Definition of Notes Payable

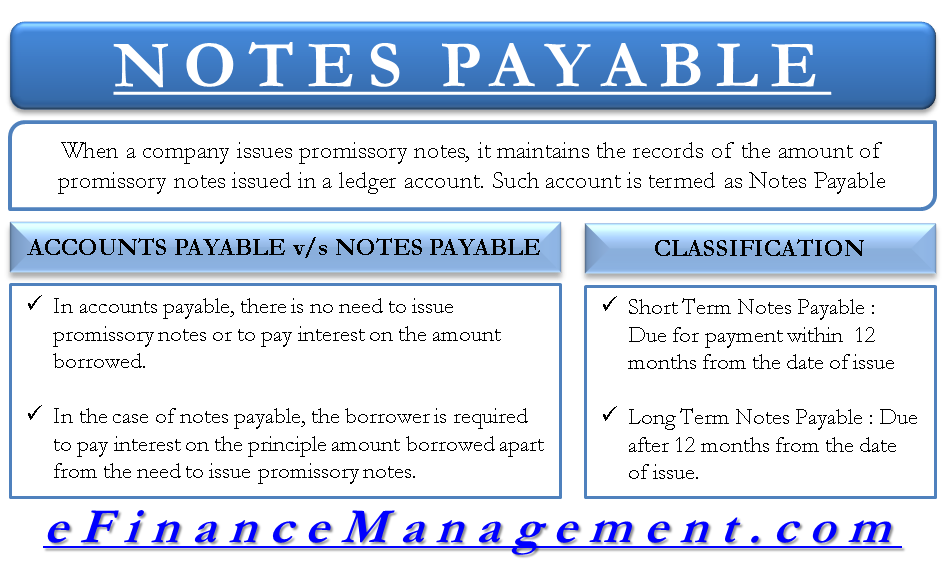

When a company issues promissory notes, it maintains the records of the amount of promissory notes issued in a ledger account. Such an account is termed Notes Payable. Under these, the lender lends the money at an agreed interest to a borrower who promises to pay back the amount within a stipulated time or on a pre-decided date.

Difference between Notes Payable and Accounts Payable

Notes payable are different from accounts payable. In accounts payable, there is no need to issue promissory notes or to pay interest on the amount borrowed. Whereas in the case of notes payable, the borrower is required to pay interest on the principal amount borrowed apart from the need to issue promissory notes.

Classification of Notes Payable

They can be classified as short-term and long-term:

- Short-term notes payable are those promissory notes which are due for payment within 12 months from the date of issue. On the balance sheet, these are represented as short-term liability.

- Long-term notes payables are promissory notes which are due for payment after 12 months from the date of issue. They are classified as a long-term liability on the balance sheet.

Notes Payable Example

X Ltd. borrows 5,00,000 at an interest rate of 10% from DZB Bank under notes payable. The borrowed amount will be paid to the bank on a specified date. The accounting entries in the books of X Ltd. on receiving of cash shall be:

| Particulars | Dr. Amount | Cr. Amount |

| Cash | 5,00,000 | |

| To Notes Payable | 5,00,000 |

When the interest to be paid on the borrowed amount accrues, the following entry shall be passed in the books of X Ltd.:

| Particulars | Dr. Amount | Cr. Amount |

| Interest expense | 50,000 | |

| To Interest payable | 50,000 |

Upon payment of interest, X Ltd. shall record the entry as:

| Particulars | Dr. Amount | Cr. Amount |

| Interest payable | 50,000 | |

| To Cash | 50,000 |

When X Ltd. pays the amount borrowed from DBZ bank, the following entry shall be passed:

| Particulars | Dr. Amount | Cr. Amount |

| Notes payable | 5,00,000 | |

| To Cash | 5,00,000 |

Conclusion

Notes Payable is a ledger account prepared by an accountant for recording transactions that involve the borrowing of money. This is the most effective way of recording the transactions relating to the amount borrowed and on which interest is to be paid. The future planning of the business depends on the information provided in the notes payable account.

This article will definitely help me to understand notes payable well. Thanks for sharing this article. This is very comprehensive and helpful. I will share this to my business owners as well.

This article will definitely will definitely help me to understand Notes Payable. I think that this will definitely help me to do my business accounting faster and easier. Thanks for sharing this article.

Very informative context, I did indulge a little and had to make sure I understood the context but it was splendid.