What is Debt Service Coverage Ratio?

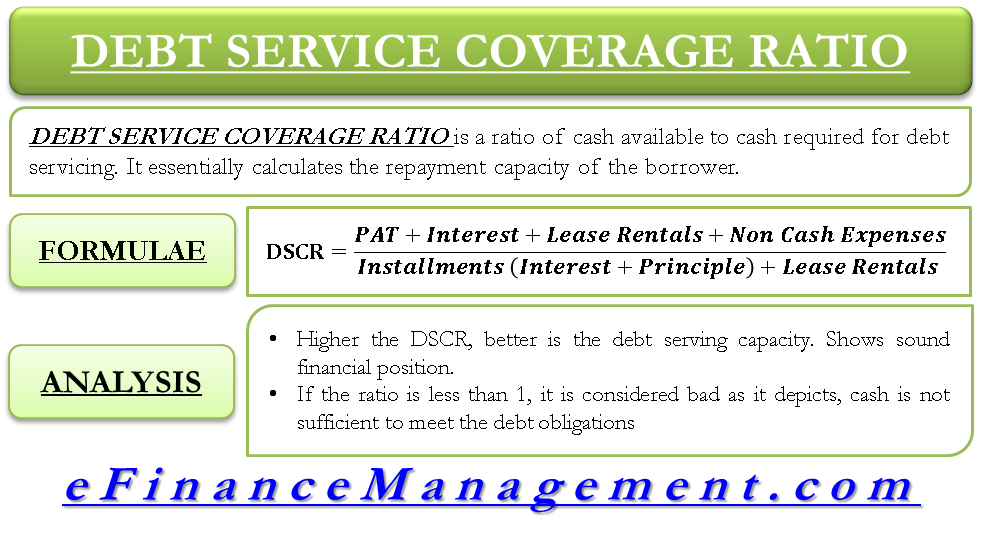

The debt service coverage ratio (DSCR) is a ratio between cash available to a business and cash required for servicing its debt. In other words, it is the ratio of the sufficiency of cash to repay the debt in time. It essentially calculates the repayment capacity of a borrower.

A DSCR less than 1 suggests a firm’s cash inability to serve its debts in time. Or that the firm will struggle in meeting its debt obligations. Whereas a DSCR of greater than one is considered to be healthy. It means that the company will be able to serve all its debt obligations smoothly.

Formula of Debt Service Coverage Ratio

Let us learn how to calculate the debt service coverage ratio. The formula is:

| DSCR = (PAT + Interest+ Non-cash expenses) / Debt Service |

The calculation of DSCR is very simple. To calculate DSCR there is a requirement for the following items from the financial statement:

Profit after Tax (PAT)

It is the balance of the profit and loss account which is transferred to the reserve and surplus fund of the business.

Interest

The amount payable for the financial year by the company on the loans taken.

Non-cash Expenses

The logic behind adding all these expenses is that such expenses do not result in any cash outflow. For example, depreciation, miscellaneous expenses written off, etc.

Debt Service

Debt service or debt servicing implies the regular payment of installments of loans. An installment includes interest on debt and a part of the principal. If a company is unable to honor its debt service obligations in the absence of required funds, the company is said to be unable to service its debt.

Sometimes, these figures are readily available, but at times, they are to be determined using the financial statements of the company/firm.

You can also use our DSCR Calculator for a quick calculation.

Interpretation of DSCR

Calculating a ratio does not serve the purpose until the analysis and interpretation of DSCR are correct. Because the result of a debt service coverage ratio is an absolute figure, the higher this figure is, the better the debt-serving capacity of the entity. It shows the sound financial position of the company. If the ratio is less than 1, it is considered harmful because it simply indicates that the firm’s cash is not sufficient to service its debt obligations.

The acceptable industry norm for a debt service coverage ratio is between 1.5 to 2. The ratio is of utmost use for money lenders such as banks, financial institutions, etc. Objectives of any financial institution behind giving a loan to a business are earning interest and ensuring that the principal amount remains secured and comes back as planned.

Let’s take an example where the DSCR is coming to be less than 1, which directly indicates negative views about the repayment capacity of the firm. Does this mean that the bank should not extend the loan? No, absolutely not, and as we say, one indicator is not enough to draw all the conclusions. The bank needs to carefully evaluate and analyze the profit-generating capacity and business idea as a whole. If the business is strong in both of them, it can improve the DSCR by increasing the loan term. Increasing the loan term will reduce the denominator of the ratio and thereby enlarge the ratio to greater than 1.

Read How to Analyze (Interpret) and Improve Debt Service Coverage Ratio (DSCR)? for more.

Why Debt Service Coverage Ratio?

Debt Service Coverage Ratio (DSCR), is one of the coverage ratios, that is calculated to know the availability of cash profits to repay the principal and interest obligations. Essentially, DSCR is calculated when a company/firm takes a loan from a bank / financial institution / any other loan provider. This ratio determines the cash profit available to the company to meet the repayment of the financial loan and interest promptly. And, therefore, DSCR is very important from the viewpoint of the financing authority that is lending a loan to the company. Moreover, just a year’s analysis of DSCR does not lead to any concrete conclusion about the debt servicing capability. Hence, DSCR is relevant only when it is for a loan’s entire or remaining period.

Also Read: How is DSCR Calculated?

Cautions

Does lower DSCR mean the banks should not provide the loan? No, the bank will look for the earning capacity of the business as well as the idea to generate higher profits. Suppose the bank is satisfied with the idea and earning capacity. In that case, it can increase the period of the loan, which will result in decreasing the installment amount and eventually lead to improve DSCR. However, ultimately here also bank would like to see that the DSCR is comfortable even during the extended loan period. Therefore, DSCR becomes an important indicator for the successful evaluation and approval of the loan proposal for banks and financial institutions

Final Words

Companies with higher DSCR can bargain for favorable terms, like a lower rate of interest, less protective covenants or security, etc. Truly for any loan, this ratio is a must. It finally says that whatever obligations the company is committing, the resources are enough to meet those obligations when the DSCR is more than 1.

Note: some writers and teachers suggest that it should also include lease rental payments in this calculation, i.e., its addition should be to the numerator and the denominator. We, however, have a different view. Lease rental can be a long-term expense, but the rental expense is like any other expense. And therefore, it is not a debt obligation. DSCR is for calculations of debt obligations. Of course, if it is a DPG arrangement, it will automatically become part of the Debt Obligations. Hence, we have not included lease payments/rentals while calculating DSCR.

Thanks for explaining in simple terms. Further could you please clarify, for an Financial Institution is this a relevant metric for assessment or should we look at Interest service coverage ratio?

For financial institution who is assessing his borrower, DSCR is a good metric.

For clarity on ISCR i.e. Interest service coverage ratio check this

Interest Service Coverage Ratio / Times Interest Earned

WHAT IS AVAILABLE TO DISTRIBUTE as dividend FOR A COMPANY. say we have bank required DCSR1.3, based on our calculation we get DCSR 2.4, anything exceeding 1.3 may be distributed and in this case it is 2.4-1.3=1.1.

should we multiply 1.1* cash flow or to our debt to determine cash can be distributed.

Useful for me

Very helpful -Thank you

Thank you for simply presentation with all related questions ,answer and explanations