Medium Term Note: Meaning

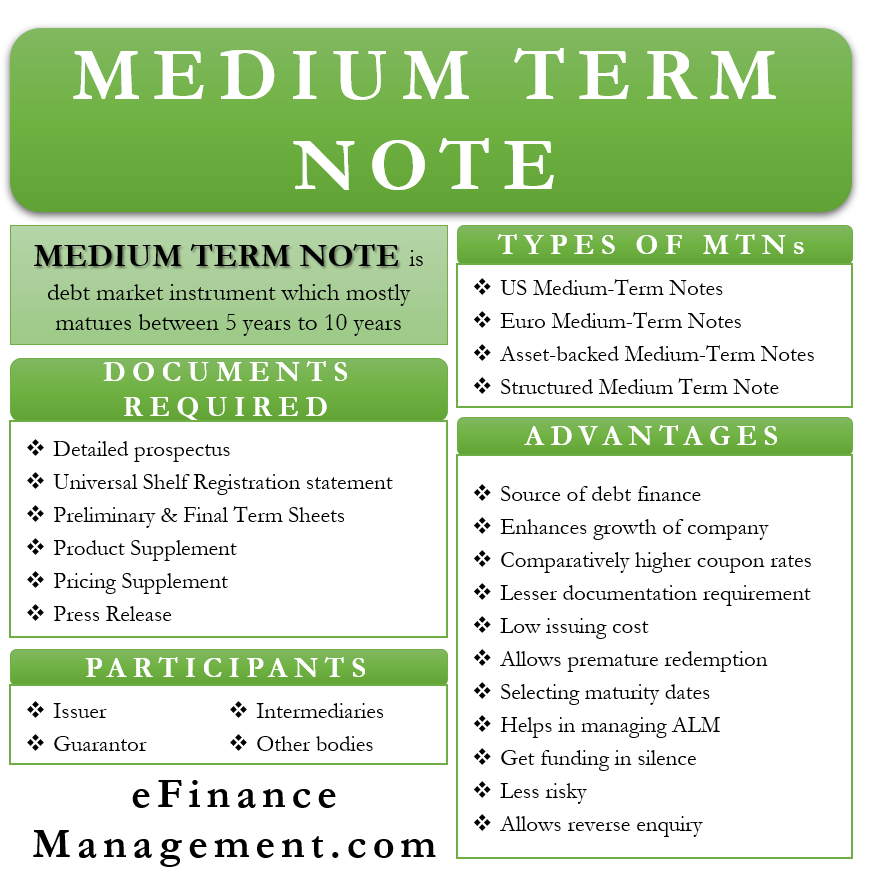

A debt market instrument, specifically a Note, which mostly matures between 5 years to 10 years, is known as a Medium Term Note (MTN). And it is issued by the Companies for a continuous period, with varying maturities ranging from 5 years to 10 years. However, these days, government agencies, institutions, banks, and countries also issue MTN. Medium-Term Notes act as a continuous source of finance for the companies. However, the duration of MTN is not strictly from 5 years to 10 years. And sometimes the duration can vary from 9 months to 30 long years as well.

MTN gives higher coupon rates in comparison to Short Term Notes and lower coupon rates in comparison to Long Term Notes. Moreover, Medium-Term Notes can be issued at a fixed interest rate, floating interest rate, zero-coupon, inverse floating rate, step-up/step down rate, etc., although they are mostly issued at a fixed interest rate. The interest rate can be compounding monthly, quarterly, semi-annually, or annually, depending on the issuing company. And the coupon rate can also be in any currency, depending on the type of MTN.

Medium-Term Notes are mostly issued with two options, i.e., a call option (also known as a callable note or redeemable note) and a non-call option. MTN with a call option allows the companies to call back the Notes before maturity. And companies, in order to take benefit of lower rates, call back the higher rate MTN and later issues new MTN at lower rates. Thus MTN with a call option allows the organizations to take advantage of lower interest rates. On the other hand, MTN with a non-call option does not allow the companies to redeem the notes before maturity. As a result, MTN with a call option provides higher coupon rates than MTN with the no-call option.

Understanding Medium Term Note

Dealers act as an intermediary between the issuing company and the investors. They offer MTN with varied maturity dates. These Dealers play a very important role in the market by acting as a connecting link and thereby facilitating the trade. Investors, before investing in a Medium Term Note, analyses various aspects like credit ratings of the company, business structure, and products of the company, the coupon rate of the note, the maturity of the note, interest rate, and financial strength, and so on.

