Lease accounting is an important accounting section as it differs depending on the end-user. A lessee and a lessor report and account for the leases differently. A lessor is the owner of the asset, and a lessee uses the leased asset by paying periodically to the lessor. The accounting and reporting of the lease in different ways have varying effects on financial statements and ratios.

Definition of Lease

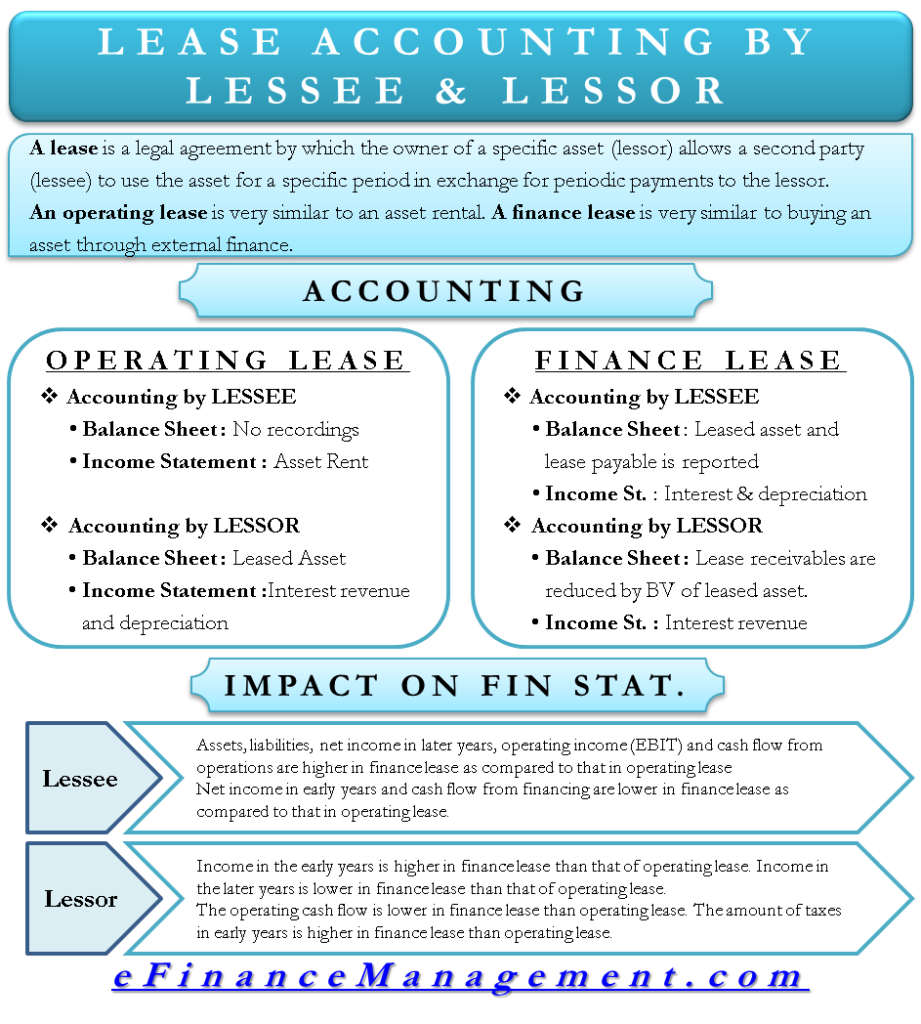

A lease is a legal agreement by which the owner of a specific asset (lessor) allows a second party (lessee) to use the asset for a specific period in exchange for periodic payments to the lessor. These periodic payments are called lease rentals. An operating lease is very similar to an asset rental. It lets the lessee use the leased asset for a specific period of time, which is generally less than the asset’s useful life. It is mostly in use when lease equipment for short terms. A finance lease is very similar to buying an asset through external finance. It allows a lessee to own an asset with the help of direct finance from the lessor. The lessee has the option to be the permanent owner of the asset at the end of the lease term.

Classification of Lease

Both IFRS and U.S.GAAP have different criteria for classifying the lease as a finance or an operating lease:

IFRS

If the lessee is entitled to all the risks and rewards related to ownership, the lease is categorized as a finance lease. The lessee needs to report the lease liability and the leased asset on the balance sheet. A lease not meeting the above criterion is categorized as an operating lease.

U.S. GAAP

A lease is categorized as a finance lease if it meets even one of the following four requirements:

- If the lessee becomes the owner of the leased asset at the end of the lease.

