What is a Capital Lease Obligation?

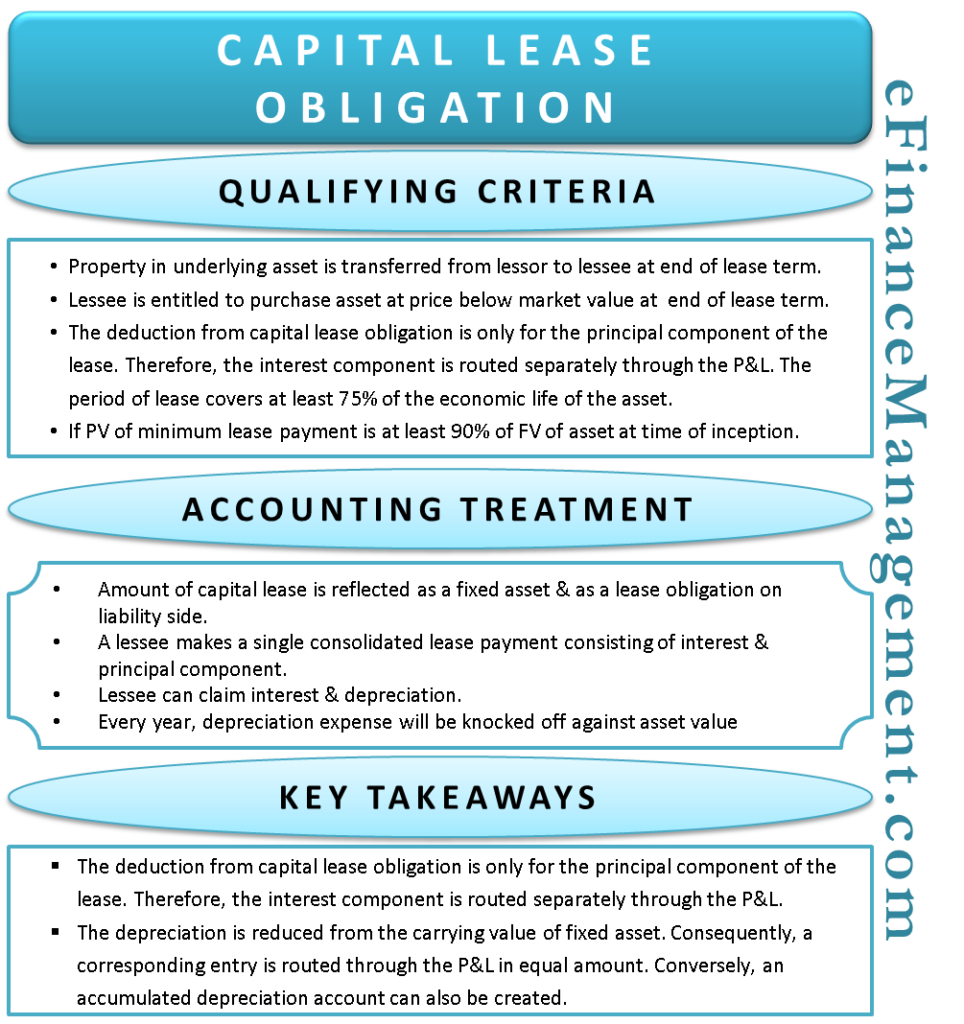

A capital lease obligation is the amount of hire charges or rent owed by the lessee to the lessor for taking capital assets on hire under a capital lease. A capital lease is essentially a means of financing a capital asset. It enables the lessee company to make a purchase of capital assets without spending large amounts of money in a single go.

A lease agreement can be classified as an operating lease or capital lease. There lies a fundamental point of distinction between the two. The risk and benefits associated with the ownership of the asset lie with the lessor in an operating lease. Whereas the same is passed on to the lessee in a capital lease.

Therefore, though a capital lease obligation is a hire purchase contract on the surface, it converges to replicate the features of the purchase of a capital asset.

Accounting Treatment of Capital Lease Obligation

The Financial Accounting Standards Board (FASB) amended its rules in 2016. Under the amendment, the lessee will be required to recognize both assets and liabilities for a lease exceeding a term of 12 months.

The following points encapsulate the accounting treatment of a capital lease obligation.

• The amount of capital lease recorded is the sum of present values of the capital lease obligations payable during the term of the lease. This amount is reflected as a fixed asset held on the asset side and simultaneously as a lease obligation on the liability side.

• A lessee makes a single consolidated lease payment. Therefore, this amount must be broken down into its interest and a principal component. The interest amount is determined in accordance with the terms of the contract and the going rates in the capital market.

• The lessee will be entitled to claim the deduction of both interests on the lease and depreciation of the asset.

• Every period, the depreciation expense will be knocked off against the asset value. Similarly, the amount of lease obligation will also be written off as and when payments for the lease are made.

The following example shall clarify the concept.

Excerpt of the balance sheet at the inception of a lease. Assets and liabilities are recorded in equal values.

| Liability | Asset | ||

| Capital Lease Obligation | $200,000 | Fixed Asset | $200,000 |

At the end of Year 1

| Liability | $ | Asset | $ |

| Capital Lease Obligation | 2,00,000 | Fixed Asset | 2,00,000 |

| Principal Repayment | -8000 | Depreciation Expense | -10,000 |

| Accumulated Depreciation | 10,000 |

Key Takeaways

1. The deduction from capital lease obligation is only for the principal component of the lease. Therefore, the interest component is routed separately through the P&L. The amount of interest payable is arrived as per the payment schedule computed considering the terms of an agreement. These terms establish the interest rates, lease term, default charges, etc.

Also Read: Finance / Capital Lease

2. The depreciation expense is computed as per the depreciation schedule. It considers the life of an asset, the salvage value, and the method of depreciation (SLM/WDV) used. The depreciation is reduced from the carrying value of the fixed asset. Consequently, a corresponding entry is routed through the P&L in an equal amount. Conversely, an accumulated depreciation account can also be created. As a result, the depreciation account will be debited, and the accumulated depreciation account is credited. Eventually, this reserve account will be written off against the fixed asset carrying amount at the time of disposal.