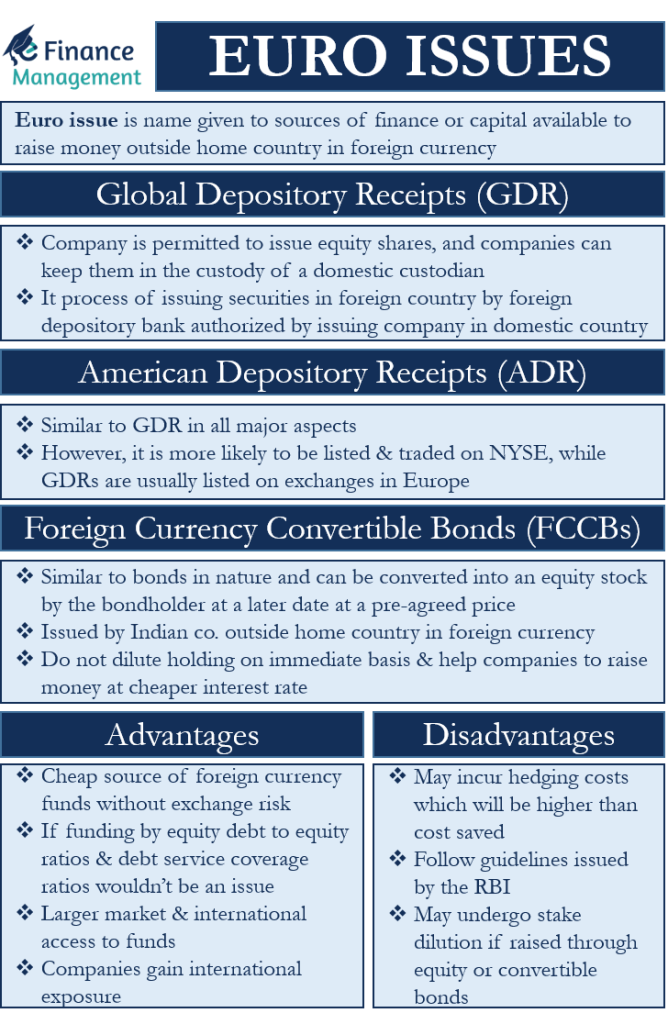

Euro issue is a name given to sources of finance or capital available to raise money outside the home country in foreign currency. The most commonly used sources of funds that fall under Euro issues are American Depository Receipts (ADR), Global Depository Receipts (GDR), and Foreign Currency Convertible Bonds (FCCB), among others.

Let us try and understand each of these sources of finance used by companies to raise capital:

Global Depository Receipts (GDR)

Under the Global Depository Receipt (GDR) option, the company is permitted to issue equity shares, and companies can keep them in the custody of a domestic custodian. Upon instruction from the domestic custodian bank, the overseas depository bank issues fresh securities in the nature of GDR for the foreign market against shares kept under the local custodian bank.

All this happens under strict guidelines permitted by the government of India. In simple words, this is essentially a process of issuing securities in a foreign country by a foreign depository bank authorized by the issuing company in the domestic country. These are denominated in foreign currency, usually in U.S. dollars, and are listed on exchanges outside the home country.

American Depository Receipts (ADR)

The American Depository Receipts are similar to GDR in all major aspects; however, the differentiating feature is that the ADRs are more likely to be listed and traded on New York Stock Exchange, while GDRs are usually listed on exchanges in Europe.

Also Read: External Commercial Borrowing (ECB)

Foreign Currency Convertible Bonds (FCCBs)

FCCBs are very similar to bonds in nature and can be converted into an equity stock by the bondholder at a later date at a pre-agreed price. These, like ADR and GDR, are issued by Indian companies outside the home country in foreign currency. These enjoy higher preference as they are issued as bonds. But at the same time, they do not dilute the holding on an immediate basis and can help companies to raise money at a cheaper rate of interest. The FCCBs issued by companies also have to be done within the set of guidelines permitted by the government of India.

Let us have a look at some of the major advantages and limitations of Euro issues. To enable a better understanding of the concept. And also to understand why companies find it attractive to raise money through this route.

Advantages of Euro Issues

- Raising funds by way of the euro issue acts as a cheap source of foreign currency funds for the company without exchange risks. Especially for companies that have foreign currency receivables.

- In the case of funding by way of equity, debt to equity ratios and debt service coverage ratios wouldn’t be an issue.

- Euro issues provide a larger market and international access to funds. They may lead to easy larger volume funding, which may be difficult from domestic sources. It opens up many new opportunities for the companies in new markets.

- Companies gain international exposure and can enhance liquidity for their shares.

Disadvantages of Euro Issues

Despite the many advantages of euro issues, making it an attractive source of finance for companies, a few limitations of euro issues need to be evaluated before choosing the right option. The limitations are given below:

- Though euro issues are usually available at lower costs, companies that do not have adequate receivables may run currency exchange risk. And may have to incur hedging costs which may turn out to be higher than the cost saved.

- Not all companies can avail funds via euro issues. The companies have to follow the guidelines issued by the Reserve Bank of India. And also meet the criterion to avail of funding through this route.

- Companies may have to undergo stake dilution if raised through equity or convertible bonds.

Conclusion

Companies have enough motivation to raise funds from foreign markets despite some of the limitations listed above. The country’s government has its own set of worries which still remain a matter of debate. Capital flowing out of the country and money laundering probabilities has remained prime concerns of the regulator. Hence, the government has various restrictions on the amount, tenure, and sectors where such funding can be availed. With financial markets interlinking globally and increasing transparency and prudent regulatory guidelines, raising funds through these sources is likely to grow much more in the future than now.

sir,

I couldn’t understand the role of firms receivables in raising capital through ADR/GDR. Can you please elaborate little bit logical way how it plays a role in companies which do not have adequate receivables as mentioned in the limitations as well as in the advantages. Thanks in advance

Euro issues are definitely a great source to fund the Indian companies as they have many benefits.But we need to ensure that it is with in the limits