Introduction

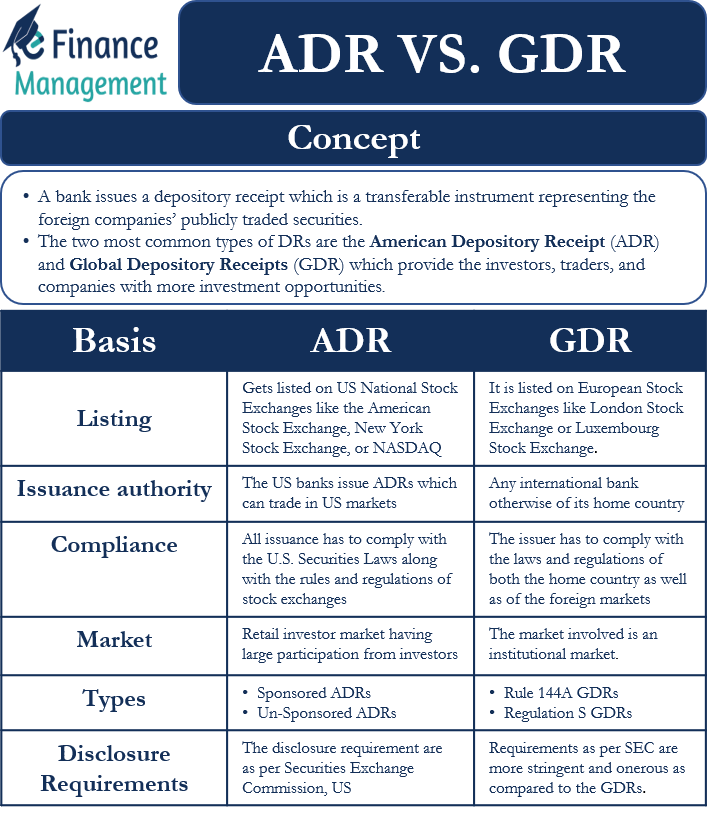

A bank issues a depository receipt which is a transferable instrument representing the foreign companies’ publicly traded securities. Investors can hold the shares in other countries’ equities with the help of a depository receipt. The two most common types of DRs are the American Depository Receipt (ADR) and Global Depository Receipts (GDR), which provide the investors, traders, and companies with more investment opportunities. The listing of ADRs representing the stocks of a foreign company happen on the American Stock Exchanges. And every transaction denomination happens in U.S. dollars and allows a US investor to achieve higher returns. A GDR is similar to an ADR, but it is not traded in the US market. Further, its trade happens outside the issuing company’s home country. The GDRs denomination can be in US dollars, Euros, and British Sterling. Let us see more about ADR vs GDR.

Though ADR vs GDR is both depositary receipts, they have differences. We will discuss those differences in this article based on their features, listing, and functions.

ADR vs GDR – Differences

The following points specify the differences that exist between an ADR and GDR:

Listing

Listing of ADRs happens only on US National Stock Exchanges like the American Stock Exchange, New York Stock Exchange, or NASDAQ. However, in contrast, GDRs can be listed on European Stock Exchanges like London Stock Exchange or Luxembourg Stock Exchange.

Issuance Authority

In the case of ADRs, the US banks issue ADRs which can trade in US markets. Some of the US banks which sponsor ADRs are – The Bank of New York Mellon (BNY) and State Street. In the case of GDRs, the issuer can be any international bank, and it allows the investors to have access to capital markets otherwise of their home country. Several international banks issue GDRs, such as Deutsche Bank and JP Morgan Chase.

Also Read: American Depository Receipt

Compliance

All the issuance of ADRs must comply with the U.S. Securities Laws along with the rules and regulations of Stock Exchanges. In contrast, while issuing GDRs, the issuer has to comply with the laws and regulations of both the home country as well as of the foreign markets, respectively.

Market

In the case of ADRs, the market is a retail investor market having large participation from investors. Whereas in the case of GDRs, the market involved is an institutional market.

Types

Types of ADRs

The ADRs are classified into two categories – Sponsored ADRs and Un-Sponsored ADRs.

Sponsored ADRs

Whenever there is a contract between a Non-US Company and a US Bank, the creation of the Sponsored ADRs happens. In this type of ADR, the company bears all the handling costs concerning the issuance of depository receipts in the market. In contrast, the bank deals with all the transactions occurring between the investors and the non-US company through depository receipts.

Un-Sponsored ADRs

The creation of un-sponsored ADRs also happens by US banks without involving any non-US company. And hence such ADRs are traded mostly over-the-counter. The unsponsored ADRs are further classified into Type I, Type II, and Type III ADRs.

Also Read: Depository Receipts

Types of GDRs

On the other hand, GDRs are broadly classified into two categories – Rule 144A GDRs and Regulation S GDRs.

Rule 144A GDRs

The GDRs that are regulated by Rule 144A of the Securities Exchange Commission (SEC) of the US is termed as Rule 144A GDRs. And through such GDRs, a non-US company has the permission to trade and raise funds in the US financial markets. Hence, GDR comes across as a cheaper alternative as compared to Type III ADRs to raise funds from US markets.

Regulation S GDRs

Whereas Regulation S GDRs permit non-US companies to raise capital and establish a trading presence in the European Markets only. Moreover, such GDRs can trade only on European stock exchanges.

Disclosure Requirements

As the issuance of ADRs is governed by the SEC of the US, the disclosure requirements are as stipulated by SEC. Further, generally, the requirements as per SEC are more stringent and onerous as compared to the GDRs.

ADR vs GDR – Conclusion

GDR and ADR are depository receipts providing investors with opportunities to raise funds from markets. Investors can create a diversified portfolio by adding these depository receipts in their portfolios and can thus have access to global markets. US investors get the opportunity to invest or deal in foreign companies’ stocks with the help of ADRs in the US markets. On the contrary, GDR allows foreign companies to deal in stocks of any market except US markets. GDRs can be negotiated globally. However, ADRs can be negotiated only in the USA. ADRs and GDRs enlisting can happen only in American Stock exchanges and European Stock Exchanges, respectively. They can be differentiated based on their types. Issuance authorities and regulatory authorities are different for both the DRs. However, both of these DRs do involve risks associated with the fluctuation in foreign exchange rates.