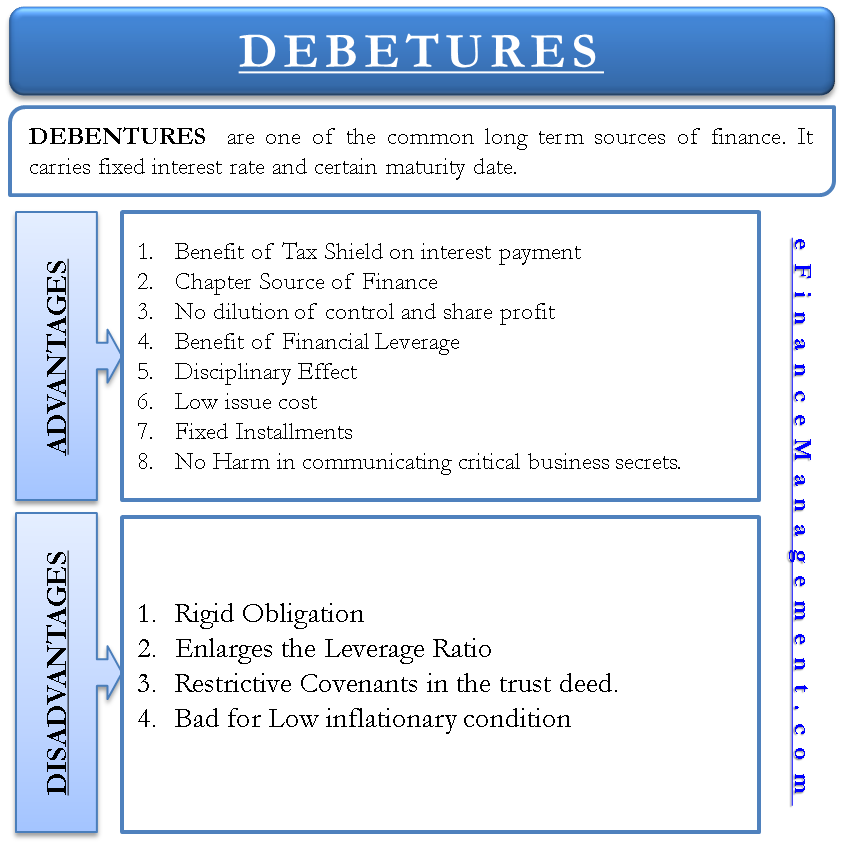

Long-term debt financing is majorly categorized into term loans and debentures. Debentures are one of the familiar long-term sources of finance. They usually carry a fixed interest rate and a certain date of maturity. One has to pay interest every year and the principal on the maturity date. A term loan carries a fixed interest rate, and the payment is made in installments, which consists of both principal and interest. There are several advantages and disadvantages of debentures explained in this article.

A financial institution or a bank lends the term loan, so the financier is the bank or financial institution. Whereas the debentures are issued to the general public, the financier is the general public. This is the fundamental difference between these two types of long-term sources of debt finance—the difference between the terms – Debentures, Bank loans, equity shares, and bonds.

Since both debenture and term loans are types of debt financing, characteristics of debentures are similar to those of characteristics of debt, and hence their advantages and disadvantages are also similar. Following are some benefits and disadvantages of debt financing (debentures or term loans) from the point of view of a company.

Advantages of Debt Financing- Debentures and Term Loan

Benefit of Tax

‘Debt Financing’ or ‘Issuing of Debenture’ results in interest expense for the borrower, which is a tax-deductible expense. A company can claim an interest as an expense against its profits. In contrast, dividends paid to equity or preference shareholders are paid out of net profits after taxes. In short, debt financing, such as debentures, term loans, etc., avails tax benefits to the borrower, which is not there in the case of equity.

Also Read: Characteristics of Debenture

Cheaper Source of Finance

As discussed above, the interest cost incurred on debt financings such as debentures or term loans enjoys a tax shield which indirectly lowers the cost. Effective interest cost of a 12% debenture with current tax rate of 30% is 8.4% {12% * (1-30%)}. The underlying assumption behind the calculation is that the entity is making a profit at least to the tune of the total interest payment. Even the rate of interest is lower than the cost of equity. Because of this, debt financiers have comparatively lower risk, so they are offered less return. Following are the reasons why investors of debenture have a comparatively lower risk.

| Sr. No. | Debenture | Equity |

| 1 | The company has to pay Interest no matter profit or loss. | There is no Equity Dividend in case of loss. If there is a profit, even in that case, unless the Board of Directors offers a dividend, equity shareholders do not receive a dividend. |

| 2 | Assets of the company are mortgaged in favor of the debenture holder. In case of liquidation of the company, the sale value of these assets will be used first to redeem debentures. | Equity Shareholders don’t get such facility of the mortgage. |

| 3 | Suppose the sale value of these assets is insufficient to redeem debentures holders. In that case, the sale value of other assets will be used first to redeem debentures and, after that, equity shareholders. | Equity shareholders are last in the queue to receive their amount in case of liquidation of the company. |

No Dilution of Control

Issuing debentures or accepting bank loans does not dilute the control of the existing shareholders or the company’s owners over their business. If there is a rise in the same fund using equity finance, there are chances of losing control of existing shareholders.

