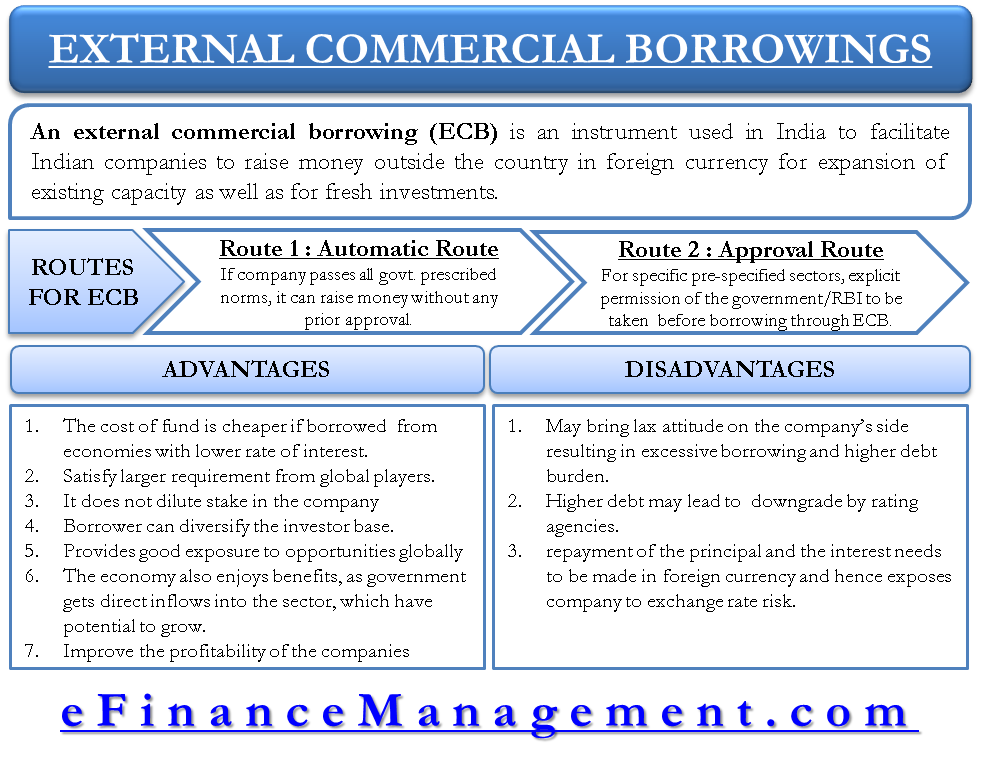

An external commercial borrowing (ECB) is an instrument used in India to facilitate Indian companies to raise money outside the country in foreign currency. The government of India permits Indian corporates to raise money via ECB for expansion of existing capacity as well as for fresh investments.

Other such external sources of finance/capital include FCCBs and FCEBs. While foreign currency convertible bonds are issued to raise finance, ECB refers to commercial loans, which can be in the form of bank loans, bonds, securitized instruments, buyers’ credit, and suppliers’ credit availed from non-resident lenders with a minimum average maturity of 3 years.

Routes for ECB

ECB can be availed by either automatic route or by approval route. Under the automatic route, the government has permitted some eligibility norms with respect to industry, amounts, end-use, etc. If a company passes all the prescribed norms, it can raise money without any prior approval.

For specific pre-specified sectors, the borrowers have to take explicit permission from the government/The Reserve bank of India (RBI) before borrowing through ECB. RBI has issued formal guidelines and circulars specifying these borrowing rules.

Also Read: Foreign Currency Convertible Bond (FCCB)

Let us look at the advantages and limitations of ECBs to understand the topic in further detail.

Benefits of ECB

- The cost of funds is usually cheaper from external sources if borrowed from economies with a lower interest rate. Indian companies can usually borrow at lower rates from the U.S. and the Eurozone as interest rates are lower there compared to the home country, India.

