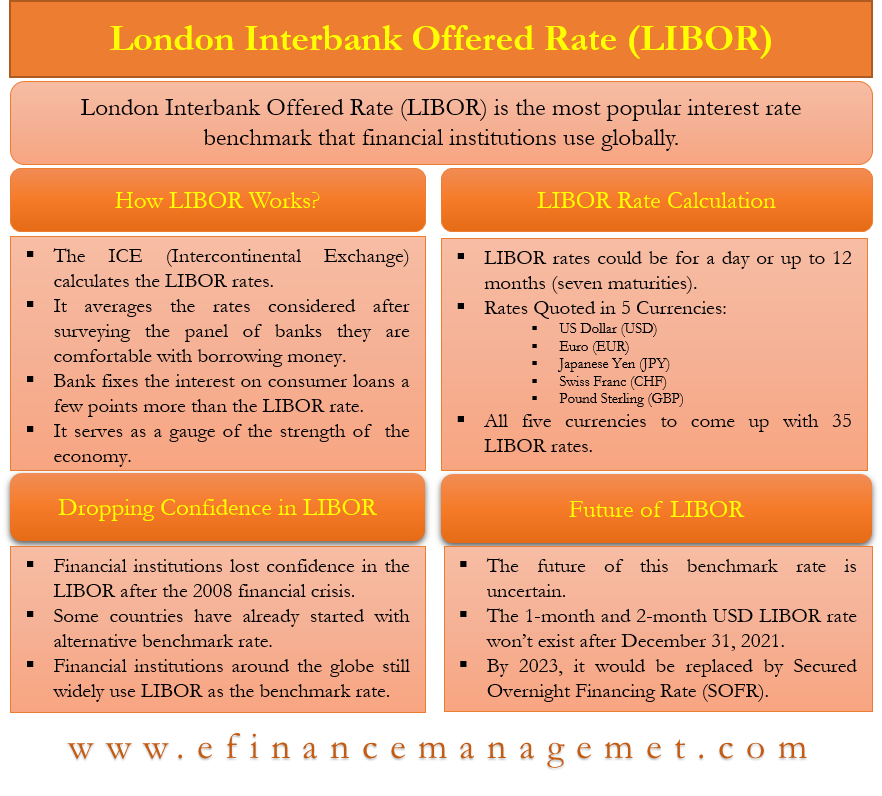

London Interbank Offered Rate (LIBOR) is the most popular interest rate benchmark that financial institutions use globally. Financial institutions, such as banks, use LIBOR rates to set the interest rate on credit cards, loans, etc. And this LIBOR rate is used by banks for all their inter-bank short-term loan arrangements.

Financial institutions use the LIBOR rate to set rates for securities ranging from overnight to one year. On any given day, there could be 35 unique LIBOR rates. However, the most popular is the three-month U.S. dollar rate. We can also call the three-month LIBOR rate as current LIBOR rate.

ICE London Interbank Offered Rate

Before the 2008 crisis, the LIBOR was called BBA (British Bankers Association) LIBOR. Following the 2008 controversies, ICE took the responsibility for calculating the LIBOR rate. Thus, in order to give a fresh name and make it different from earlier, it got a new name, ICE (Intercontinental Exchange) LIBOR.

Along with the name, ICE also follows a slightly different process to calculate the LIBOR. BBA used to take estimates from about 200 member banks, but ICE reduced the reference bank to less than 20.

Also, IBA oversees the LIBOR rates. The regulator includes benchmark users, financial analysts, and other experts. And this helps to maintain the authenticity of the LIBOR. This is one primary reason why LIBOR is safer now than it was a decade back.

How does London Interbank Offered Rate work?

The ICE (Intercontinental Exchange) calculates the LIBOR rates. They do this by surveying the panel of banks on the rates they are comfortable with borrowing money. The association then averages those numbers to come up with LIBOR rates.

Financial institutions then use these rates for a variety of securities. These securities include government and corporate bonds, derivatives, student loans, currency swaps, credit cards, mortgages, interest rate swaps, and more.

