What is the Amortization of Intangible Assets?

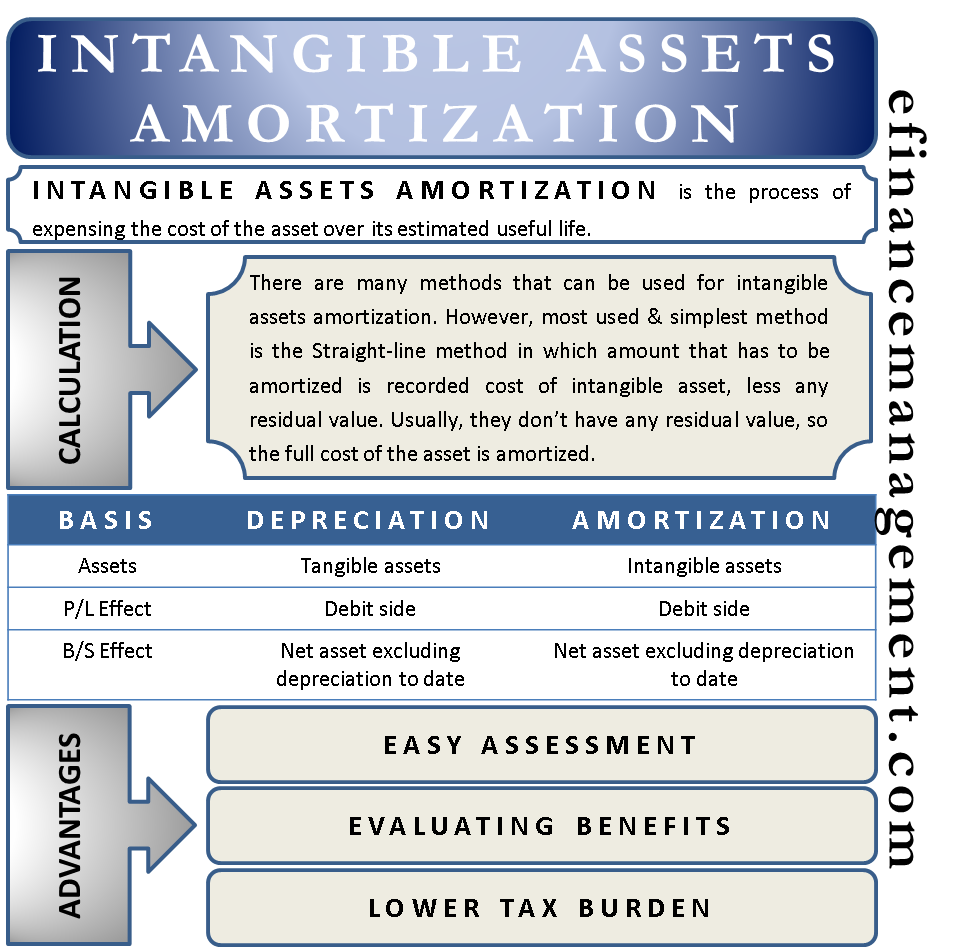

Amortization refers to the systematic allocation of an asset’s cost over its useful life. By amortizing intangible assets, businesses can spread the cost of acquiring or developing these assets and match the expense with the revenue generated from their use. The accounting treatment of amortization is similar to that of depreciation.

Unlike tangible assets, which can be physically seen and touched, intangible assets lack a physical presence. As tangible assets lose value over time due to their use, intangible assets also wear down due to obsolescence, contract expirations, and other non-physical factors. Intangible assets having a finite useful life are treated similarly to physical assets, i.e., a part of their cost is treated as an expense. While intangible assets having an infinite life does not get amortized.

Amortization expense is also a part of the income statement, representing a periodic allocation of cost as an expense. The carrying amount of the intangible asset in the balance sheet shows after the reduction of the amount of amortization expense.

Step-by-step Guide to Amortizing Intangible Assets

Given below are the steps to calculate the amortization of intangible assets:

Step 1: Identify and Classify Intangible Assets

Begin by identifying and classifying the intangible assets your business possesses. Common examples include patents, trademarks, copyrights, licenses, franchises, and customer lists. Categorizing these assets will help determine the appropriate amortization method.

Also Read: Depreciation

Step 2: Determine Useful Life

Estimate the useful life of each intangible asset. The useful life represents the period over which the asset is expected to generate economic benefits. Consider factors such as technological advancements, legal restrictions, market conditions, and industry standards. Some intangible assets may have a finite useful life, while others may be deemed indefinite.

Step 3: Assess Residual Value

Determine the residual value of the intangible asset. Residual value refers to the estimated fair value of the asset at the end of its useful life. For certain intangible assets, the residual value may be negligible or zero.

Step 4: Select an Amortization Method

Choose an appropriate amortization method based on the nature of the intangible asset. The two commonly used methods are straight-line amortization and accelerated amortization. Straight-line method evenly spreads the cost over the asset’s useful life, while accelerated amortization front-loads the expense, reflecting a higher expense in the early years.

Step 5: Calculate Amortization Expense

Calculate the annual amortization expense by dividing the asset’s cost (excluding any residual value) by its useful life. For example, if an intangible asset is purchased for $100,000 with a useful life of 10 years, the annual amortization expense would be $10,000 ($100,000/10).

Also Read: Intangible Assets

Step 6: Record Journal Entries

Record journal entries to reflect the amortization expense. Debit the amortization expense account and credit the accumulated amortization account, which is a contra-asset account that offsets the intangible asset’s cost over time. Ensure accurate and consistent record-keeping to comply with accounting standards.

Step 7: Review and Adjust Periodically

Regularly review and reassess the useful life and residual value of intangible assets. Adjustments may be necessary due to changes in market conditions, technological advancements, or legal factors. Any changes should be reflected in the amortization calculations and financial statements.

Intangible Asset Amortization Example

Let us understand how to amortize intangible assets with a business case. A company named XYZ acquires a patent for $35,000 that will expire after 10 years. So, the patent’s useful life, in this case, is ten years.

Based on the straight-line method, the company will amortize $3,500 each year (that is, $35,000/10) for the next ten years. Each year $3,500 will become part of an expense in the income statement. The intangible asset will reflect the amount net of amortization expense in the balance sheet.

Now, consider a case where, after seven years, XYZ found that the patent has become worthless. In such a case, the cost of the asset has already been amortized by $3,500 each year for seven years. The remaining unamortized cost, i.e., $10,500, will become an expense of the company, and on the balance sheet, the value of the assets turns to zero.

Advantages of Amortization

Easy Value Assessment

Amortization helps a business to easily assess the value of the amortized asset.

Evaluate Benefits

Amortization helps in evaluating the benefits of owning a specific asset

Lower Tax Burden

Intangible assets amortization helps lower the tax burden (businesses often use a different amortization method for tax purposes).

Are Depreciation and Amortization Different?

The only major difference between depreciation and amortization is that the latter is related to intangible assets, while the former is to tangible assets. Amortization applies only to intangible assets with a finite useful life. Amortization does not apply to assets with infinite useful life, like goodwill.

Periodical evaluation of such assets can check if they now have a determinable useful life. Or if their value has become impaired. Impairment of intangible assets is a separate topic, and to know more, refer to the article impairment of Long-Lived Assets.