Also Read: Structured Notes

The issuing company of Medium Term Note has to submit various documents to the Securities Exchange Commission (SEC). Those documents are as follows:-

- A detailed prospectus

- A Universal Shelf Registration statement for debt securities and other types of securities

- Preliminary and Final Term Sheets

- Product Supplement

- Pricing Supplement

- Press Release

These documents are non-exhaustive in nature

Risk in Medium-Term Notes

Medium-Term Notes, as compared to the bonds, are less risky in nature. According to the experts, almost 33% of the MTNs have full or partial protection on their principal amount. However, though these MTNs and partially protected, still their classification in the books of accounts of the issuing company remains as Unsecured Creditors.

Types of Medium Term Note

US Medium-Term Notes

On the basis of the location of issuance, there are two types of MTNs, i.e., US Medium Term Notes and Euro Medium Term Notes. US MTNs are issued under the US Medium-Term Note Program for the investors of the United States. The issuer has to submit a shelf registration and dully filled prospectus to the Securities Exchange Commission (SEC) of the USA.

Euro Medium-Term Notes

All those MTNs, which are traded in countries except the USA and Canada, are known as Euro Medium Term Notes. These MTNs have access to a wide market, and trade takes place with varying maturities and varied currencies.

Asset-backed Medium-Term Notes

Medium-Term Notes which are backed by mortgages or any other assets, are known as Asset-backed MTNs. Mostly MTNs do not have any asset backing and are solely issued on the basis of the creditworthiness of the issuing company.

Also Read: Notes Payable

Structured Medium Term Note

There are also Medium Term Notes which are linked to derivatives and are known as Structured Medium Term Notes. They serve the investing requirements of the investors and also reduce the risk level of the investor, thereby serving the purpose of both parties. There are also many types of structured notes, like LIBOR Differential Note, Dual Currency MTN, Exchange Traded Notes, etc.

The financial community is always trying to come up with some innovative ways of raising funds. Hence, the classification and types of MTNs will always be dynamic.

Participants in Medium Term Note Program

There are many participants who play a vital role in the MTN issuance program.

Issuer

They are the main issuing body of the MTNs. They are the companies willing to access medium-term debt security by giving coupon rates in return.

Guarantor

Guarantors are not always participants in the MTN program. They are generally subsidiaries that give a guarantee when the credit rating of the issuing company is not sound enough. Guarantors mostly have higher credit ratings than the issuing company.

Intermediaries

There are intermediaries that enhance the MTN trade. These intermediaries are Arranger, Selling Agents, and Regional Dealers. They act as an intermediary between the issuer and the investor and make the trade successful.

Other Bodies

For other related work, there are several bodies that need to perform those specific tasks. Law firms scrutinize the legal obligations, Accounting firms conduct the process of auditing, and Credit Rating Agencies give credit ratings to the issuing company.

These intermediaries are non-exhaustive in nature.

Advantages of Medium Term Note

- MTN acts as a continuous source of debt finance for the companies.

- This instrument keeps enough cash flow in the organization and thereby enhances the growth of the company.

- One of the biggest advantages of MTN is that it gives higher coupon rates as compared to Short Term Note.

- MTN permits the issuing company to register itself under the Securities Exchange Commission (SEC) only once for all of its issues. This helps the companies in abiding by the regulatory requirement in a hassle-free manner with lesser documentation.

- Since MTN registration happens under Shelf Registration, it reduces the total issuing cost of the company.

- This instrument serves the purpose of all those investors who are unwilling to invest for short or long durations. This debt instrument fits best to investors who give preference to medium-term investment.

- Medium-Term Notes with a call option allow the companies to initiate premature redemption if they have sufficient cash flows. It also permits them to take benefit of lesser interest rate by reissuing the notes.

- MTN reduces the risk of reinvesting funds at a lower interest rate in a shorter duration. Investors engage their funds for a comparatively large duration with a fixed interest rate under MTN.

- Medium Term Note allows the investors to select maturity dates according to their time zone. It also allows them to select between the call option and the non-call option.

- MTN helps the company in managing its asset-liability management (ALM).

- Medium Term Note allows the issuing company to get funding in silence. Because for such issuance, the company need not make public disclosure of its financial status.

- MTN allows the investor to conduct a reverse inquiry if the investment product with its required characteristics is not available in the market.

These advantages are non-exhaustive in nature.

Medium-Term Notes Vs. Bonds

One of the major differences between Bond and MTN is that the issuance of Bonds happens only once while MTNs issuance happens on a continuous basis with varying maturities. Thus the funds mostly remain available with the company on a rolling basis. The target investors of Bonds are the general public at large, and that of MTNs are HNIs (High Net Worth Individuals) and institutional investors. Bonds are riskier than MTNs. These differences are non-exhaustive in nature.

Conclusion

Medium-Term Notes (MTNs) are an important source of debt finance for the issuing body. Because of the flexible nature of the MTN, both the investor and the issuer prefer this instrument. It gives higher coupon rates in comparison to other short-term investments and comes up with varying maturities. The callable nature of MTN gives the issuing company to take advantage of lower interest rates. Thus it is one of the very important debt instruments.