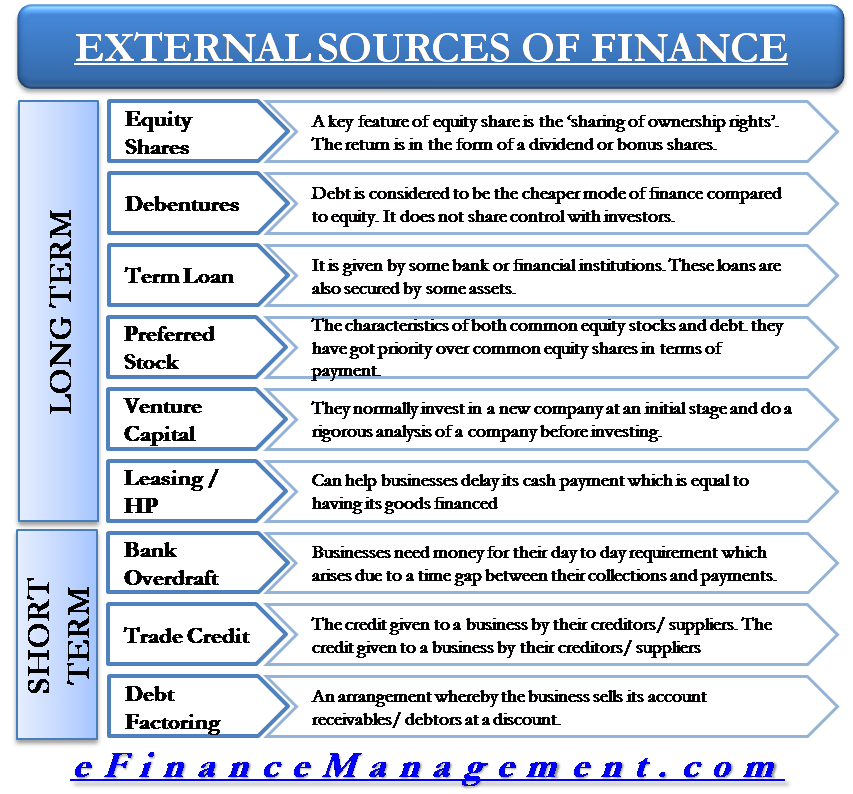

The term ‘External Source of Finance / Capital’ itself suggests the very nature of finance/ capital. External sources of finance are equity capital, preferred stock, debentures, term loans, venture capital, leasing, hire purchase, trade credit, bank overdraft, factoring, etc. By external sources, we mean the capital arranged from outside the business, unlike retained earnings which are internally generated out of the activity of a business.

External sources of finance are those sources of finance that come from outside the business. For example, retained earnings are an internal source of finance, whereas bank loans are an external finance source. We can segregate external sources of funds between long-term sources of finance and short-term sources of finance.

Long-Term Sources of Finance

Equity Shares

Equity shares are a common source of finance for big companies. Not all businesses can use this source as it is governed by many legislation. A key feature of equity share is the ‘sharing of ownership rights,’ and therefore, the current shareholders’ rights are diluted to some extent.

It is considered costly compared to debt finance because the return in the form of a dividend or bonus shares offered to shareholders is not tax-deductible. Also, it’s not easy to raise this capital as it requires many legal formalities to be complied with, and above all, the investors should have faith in the company.

Also Read: Internal Sources of Finance

Debentures

Debentures are another common means of finance used by companies who prefer debt over equity. Debt is considered to be the cheaper mode of finance compared to equity. It does not share control with investors. It is because the interest paid to debenture holders is tax-deductible. The rest of the process of debentures issue is similar to the equity issue. It is offered to the common public, and therefore necessary legislations need to be complied with. Debentures also involve some cost of issuing, and they are collateralized by some company assets.

Term Loan

The characteristics of a term loan are very similar to debentures, except that it does not include too much cost of issuing because some banks or financial institutions give it. There is no involvement of a public company. The bank does a rigorous analysis of the company’s financials and future plans to judge the debt servicing capacity of the company. Some assets also secure these loans.

Preferred Stock

The preferred stock shares characteristics of both common equity stocks and debt. They are called preferred because they prioritize common equity shares in terms of payment of dividends and the capital at the time of liquidation. A special kind of preferred share called cumulative preference shares has its dividend accumulated till it is not paid. There can be a delay in the payment of such dividends but cannot be ignored.

Venture Capital

It is the same as equity shares, except that the investors are a different group of people. Commonly known as venture capitalists, they usually invest in a new company at an initial stage and do a rigorous analysis of a company before investing. Venture capitalists exit the firm once it starts getting a reasonable valuation.

Leasing and Hire Purchase

Choosing hire purchase or lease as an option over paying the total amount to the supplier of goods can help businesses delay their cash payment which is equal to having their goods financed. Normally, the hire purchase option is provided by suppliers of big machinery, or the bank becomes an intermediary at times. Both lease and hire purchase to provide the buyer with an option to purchase the asset at the end of its term.

Short Term Sources of Finance

Bank Overdraft

Bank overdraft is a simple mode of short-term financing. Businesses need money for their day-to-day requirements, which arises from a time gap between their collections and payments. A bank overdraft is an ideal short-term source of finance to fulfill such requirements.

Trade Credit

Trade credit is nothing but the credit given to a business by its creditors/ suppliers. It allows a business to delay its payments for some period. The credit period depends on the credit terms between the business and the suppliers.

Factoring in Debt

It is an arrangement whereby the business sells its account receivables/ debtors at a discount. In this arrangement, the buyer, who is known as the factor, collects the money from the debtors on behalf of the business and charges a premium for this service. If the debtor does not pay for any reason, the factor can get back to the business for the payment.

Quiz on External Source of Finance / Capital

This quiz will help you to take a quick test of what you have read here.

thank you so much…your blog helped me a lot to prepare for my exam…thank you once again..

Excellent beat! I would like to apprentice while you amend your web site, how could I subscribe for a blog web site? The account aided me with an acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept.

Thanks for sharing this article. This article is very helpful for me to have a good financial management.I also believe that this will definitely help me to finance my business. I’ll definitely return to this very helpful site.

Factoring is new yet I think that it’s very useful for business owners to get paid on time. This article is very informative and helpful as well. Thanks for sharing this.

Good notes and knowledge acquired

Good