Bonds are capital market instruments used to raise debt capital from the open market. There are many types of bonds; the most basic ones of the lot are Plain Vanilla Bonds. This will be our topic of discussion in today’s article.

To understand plain vanilla bonds, first, we must understand the term “plain vanilla.” Let’s take the term literally for a deeper understanding. If you go to an ice cream store and you order plain vanilla ice cream, you know that you have ordered the most basic form of ice cream. We add flavors to the vanilla ice cream if we want a different flavor. So we know that there are no flavors or toppings in here. Similarly, when we say plain vanilla bonds, we understand these are the most basic form of bonds.

The term plain vanilla can be applied to many financial products such as plain vanilla options, plain vanilla swaps, plain vanilla credit cards, etc. In a nutshell, plain vanilla means the most basic version of any product.

Plain Vanilla Bonds

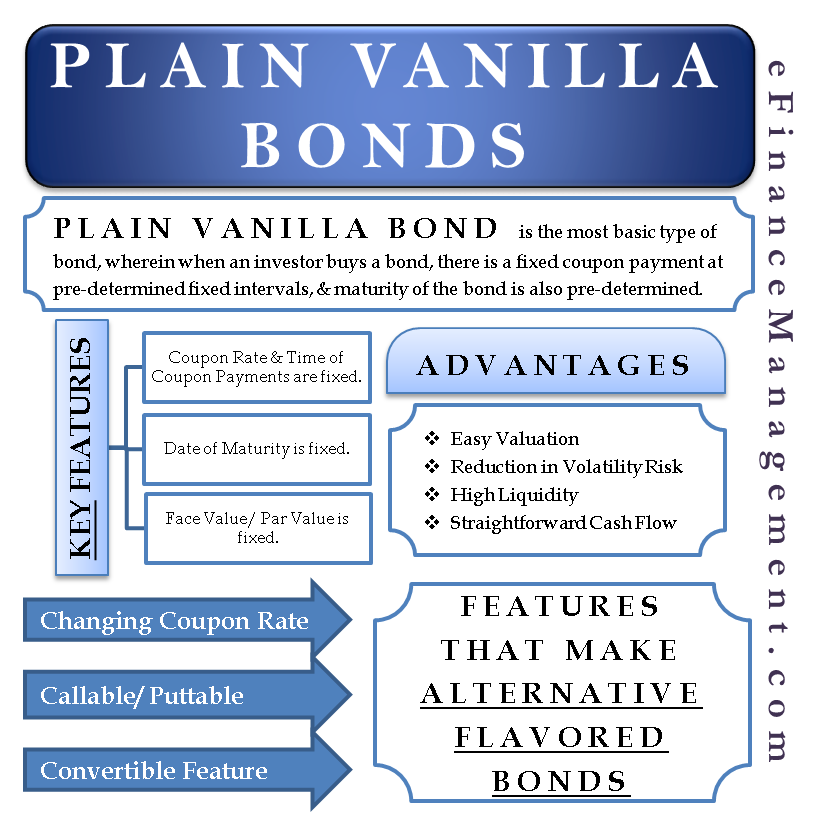

A plain vanilla bond is the most basic type of bond, wherein when an investor buys a bond, there is a fixed coupon payment at pre-determined fixed intervals, and the maturity of the bond is also pre-determined. Furthermore, the face value of the bond is also predetermined, and the issuer redeems the bond at face value on the date of maturity.

Also Read: Bonds and their Types

In understanding, a plain vanilla bond has the following features that are fixed and known to investors:

Key Features of Plain Vanilla Bonds

- The coupon rate & time of coupon payments are fixed.

- Fix date of maturity.

- Fix face value/par value.

