What are Term Loans?

If you need funds, be it for starting a new business, expanding your current business, or managing daily business expenses, you must have heard of the various types of term loans. Such loans are tailor-made to meet the specific financial need of a business.

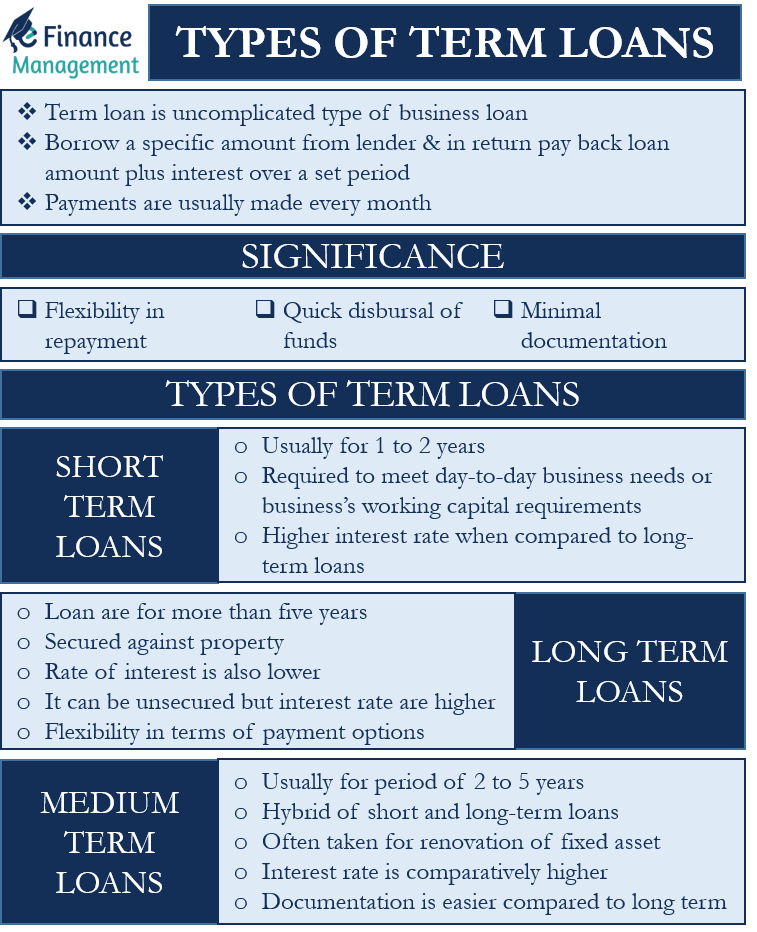

A term loan is comparatively the most uncomplicated type of business loan. You borrow a specific amount from the lender and, in return, agree to pay back the loan amount plus interest over a set period. Payments are usually made every month.

Lenders, usually banks or specialized institutions, assess the borrower’s financial condition before lending the money. Significant benefits of a term loan are flexibility in repayment, quick disbursal of funds, and minimal documentation.

Types of Term Loans

Now that you know what a term loan is, you must also know the types of term loans to make an informed business decision. Term loans are classified based on the loan tenor, i.e., the period you need the funds for. Therefore, the types of term loans are – Short-term, Medium-term, and Long-term.

Let’s talk about each of the types of term loans in detail:

Short Term Loans

A short-term loan is usually for 1 to 2 years. A short-term loan is often required to meet the day-to-day business needs or the business’s working capital requirements. There are several sources of short-term loans, including a loan from a Commercial bank, Trade Credit, Discounting Bills of Exchange, Factoring, and more.

Short-term loans carry a higher interest rate when compared to a long-term loans. Also, it may involve even weekly repayment if the term of the loan is very short. It is a general rule – the shorter the term and the easier a loan is to get, the higher the interest rate. One must be very careful when going for this type of term loan as it not only involves a higher interest rate, but charges may also be on the higher side if you default on repayments.

Medium-Term Loans

A medium-term loan is usually for a period of 2 to 5 years and can be said to be a hybrid of short and long-term loans. Such a loan is often taken for carrying out repair or renovation of the fixed asset. For example, modernizing a showroom.

A medium-term loan is usually skipped when talking about the types of terms loans as people may go straight to the long-term loan after discussing the short-term loan. However, it is better to keep the duration of 2 to 5 years under medium-term as terms and condition for such a period is somewhat different from the long-term loan. Like, the interest rate is comparatively higher, while the documentation part is easier when compared to the long-term loans.

Long Term Loans

These types of term loans are for more than five years. Most of the long-term loans are secured, for instance, home loans, car loans, and loans against property. Since the loan is secured, the rate of interest is also lower. However, it can be unsecured as well. In an unsecured loan, no collateral or asset is needed, but the rate of interest is comparatively higher as the lender bears more risk.

EMI for such a loan is also quite low as the payment is spread over a long period. A long-term loan is credit-based, so the better your credit score is, the better the chances that you get a lower interest rate. The amount of the loan will also depend on your credit history and income. (Read Credit Appraisal of Term Loans by Financial Institutions like Banks to learn more).

Further, a long-term loan also comes with flexibility in terms of payment options. For instance, you may go for a fixed interest loan, where the rate is the same over the term of the loan, or an adjustable rate, where the rate may change each year. Also, there is an interest-only loan, where the borrower can pay only the interest for a set period and then start paying the principal.

For more clarity among various short term sources, read:

- Term Loan or Project Finance – A Long Term Source of Finance

- Working Capital vs. Term Loan

- Difference between Hire Purchase vs. Term Loan

- Lease Finance vs. Term Loan

Conclusion

Taking a loan is easy, but repaying it is difficult. So, before you decide on the type of term loan, you must think about a few things, like do you really need a loan, and if yes, then how much and for how long. Analyzing such questions and comparing them with your need and your potential future income would give you a clearer idea of the type of term loan to go for. Also, it is always wise to explore more options (in this case, borrowers) to get the best interest rates and other terms.

Continue reading – Restrictive Debt Covenants on Term Loan Agreement.