Generally, a bank fixes the interest rate on consumer loans a few points more than the LIBOR rate. For instance, a bank may set an interest rate on a 5-year loan at a six-month LIBOR plus 2%. This would effectively mean that after every six months’ frequency, the bank would change the interest rate. That will be based on the prevailing six-month LIBOR, plus 2%. It could further mean that this may either raise or drop the interest rate from the earlier effective rate.

Suppose, in the above example, the current LIBOR rate is 4%. So, the bank will set the six months floating interest rate at 6% (4% plus 2% spread). After six months, the LIBOR rate drops to 3.5% so the bank would charge the floating interest rate to 5.5%.

Along with serving as the benchmark, the LIBOR also serves as a gauge of the strength of the economy. For instance, if the LIBOR rate is weak, the U.K. economy is said to be underperforming, and vice versa. Moreover, banks consider London Interbank Offered Rate when coming up with their own financial policies and targets.

Also, read – TED vs. LIBOR-OIS Spread

LIBOR Rate Calculation

LIBOR rates could be for a day to up to 12 months (seven maturities). Generally, these rates get listed in the morning, around 11 am London time. These rates are quoted in five currencies – US Dollar (USD), Euro (EUR), Japanese Yen (JPY), Swiss Franc (CHF), and Pound Sterling (GBP)

As said above, 35 LIBOR rates come out on a daily basis. To set these rates, the ICE committee uses the advice of a panel of 11 to 16 banks. These 35 LIBOR rates are the combination of five currencies and seven maturities. The seven maturities for which the LIBOR rate is set are overnight/spot next, one week, one month, two months, three months, six months, and twelve months.

The process of setting the rates is as follows:

- The committee asks the panel banks the rates at which they will be comfortable giving money to other financial institutions. This process usually starts in the morning before publishing the LIBOR rates.

- The rates from the panel are then listed in top-down order.

- Now, the committee removes the extreme quotes, usually the top and bottom 25%. The committee averages the remaining rates and rounds them to the five decimal places.

The committee repeats the same process for all five currencies to come up with 35 LIBOR rates. For the USD LIBOR, the ICE committee invites rates from 16 major U.S. banks. These banks include names like UBS, Citibank, JPMorgan Chase, Bank of America, and more. The selection process of the panel banks is carried out on a yearly basis. Generally, the panel selects the banks that enjoy a sizable presence in the U.K. market.

Dropping Confidence in LIBOR

Financial institutions lost confidence in the LIBOR after the 2008 financial crisis. This is because, at the time, several banks were using the benchmark rate to manipulate and make more money and hide the actual funding costs.

This led to a big controversy, forcing FSB (Financial Stability Board) to intervene. In 2013, regulations were introduced over the calculation of the LIBOR rates on the basis of recommendations by the Wheatley Review.

Also, to restore confidence in the LIBOR rate, the ICE Benchmark Administration made changes to LIBOR’s submission and calculation techniques. The ICE Benchmark Administration was entrusted with calculating the rate from 2014. Before this, the British Bankers’ Association (BBA) was responsible for calculating LIBOR rates.

Despite the controversies, financial institutions around the globe still widely use LIBOR as the benchmark rate. As per an estimate by the Federal Reserve Bank of New York in 2018, around $200 trillion of financial securities were based on the USD LIBOR, with derivatives accounting for about 95%.

Some countries, however, are working or have already decided on an alternative benchmark rate. For example, SOFR (Secured Overnight Financing Rate) in the U.S. and SARON (the Swiss average rate overnight).

Future of London Interbank Offered Rate

Despite the efforts from ICE to restore confidence in LIBOR, the future of this benchmark rate is uncertain. As per the Federal Reserve and regulators in the U.K., London Interbank Offered Rate will be ceasing to exist by June 2023. The Secured Overnight Financing Rate (SOFR) would replace it. As part of the phase-out process, the 1-month and 2-month USD LIBOR rates won’t exist after December 31, 2021.

Continue reading – LIBOR vs. SOFR.