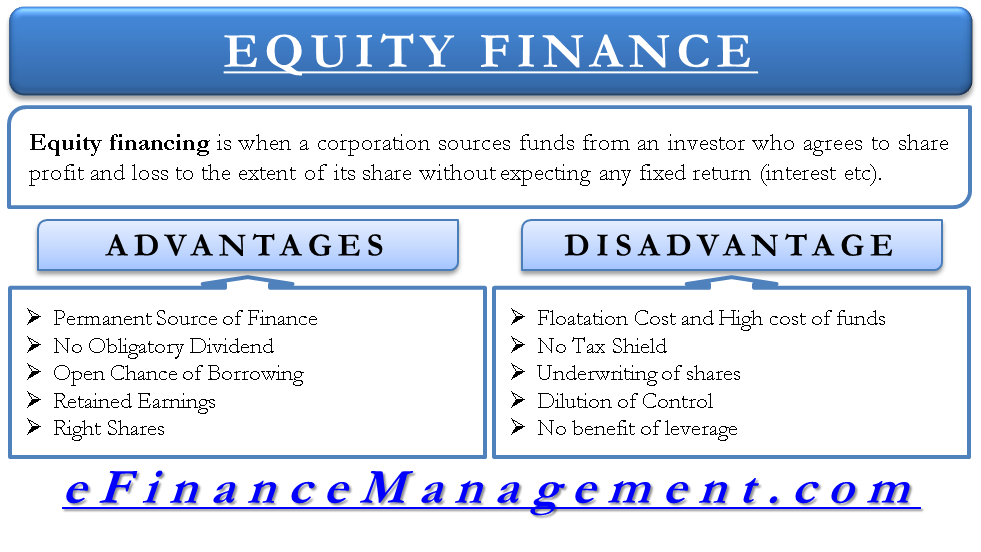

Different stakeholders look at equity shares from different perspectives. There are two major angles of looking at it – the company angle (equity financing) and the investor angle(equity investments). Equity financing is when a corporation sources funds from an investor who agrees to share profit and loss to the extent of its share without expecting any fixed return (interest, etc.). These investors become the company owners to the extent of their share of investment. Equity financing is one of the main funding options for any corporation. This article explains the pros and cons of equity finance from a company’s point of view.

Advantages of Equity Finance

The following are the advantages to a company for raising funds through equity financing:

Permanent Source of Finance

Equity financing is the permanent solution to the financial needs of a company. It keeps management away from the hassles of raising funds again and again like other sources of financing viz. debt. Debt is raised and requires to be paid back over a period of time. Equity forms a part of the long-term capital structure. No repayment obligation arises during the lifetime of the company.

No Fixed Obligations

Equity finance for a new company is like the blessing of an angel. The main limitation of a new company is the uncertainty of cash flows. The equity mode of finance gives management a breathing space by having no fixed obligation to pay dividends. A company can choose to pay no dividend or smaller dividends as per the cash flow position. It preserves the cash flows in the business.

Collateral Free

Raising equity does not result in the creation of a charge on the assets of the company. The firm can hold a clear title on the assets it owns. Or else they remain available to be mortgaged to raise further capital.

Better Credit Standing

A company majorly financed from equity sources enjoys a good credit score. More ownership funds on the balance sheet leave sufficient room to raise debt capital in the future when the need arises. Lower-levered firms have higher chances of smooth borrowing of debt in times of need.

Funds Disposable at Board’s Discretion

The management can spend the funds raised through equity in whatever manner it intends to. Debts are granted for funding specific projects. Therefore their use remains very confined. Also, the company has to remain very cautious of the funds raised by banks. There is always some agency keeping a check over the shoulder in case of debt funds. The management remains free to invest equity proceeds into profitable and new ventures without going through unnecessary hassles.

Rights Shares

Having equity in capital structure opens the door for raising funds further. A company can get the required capital via an issue of rights shares from its existing capital providers which have almost nil floatation cost. Floatation cost is the cost that arises in raising funds.

Disadvantages of Equity Finance

Despite having a number of advantages of equity financing, it is very crucial to look at its drawbacks too before approaching it. The following are the various disadvantages of equity financing:

Also Read: Equity Financing – When to Use it?

Dilution of Ownership

When a company raises funds via equity, it dilutes the existing shareholder’s stake. Percentage shareholding reduces when new shareholders arrive.

High Cost of Capital

The cost of equity is always more than the cost of debt. The obvious reason is the higher required rate of return from equity share investors. Since equity share investment is a high-risk investment, an investor will always expect a higher rate of return.

No Tax Shield & No Benefit of Leverage

The dividends distributed to the shareholders are not tax-deductible expenses. On the contrary, the interest expense is an eligible expense for tax benefits. A 12% interest rate with a 40% prevailing tax rate makes the effective cost of funds to be 7.2% {12% * (1-40%)} in case of debt. This benefit is not available to the equity source of financing and therefore, considers it as a costly source of financing.

Underwriting of Shares

At the time of offering equity shares to the public, the company usually requires the appointment of IPO underwriters. The job of an underwriter is to assume the risk of subscription. Underwriters would agree to subscribe to the shares to the extent not subscribed by the general public and will charge a fee for that service. The fee may be in the form of an upfront payment or maybe a discounted equity share price.

Floatation Cost

Financing through equity is the most difficult way of getting funds to the company. It requires a lot of statutory compliances and has other costs like the fee of a merchant banker, other expenses such as brokerage, underwriting fees, and lots of other issue expenses.

Exit Strategy

Equity financing often involves investors looking for a return on their investment within a certain time frame. It’s important to have a clear exit strategy in place that outlines how and when investors will be able to cash out their investments.

Equity finance adds money to your capital through selling shares. You gain from your investors without the worry of paying interest but there can rise a conflict due to shared profits that is surely a downfall.