Shelf Registration: Meaning

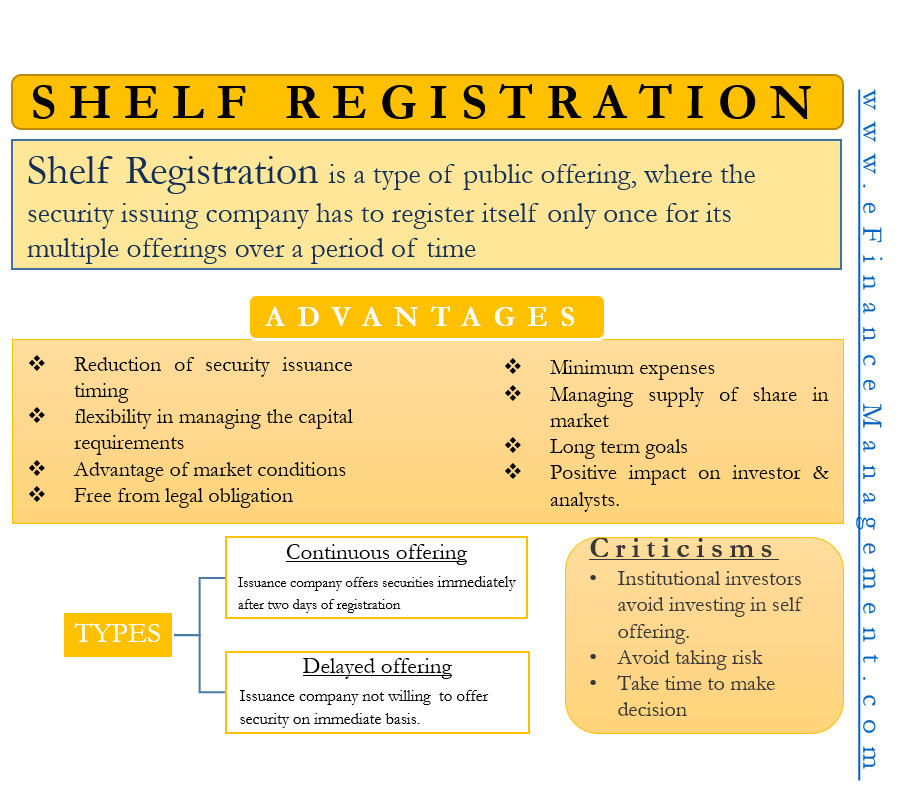

Shelf Registration is a type of public offering where the security issuing company has to register itself only once for its multiple offerings over a period of time. The Securities Exchange Commission (SEC) of the USA provides this facilitation under Rule 415, which allows the issuing company to conduct public offerings for an extended period of 2-3 years, only on one-time registration.

Shelf Registration is a term used when the offerings are expected to occur on a future date but are registered beforehand by the company. It allows the issuing company to enter the securities market at a favorable and correct time without involving frequent documentation. Although, the issuing company has to submit its quarterly financial reports and annual financial reports to the Securities Exchange Commission. Shelf Registration can be for Primary Market and/or Secondary Market.

Understanding the term: Shelf Registration

Under Shelf Registration, it is assumed that the securities are kept on the shelf for a while. These unissued securities are recorded in the books of accounts as Treasury Stocks. When the timing is favorable, the issuing company takes the securities off the shelf and releases them for the market issue. “Takedown” is the term in practice for this process. After the removal of securities from the shelf, they are released to the public. Submission of various documents like Shelf Registration, Base Prospectus, or Core Prospectus and Prospectus Supplement occurs at this juncture.

Suppose the issuing company is not able to issue any securities in the given time frame of 2 years to 3 years. In that case, the issuing company is eligible to get an extension after completing the required formalities.

The other name of Shelf Registration is Shelf Offering or SEC Rule 415.

Advantages of Shelf Registration

- The first and foremost advantage is the reduction of security issuance timing to the minimum once shelf registration has been done.

- Shelf Registration gives flexibility in managing the capital requirements to the issuing company.

- Shelf Offering allows the issuing company to take advantage of market conditions by entering the securities market at the correct time.

- Under the Shelf Registration, the issuing company is free from frequent documentation and legal obligation. Only one registration is necessary for all its offerings.

- Under this type of registration, the issuing company incurs minimal expenses.

- Shelf Offering allows the issuing company to manage the supply (quantity) of shares in the market. By managing the quantity of issuance, the issuing company can thereby manage the price of securities.

- This type of Registration works best for the companies planning a long-term security issuance target. The company can issue securities for years, only on the basis of one registration.

- Shelf Offerings, just like a normal public issuance, release all financial information to the public at large. And so the investors have a fair advantage when analyzing the company.

- The companies going for Shelf Offerings positively impact the investors and analysts. They think that the company is focusing on growth and expansion.

These advantages are non-exhaustive in nature.

Types of Shelf Registration

Mostly, Shelf Offerings are of two types, i.e., Continuous Offerings and Delayed Offerings. Continuous Offering is a type of issuance where the issuing company is planning to offer its securities immediately after two days of registration. Here, the issuing company is willing to offer its securities in various breakups for the whole tenure of 2-3 years, starting immediately after two days of the registration.

In Delayed Offering, the issuing company is not willing to offer securities on an immediate basis. Under these offerings, the company can issue securities anytime between the time span of 2-3 years. Although, Delayed Offerings require more documentation than Continuous Offerings. Mainly the business and financial performance needs to be filed since the shelf registration or last update of these details.

The prospectus of the company shows whether the offerings are continuous offerings or other types of offerings.

Criticisms of Shelf Registration

One of the biggest criticism of Shelf Registration is that big financial institutional investors and other big players avoid investing in Shelf Offerings. These big players avoid taking risks instantly and therefore wait for initial offerings to pass. These investors also believe that various substantial offers might also hamper the share price of the company, ultimately hampering the market value of the company. So they allow such companies to first test the market and accordingly then take a decision to invest.

These criticisms are non-exhaustive in nature.

What is Baby Shelf Rule?

Under the Shelf Registration Rule Book, there is a Baby Shelf Rule for small companies having a total aggregate market value of equity less than $75 million. According to the Baby Shelf Rule, if the total aggregate market value of issuing equity is less than $75 million, then the issuing company can only offer a maximum of 1/3rd of stocks in a 12 months period. Thus, the issuing company can offer up to 1/3rd of stocks in a year.

Also Read: Fixed Asset Register

Conclusion

Shelf Registration is a type of Public Offering which allows the issuing company to take advantage of market conditions in a hassle-free manner. It gives the issuing company; flexibility in the process of issuance with only single registration with the SEC. Irrespective of the few criticisms attached to Shelf Offerings, its advantages far outweigh those criticisms. Thus, this works best for the issuing company and the investor.

Continue reading – IPO Process.