There are no elements of surprise for the investor in plain vanilla bonds. A plain vanilla bond looks something as follows:

Example of a Plain Vanilla Bond

A 3-year bond that pays a 5% annual coupon rate (payment semi-annually) with the face value of USD 100.00

Therefore, in this plain vanilla bond –

Coupon Rate = 5% of USD 100.00 = USD 5.00 per year

Time of coupon payments = semi-annually = USD 2.50 every 6 months (USD 5.00/2)

Date of Maturity = 3 years from the date of purchase

Face Value = USD 100.00

It is good to know a few other types of bonds to completely understand a plain vanilla bond. There are many other features that can be embedded in the bond as per the issuer’s or investor’s requirement. Following are examples of such features:

Features that Make Alternative Flavored Bonds

Changing Coupon Rate

There are many coupon features that can come in a bond. A bond can be a zero-coupon bond, in which there is no coupon payment, or it can be a step-up bond, in which the coupon rate increase after a predetermined period of time, and there are also floating-rate bonds whose coupon rate keeps changing every few months. Such is not the case with plain vanilla bonds. In plain vanilla bonds, the coupon rate remains constant throughout the life of the bond.

Callable/Puttable Feature

In a callable bond, the issuer has a right to retire the bond before the date of maturity. On the other hand, in a puttable bond, the investor has the right to redeem the bond before maturity. Thus with these features, the date of maturity of the bond is adjustable. However, in plain vanilla bonds, the maturity date is fixed and cannot be changed.

Convertible Feature

When a bond comes with a conversion feature, this bond can be converted into equity shares or preference shares at a pre-determined date. They are called Convertible Bonds. A plain vanilla bond remains a bond until it is redeemed at the date of maturity. It can not be converted into any other type of security or asset.

Also Read: Bond Valuation

Therefore we can note that a plain vanilla bond doesn’t have any of the above-mentioned features.

Advantages of a Plain Vanilla Bond

Easy Valuation

Valuation of any financial security requires us to establish its cash flow over the lifetime of that security. The cash flow of plain vanilla bonds is pretty straightforward. There are regular coupon payments over the lifetime of the bond and payment of face value at the date of maturity. This stable cash flow makes the valuation of plain vanilla bonds very simple & straightforward. Let’s continue with our previous example for better understanding –

A 3-year bond that pays a 5% annual coupon rate (payment semi-annually) with the face value of USD 100.00

Suppose this bond was purchased in December 2018. Therefore the cash flow is as under

| Period | Cash Flow |

| June 2019 | USD 2.50 |

| December 2019 | USD 2.50 |

| June 2020 | USD 2.50 |

| December 2020 | USD 2.50 |

| June 2021 | USD 2.50 |

| December 2021 | USD 2.50 + USD 100.00 (FACE VALUE) = USD 102.50 |

Now it is very easy to calculate the value of this bond by the present value method.

Reduction in Volatility Risk

Returns on plain vanilla bonds are much safer than other feature-added bonds. There is a very simple reason behind this; the market price of the bond is affected by each of its features. For example, a puttable bond may trade higher than a plain vanilla bond in the secondary market, as investor values this feature. Similarly, a callable bond may start trading at a discount during its lifetime. This risk of volatility is completely avoided in plain vanilla bonds.

High Liquidity

It is easier to sell basic products than fancy ones. For example, it will be much easier to sell a bottle of vodka than a bottle of pre-mix vodka martini. What is the reason for this? Everyone has different tastes when it comes to fancy products; however, there is no taste for a simple product. A similar phenomenon applies to plain vanilla bonds as well, investors buy plain vanilla bonds at a higher frequency than other bonds, and thus they provide higher liquidity.

On the other hand, plain vanilla bonds miss out on a lot compared to other types of bonds. For example, if the interest rate in the market is rising, then an investor can take advantage of this rising interest rate if he has invested in step-up bonds or bonds with the callable feature. If the investor holds plain vanilla bonds in such a market, he is actually at a loss.

In conclusion, we can say that a plain vanilla bond, like any other financial product, has its pros and cons. Understanding one’s investment goals and diversifying portfolios is more important to reduce risk and maximize returns. An efficient frontier cannot be constructed if we isolate financial products; each product has to be analyzed relatively to arrive at an efficient frontier.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with me. The thoughts you express are really awesome. Hope you will right some more posts.