What is International Banking Facility?

International Banking Facility or IBF is a facility wherein the US Banking institutions provide banking services such as granting loans, and accepting deposits to foreign residents and foreign banks. Banks establish a separate account to provide these services; they, however, can conduct their IBF operations from their existing US-based offices. As banks establish a separate account for this service, the accounting for transactions under this facility is also separate from the domestic transactions.

Three Regulatory Developments have led to the Establishment and Structuring of IBFs.

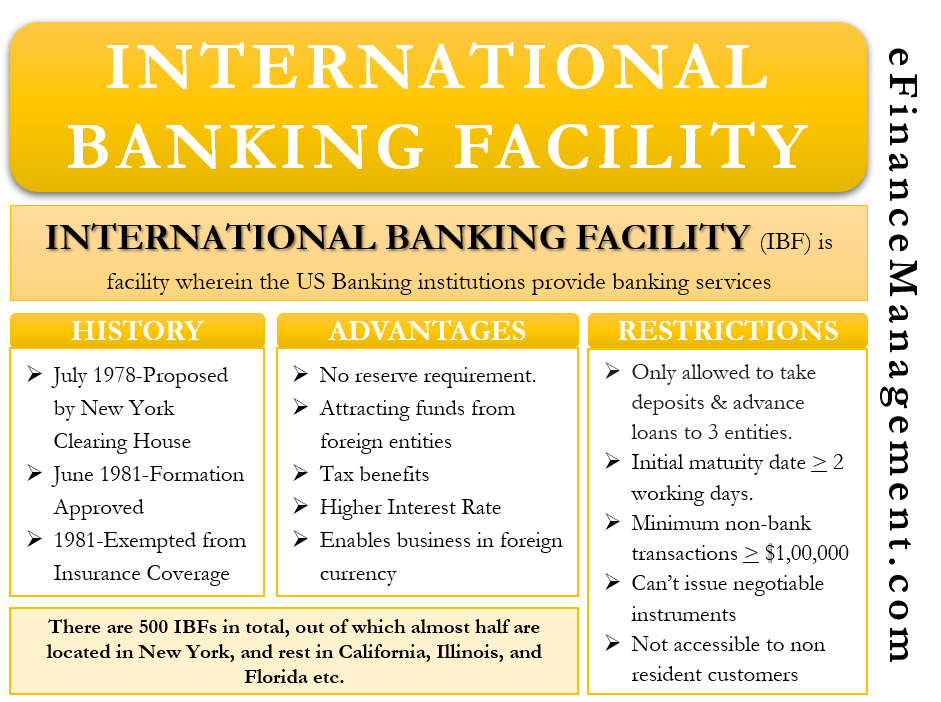

- In July 1978, the New York Clearing House proposed the concept of IBFs. The concept was proposed to the Board of Governors in the Federal Reserve Board, citing the economic sense to the US out of it.

- In June 1981, the formation of IBFs got approval from the Board of Governors in the Federal Reserve.

- IN 1981, Federal legislation exempted IBFs from Insurance Coverage given by The Federal Deposit Insurance Corporation.

What Advantages Accrue to the International Banking Facility?

IBF operations of a bank are free of the reserve requirements or the interest rate ceilings under the Federal Reserve System. This privilege of not being bound by the reserve requirements set by the Federal Bank was formerly available to only foreign banks. With this facility coming into play, it made it possible for the US financial entities to compete with foreign banks. And allowed the domestic institutions to attract and garner funds from foreign individuals and entities. This money could, otherwise, have gone to the foreign banks. Therefore, many US states encourage domestic banking institutions to set up IBF services. They do so by giving them tax benefits under their local laws. In Florida, for example, IBFs are completely exempt from local taxes.

The Federal Deposit Insurance Corporation (a Federal Agency that insures deposits in the US Banks) does not ensure the deposits under IBFs. This means that the deposits under IBFs are at higher risk. Therefore, the IBF deposits attract a higher rate of interest.

IBFs can offer time deposits in large denominations to foreign residents. The minimum non-bank deposits and withdrawals at an IBF must be $1,00,000. IBFs can conduct business in foreign currency. Also, they can extend credit to other IBFs or the US offices of the IBF parent institution. However, the funds borrowed by a parent institution from its own IBF are contingent on Euro currency reserve requirements.

Also Read: International Banking

Restrictions on International Banking Facility

In order to separate International Banking Facility from the domestic money market operations, there are four restrictions on their operations:

- IBFs can take deposits from and advance loans to only 3 entities: 1) A non-resident individual of the US, 2) other IBFs 3) the Parent institution of the IBF itself.

- The initial maturity date on a deposit by a foreign individual must be at least two working days. This is to ensure that IBFs do not create a substitute for checking accounts (a type of bank account that allows you unlimited deposits and withdrawals for daily transactions)

- The minimum number of non-bank transactions must be at least $1,00,000. This is to limit the operations of the IBFs to the wholesale money market (borrowing or lending money in large quantities, majorly done by governments, corporations, and large institutions)

- Under an International Banking Facility account, a bank cannot issue negotiable instruments. A negotiable instrument is an instrument duly issued/signed and stamped by the bank. Since the bank signs the instrument, it amounts to a guaranteed payment by the bank of the money involved in the instrument at a specific time or when the owner demands it. IBFs are not allowed to issue these instruments as they can be easily used in the US money market.

- IBFs cannot accept deposits and grant loans to non-resident customers for the customer’s economic activities in the US. This ensures that IBFs do not compete with domestic sources of credit.

Location of IBF Centers

Of the nearly 500 International Banking facilities in existence, almost half of them are located in New York. Another big chunk of the remaining pie is in California, Illinois, and Florida. What this uneven distribution of IBFs reflects is the locus of the international banking business. This distribution, however, can be due to differences in tax treatments accorded to IBFs by different states.

Continue reading – International Banking.

RELATED POSTS

- International Financial Markets

- Financial Intermediaries – Meaning, Functions And Importance

- Bankers Acceptance – Meaning, History And More

- International Monetary System: Meaning, Evolution, Advantages, Criticisms and More

- Correspondent Banking – Meaning, Features and More

- Bancassurance – Meaning, Advantages, Challenges, and More