Per month depreciation is equal to 1033238/72 = 14350.53~ 14351.

Journal Entry for Capital Lease

Now, let’s look at the entries that will take place for the capital lease in the books of the lessee:

Entry in the first period or first month, in our case.

| Date | Journal Entry | Debit | Credit |

| Jan-1-18 | Gross Asset (Equipment) | 1,033,238 | |

| Lease Liability | 1,033,238 | ||

| Jan-1-18 | Lease Rental Expense (Reduction of Lease Liability) | 20,000 | |

| Cash (Paid to Lessor) | 20,000 | ||

| Jan-31-18 | Depreciation (Reduction of Gross Asset) | 14,351 | |

| Depreciation Expense Account | 14,351 |

Entry in the second period or second month, in our case. The following entries will follow for the entire lease period.

| Date | Journal Entry | Debit | Credit |

| Feb-1-18 | Lease Rental Expense (Reduction of Lease Liability) | 9,868 | |

| Interest Expense | 10,132 | ||

| Cash (Paid to Lessor) | 20,000 | ||

| Feb-28-18 | Depreciation (Reduction of Gross Asset) | 14,351 | |

| Depreciation Expense Account | 14,351 |

Capital Lease Accounting Table

The following table will show the calculation for capital lease accounting. This can be used to record journal entries for each of the 72 months.

| Months | Liability Beginning | Interest | Lease Rental | Liability Reduction | Liability Ending |

| Jan-18 | 1033238 | 20000 | 20000 | 1013238 | |

| Feb-18 | 1013238 | 10132 | 20000 | 9868 | 1003370 |

| Mar-18 | 1003370 | 10034 | 20000 | 9966 | 993404 |

| Apr-18 | 993404 | 9934 | 20000 | 10066 | 983338 |

| May-18 | 983338 | 9833 | 20000 | 10167 | 973171 |

| ↓ | ⇓ | ↓ | ⇓ | ↓ | ⇓ |

| Aug-23 | 97069 | 971 | 20000 | 19029 | 78039 |

| Sep-23 | 78039 | 780 | 20000 | 19220 | 58820 |

| Oct-23 | 58820 | 588 | 20000 | 19412 | 39408 |

| Nov-23 | 39408 | 394 | 20000 | 19606 | 19802 |

| Dec-23 | 19802 | 198 | 20000 | 19802 | 0 |

Frequently Asked Questions

A capital lease accounting has broadly 3 effects on the balance sheet.

1. Asset is recorded on the Gross Assets.

2. A liability for Lease is also recorded on the liability side.

3. Although depreciation is expensed in the income and expenditure account, it also becomes part of accumulated depreciation in the balance sheet to show the net book value of assets (Gross Assets less Accumulated Depreciation).

Depreciation Expense Account is a credit? Why

Thanks, Wilson for visiting our site and raising a query. Please note that depreciation accounting for leasing is no different than the general one. Whenever we show the gross block (original cost of the asset throughout) we debit the depreciation expense to the profit, and loss Or Income and Expenditure Account and credit the same as Depreciation (accumulated depreciation) account.

This way debit happens in the P&L and this credit balance is shown as a deduction from the gross block from the fixed assets. So credit is only the accumulated depreciation charged so far in the P&L account and after deducting this from the gross block we get the depreciated value of the fixed assets. Do hope we have been able to clear your doubts. Thanks

Would you mind explaining this from Lessor books?

What would happend to the future interest if payment in any given month was not paid as the lease liability ending balance of that month will be different comparing to previous calculation

Simple. The unpaid installments will accumulate and will carry further interest and/or penalties, as per the provisions of the Lease Arrangement. Hope this answers your query. Thanks