- The lease allows the lessee to purchase the same leased asset at a price that is less than the fair value of the asset in the future.

- The lease term is 75% or more of the leased asset’s useful life.

- If the present value of the lease payments is 90% or more of the fair market value of the asset.

Accounting and Reporting by Lessee

A lessee uses the leased asset and makes regular payments to the lessor. The accounting and reporting of different leases are as follows:

Accounting for Finance Lease by Lessee

The finance lease is reported by the lessee as follows on different financial statements:

Balance Sheet

Both leased assets and lease payable (liability) are reported. The value reported is lower of the present value of the lease payments in the future or the leased asset’s fair market value.

Income Statement

The interest expense on the lease payable is reported. It is calculated on the lease payable at the beginning using the implied interest rate in the lease. Generally, the interest rate used is lower than a lessee’s borrowing rate and the implicit rate of a lessor. If the leased asset is depreciable, then a depreciation expense is also reported as with any other asset.

Cash Flow Statement

Under U.S.GAAP, the interest component of the lease payment is reported as an operating cash outflow. And the principal repayment component that reduces the lease payable is reported as a financing cash outflow. Under IFRS, the interest expense can be reported either as an operating cash outflow or financing.

Accounting for Operating Lease by Lessee

The operating lease is reported by the lessee as follows on different financial statements:

Balance Sheet

Neither an asset nor a liability is reported.

Income Statement

The asset’s rent is expensed, which is the same as the lease payment.

Cash Flow Statement

The complete lease payment or the rent expense is reported as operating cash outflow.

Impact of Lease Accounting on Lessee’s Financial Statements

The difference in accounting in both the leases – finance and operating impacts the various elements of the financial statements as below:

- Assets, liabilities, net income in later years, operating income (EBIT), and cash flow from operations are higher in a finance lease than in an operating lease.

- Net income in the early years and cash flow from financing are lower in a finance lease than in an operating lease.

- Though total income and total cash flow remain the same in both the leases.

Impact of Lease Accounting on Lessee’s Financial Ratios

As with financial statements, financial ratios are also impacted by the different leases:

- The current ratio, working capital, asset turnover ratio, fixed asset turnover ratio, return on assets in early years and return on equity in earlier years are lower in the finance lease.

- Return on assets in later years, return on equity in later years, debt to assets ratio, and debt to equity ratio is higher in the finance lease.

Accounting and Reporting by Lessor

Accounting for Finance Lease by Lessor

For the lessor, the finance lease is of two types under U.S.GAAP. If the present value of all the lease payments is the same as the carrying value of the leased asset, such lease is called a direct financing lease. If the present value of the lease payments is more than the carrying value of the leased asset, it is called a sales-type lease. Both these types of a finance lease are reported by the lessor as follows on different financial statements:

Balance Sheet

The lease receivable is reported. The value is derived from the present value of lease payments in the future. Also, the assets are reduced by the book value of the leased asset.

Income Statement

The interest revenue is reported. It is calculated on the lease receivable at the beginning using the interest rate in the lease.

Cash Flow Statement

The interest component of the lease revenue is reported as an operating cash inflow, and the principal component of the payment is reported as an investing cash inflow.

Accounting for Operating Lease by Lessor

The operating lease is reported by the lessor as follows on different financial statements:

Balance Sheet

The leased asset is reported as always.

Income Statement

The interest revenue is reported, and the depreciation related to the asset is reported.

Cash Flow Statement

The periodic lease payment is categorized as an operating cash inflow.

Impact of Lease Accounting on Lessor’s Financial Statements

The financial statements of the lessor are impacted by the difference in both the leases in the following ways:

- The lease revenue and the total cash flow are similar under both leases.

- Income in the early years is higher in the finance lease than that of the operating lease.

- Income in the later years is lower in the finance lease than that of the operating lease.

- The operating cash flow is lower in a finance lease than in an operating lease.

- In the early years, the amount of taxes is higher in a finance lease than in an operating lease.

Conclusion

The accounting and reporting of a lease differ from the perspective of a lessor and a lessee. It also further differs depending on the type of lease – finance or operating. Thus, it is imperative that the lease is properly categorized and reported as it has numerous implications on financial statements and financial ratios.

Also read – Leasehold Improvement GAAP

Quiz on Lease Accounting by Lessee and Lessor

Just want to thank you. Really great work. Thank you

How many accounts do you open in the finance lease and operating lease in a cash flow statement

Excellent stuff, thank you so much…

Very interested, thank you sir