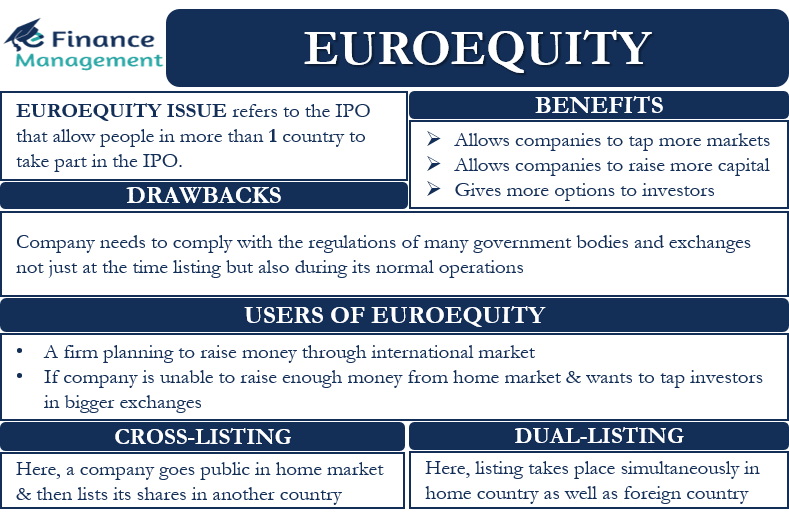

Euro equity or Euroequity issues is a source of finance. It is a term that one would come across in case of an IPO. Usually, when a company goes public, it offers its shares to the public where it is registered. But euro equity refers to the IPO that allows people from more than one country to take part in the IPO. Or we can say that shares of the company are available simultaneously for subscription in many financial markets.

Such an arrangement is beneficial both for the company and the investors. It allows a company to raise more capital, and for investors, it allows them to participate in potential overseas companies. In the case of euro equity, the securities are usually made available by an international underwriting syndicate.

Real-World Example

One real-world example of euro equity is Gucci Group. In 1995, holding company Investcorp sold its 49% stake in Gucci Group in an IPO on NYSE, as well as AEX (Amsterdam Stock Exchange) simultaneously. Investcorp sold the remaining stake in the Italian luxury goods firm in 1996.

Gucci was nearing bankruptcy in the early 1990s, but the dual listing worked well for the company. The company was able to boost its revenue, as well as the number of stores.

Also Read: Euro Issues

Who Uses Euroequity?

- Generally, a firm that plans to raise more money and that too from various countries uses this route.

- If a company feels that it will not be able to raise enough money in the home market and wants to tap investors in bigger exchanges, like NYSE, then it may take this route to list in more than one country.

Usually, foreign companies prefer listing in the U.S. because of its massive capital markets and protective SEC (Securities and Exchange Commission) regulations.

Cross-Listing & Dual-Listing

You must not confuse euro equity with cross-listing. In cross-listing, a company goes public in the home market and then lists its shares in another country. But, in euro equity, a company’s shares lists simultaneously on more than one market, including the home market.

However, the euro equity way of the listing is similar to dual-listed IPOs. In the case of dual-listed IPOs, a company lists shares simultaneously in the home country and a foreign country. However, a company may also list in more than two markets in euro equity.

Benefits and Drawbacks of Euroequity

Like with any other thing, euro equity has its own share of benefits and drawbacks.

Benefits

- It allows companies to tap more markets and raise more capital.

- It gives more options to investors to invest their money.

Drawbacks

Coming to drawbacks, the biggest one is that the company needs to comply with the regulations of many government bodies and exchanges.

Moreover, companies need to comply with the regulations (in all the markets it lists) not just at the time of listing but also during their normal operations. This could substantially raise the cost for the company because compliance remains a continuous exercise.

For instance, the 2002 Sarbanes-Oxley Act increased the regulations on companies in an attempt to restore investor confidence following many accounting scandals. This raised the cost of financial reporting. Also, many of the Act’s rules did not go well with the European Union (EU) data and privacy legislation.

Also Read: International Equity Market

Following the 2002 Sarbanes-Oxley Act, several foreign companies, including car maker Porsche, gave up their intentions to list on the U.S. exchanges. Even Gucci withdrew from the U.S. market following the new regulations. Similarly, British telecom giant BT Group also came up with plans to delist from the NYSE due to high reporting costs. Thousands of U.S. firms also went private after those regulations were put in place.

Frequently Asked Questions (FAQs)

– a firm that plans to raise more money from various countries

– a company that is unable to raise enough money in the home market

The above are the users of euro equity.

In the case of dual-listed IPOs, a company lists shares simultaneously in the home country and a foreign country. However, a company may list its shares in more than two markets in euro equity.

The biggest drawback is that the company needs to comply with the regulations of many government bodies and exchanges not just at the time of listing but also during its normal operations.