No Dilution in Share of Profits

Opting for debentures over equity as a source of finance keeps the profit-sharing percentage of existing shareholders intact. Debenture holders or financial institutions do not share profits with the company. They are liable to receive the agreed amount of interest only. Therefore, the same number of hands share the profits before and after the new project. However, in the case of convertible debentures (debentures that convert into equity shares after a certain time), this may no more remain an advantage as the debenture holders would then become equity shareholders receiving all the rights as of the equity shareholders.

The benefit of Financial Leverage

By involving debt in a profit-making company, the management can always maximize the shareholders’ wealth. For example, a company’s internal rate of return is 15% against a 12% rate of interest on debt funds. The shareholders share the extra 3% of earnings out of the money of, say, debenture holders since there is a definite interest cost on the debt. Therefore the returns over and above the cost of interest spill over into the hands of shareholders only. This is how financial leverage converts into wealth maximization. All this is true under the condition that the rate of return on investment on debt funds is at least greater than the percentage of interest.

Disciplinary Effect

There is a burden of interest despite business profit or loss, operational situations, etc. This makes the entrepreneur all the more cautious and committed to managing the business and maintaining the cash flows effectively. It is because a severe punishment, i.e., ‘bankruptcy,’ is enclosed for nonpayment of debenture interest on time. It is similar to the situation of a car seat belt. One uses it more because of the penalties the government authority imposes rather than for safety reasons. Similarly, a fixed installment of debt repayment brings in a discipline in the management for better management of cash flows and other operations.

Low Issue Cost

In the case of a term loan, there is a comparatively lower cost of the issuance. Whereas in the case of equity financing, there is a huge cost of issuance.

Fixed Installments

Debt financing by term loan or debentures has fixed installments/coupon payments until the loan’s maturity. In a rising economy with increasing inflation, the effective cost of future installments decreases due to a decline in the currency’s value.

No Harm in Communicating Critical Business Secrets

In the case of a term loan, the company may have to reveal a lot of information about the company to the financial institutions. By entering into NDA (non-disclosure agreement), the company can ensure its secrets remain hidden from its competitors.

Callable Debentures / Bonds

There can be a debenture or Bond issuance with a callable feature. If in case there is a decrease in the rate of interest in the market, the company can redeem the existing debenture. It can do so by offering a premium and can issue new debt financing at a lower interest rate.

Disadvantages of Debt Financing- Debentures and Term Loans

Rigid Obligation

‘Interest paid to the debenture holders’ or ‘installment and interest of term loan’ is a legal obligation, and the business has to honor the same come what may. This feature of debt financing, in general, creates a problem for the business in bad times. Economic and other environmental ups and down are certain to come. Under those situations, a new business that is about to take off cannot have such disciplined cash flows to pay the interest or installment on time.

Therefore, debenture and term loans are not the right kinds of financing options for them, especially in their nascent stage. This fixed expense may create a big mismatch with cash flows, and the company may have to go into bankruptcy. A term loan can still be viable because banks provide a moratorium or gestation period or, at times, adjust the obligation with the pattern of cash inflows of the company. Such modifications are not possible in debentures.

Enlarge Leverage Ratios

Debt financing raises the leverage of the business. High leverage means a high risk of bankruptcy. Bankruptcy is not the only risk, but if the company’s rate of return declines below the debenture interest rate at a later stage after issuing the debentures, it can bring the whole project on a toss. The costs of projects may increase due to market conditions, but interest payment would not change to compensate for such an increase in costs.

Restrictive Covenants

In the trust deed formed between the company and the trustee bank or financial institution, certain restrictive covenants restrict the hands of the management from doing business with liberty. There are various restrictions with respect to the usage of assets, the creation of liabilities, cash flows, control, etc. They may stumble upon every business decision and affect the effectiveness of the overall decision-making process.

Bad for Low Inflationary Conditions

Although fixed interest has certain benefits like it is beneficial to a high inflation environment, it also accompanies disadvantages. Under low inflationary conditions, the cash outflow remains constant, but the money’s value increases. To compare it with business situations, the market price of the products of the company will decline in low inflationary conditions. Still, the interest payment will remain the same, and hence that will create a loss-making mismatch.

Advantages and Disadvantages of Debentures from an Investor’s Point of View

From an investor’s viewpoint, the prime advantage of investing in debenture is the fixed and stable return. They not only get that benefit but also a preferential right of payment at the time of liquidation. At the same time, that is not in the case of equity or preference shares. The main disadvantage of preferring debenture over equities is that the debenture holder does not get the right to vote, and there is no profit sharing. The returns are finite to the extent of interest irrespective of the higher earnings of the company. Also, there is another benefit besides this. In case of an increase in the market interest rate, the debenture holder will get their fixed interest income even though the interest rate has increased in the market.

your work is commendable. keep it up.

Which one is less costly for a.company, debntures or preference share?

thanks…really helped

thanks for creating this site, it really helps me understand the flow of the business environment. . . . and it really fits my course which is about financing. Keep it up!

I do not even understand how I finished up right here, however, I assumed this submit was good. I do not recognize who you’re but certainly, you’re going to be a famous blogger when you aren’t already. Cheers!

Great article. Thank you