- Availability of a larger market can help companies satisfy larger requirements from global players better than what can be achieved domestically.

- ECB is just a form of a loan and may not be of an equity nature or convertible to equity. Hence, it does not dilute the stake in the company and can be done without giving away control because debtors do not enjoy voting rights.

- The borrower can diversify the investor base.

- It provides access to international markets for the borrowers and gives good exposure to opportunities globally.

- The economy also enjoys benefits, as the government can direct inflows into the sector and have the potential to grow. For example, the government may allow a higher percentage of ECB funding in the case of infrastructure and SME sectors. This helps in the overall development of the country.

- Avenues of lower-cost funds can improve the profitability of the companies and can aid economic growth.

ECB is a very attractive option for companies due to the advantages mentioned above. Although there are some demerits of the ECB as given below:

Disadvantages of ECB

- Availability of funds at a cheaper rate may bring in a lax attitude on the company’s side, resulting in excessive borrowing. This eventually results in higher (than requirement) debt on the balance sheet, which may affect many financial ratios adversely.

- Higher debt on the company’s balance sheet is usually viewed negatively by the rating agencies, resulting in a possible downgrade by rating agencies which eventually might increase the cost of debt. This may also tarnish the company’s image in the market and the market value of the shares too in eventual times.

- Since the borrowing is foreign currency-denominated, the repayment of the principal and the interest needs to be made in foreign currency, exposing the company to exchange rate risk. Companies may have to incur hedging costs or assume exchange rate risk, which if goes against may end up negative for the borrowers resulting in heavy losses for them.

Conclusion

Though external commercial borrowings come at lower costs, it comes with various restriction and guidelines that need to be followed. There exist restrictions on the amount and maturity of the ECB. ECBS above $ 20 million needs to be of minimum average maturity of 5 years, and below $ 20 million should have a minimum average maturity of 3 years. There are restrictions with regards to the end-use of the funds too. The companies may use it for expansion, but they cannot use it for onward lending, real estate investments, repayment of existing loans, and many such limitations. ECBs are one of the commonly availed sources of cheaper funds by eligible companies. However, the companies need to be cautious about the exchange rate risk and impact on balance sheet debt to use it effectively.

RELATED POSTS

- External Source of Finance / Capital

- Sources and Uses of Funds – All You Need to Know

- Advantages and Disadvantages of Equity Finance – from Company’s Angle

- Advantages and Disadvantages of Bank Loans

- Industrial Revenue Bond – Meaning, Benefits, History and More

- Debt Market: Meaning, Issuers, Instruments, Advantages, Disadvantages, and More

hi!, I like your writing so much! share we communicate more about your article on AOL? I require an expert on this area to solve my problem. Maybe that’s you! Looking forward to seeing you.

I enjoy you because of all your efforts on this site. My niece really loves managing investigation and it’s easy to understand why. My partner and I hear all regarding the dynamic method you make sensible information through your website and encourage participation from website visitors on this matter then our child is really starting to learn a lot of things. Have fun with the remaining portion of the year. You’re the one conducting a useful job.

தெளிவான, அருமையான விளக்கம். பொருளாதார அறிவு சாமானியனுக்கும் ஏற்படும்படியான பதிவு. வாழ்த்துக்கள்! நன்றி.

I am interested in investing in ECBs from reputable companies and organizations in India. Can you recommend some sources for such ECB paper? Is there a data source where all organizations using ECB to raise funds have to register the information? Thanks in advance for your help.

Hi Kris,

Your option of Investing in India via the ECB route is still open ?

Best Regards

Anil Kumar Dubey.

Thank you a lot for sharing this with all folks

Hi,

We are Nagpur Based Business Family for our New Agro Tech Manufacturing StartUp Seeking ECB for 1.2Million as Debt / PE / Fixed Rate How can you Help us and if you Provide Such Services Kindly Contact.

Thanks

valuable

Thank you a lot for sharing.