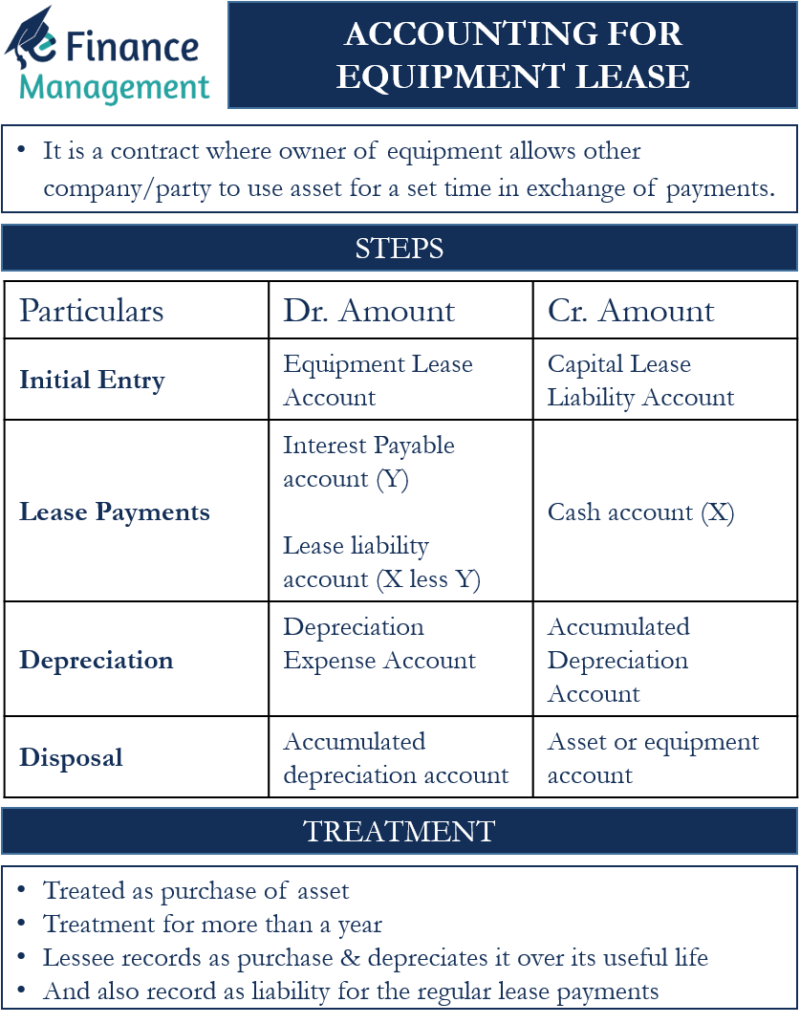

An equipment Lease is a contract where an owner of the equipment allows another company or party to use that asset for a set time period in exchange for regular payments. Specifically, the two parties enter into a lease agreement for the asset’s lease. The lessee is the person that pays for the use of the asset to the lessor, who is usually the owner of the asset. A point to note is that in the lease agreement, the lessor remains the asset owner. Still, the lessee treats the lease as a purchase of the asset. Owing to such features, equipment lease accounting differs from usual accounting.

Accounting for Equipment Lease – Treatment

Financing Lease

A financing lease is a lease arrangement wherein the arrangement is for more than a year. Secondly, in all such leases, the majority of the equipment cost is covered in the lease period.

Even though the ownership of the equipment in a finance lease rests with the lessor, the accounting for the equipment lease treats the equipment as a purchase of the asset. So, the accounting treatment is similar to what if the company buys equipment on credit.

On the lease commencement date, recognize a lease liability and a corresponding right-of-use (ROU) asset on the balance sheet. The lease liability represents the present value of the lease payments, while the ROU asset represents the lessee’s right to use the leased equipment over the lease term.

Also Read: Types of Equipment Leases

The lease liability is subsequently measured at amortized cost using the effective interest rate method. The ROU asset is measured at cost, which includes the initial recognition amount, lease payments made, lease incentives received, and any impairment loss or adjustments for certain lease modifications. The accounting for the lease payment is similar to a note payable.

Operating Lease

The leases that are for less than a year are operating leases. The accounting for such a lease is similar to rent payment. In the lessee’s books, the lease payments are recorded as a rent expense. Also, the lessee doesn’t record the equipment or any other asset in their books.

One question that arises here is why there is a different treatment for short and long-term leases. For most industries, the lease may not be a significant part, but some industries, such as airlines, depend heavily on the lease. Thus, it becomes important to differentiate lease commitments from other regular commitments. Such an accounting treatment helps to bring out the true financial position of a business.

Accounting for Equipment Lease – Steps

Usually, the accounting for an equipment lease involves four activities in the lessee’s books. Detailed below are the accounting treatments for all four activities:

Initial Entry

After entering the lease agreement, the lessee needs to record the asset as a purchase. Since there is no purchase price, one needs to calculate the present value (PV) of all the lease payments over the lease period. The PV of the lease payments will serve as the asset’s cost.

** Correction 17th July 2023: The term “Leased equipment account” is corrected to “Right-of-use (ROU) asset’s account.”

The journal entry for this will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Right-of-use (ROU) asset Dr. | ||

| To Capital Lease Liability Account |

Lease Payments

Once the lessee gets the lease invoices from the lessor, it needs to record a part of the lease payment as an interest expense. And use the remaining balance to reduce the capital lease liability account balance.

The lessee determines the interest expense by preparing the amortization schedule for the lease term. Over time, this interest expense would decrease as the liability balance decreases.

The journal entry for this will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Interest Payable account (Y) Dr. | ||

| Lease liability account (X less Y) Dr. | ||

| To Cash account / Bank Account (X) |

Depreciation

Since the lessee records the lease as an asset, it gets important to charge depreciation on the asset as well. Recognize depreciation expense for the ROU asset over the shorter of the lease term or the useful life of the underlying equipment. Depreciation can be recognized using various methods, such as the straight-line method or accelerated depreciation method.

The journal entry for this will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Depreciation (Amortization) Expense Account Dr. | ||

| To Right-of-use (ROU) asset Dr. |

Disposal

In case of the disposal (or return) of the asset, we credit the asset or equipment account and debit the accumulated depreciation account. Such accounting entries ensure the elimination of balances in these two accounts. If there is any difference between the asset’s selling price and its accumulated depreciation account, we record that as a profit or loss on the asset’s sale.

Lease Disclosures

Provide detailed disclosures in the financial statements about the lease arrangement, including lease commitments, significant assumptions, maturity analysis, and other relevant information.

Accounting for Equipment Lease – Example

Company A signed an 8-year lease for equipment on January 1, 2020. The two parties agree on an annual lease payment of $28,500. These payments need to be made at the start of each year. The equipment has a useful life of 8 years and has no salvage value. The interest rate is 10.5%. After the end of the lease period, the equipment will return to the lessor.

First, we need to calculate the present value of the lease payments. Using the above information and the PV formula, we get PV of $164,995.

So, the journal entry on January 1, 2020, will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Right-of-use (ROU) asset Account Dr. | $164,995 | |

| To Cash Account (for lease payment) | $28,500 | |

| To Lease Liability Account | $136,495 |

Note: the journal entry for this includes the first lease payment because the lease payments are to be made at the start of the year.

At the end of the year, i.e., on December 31, 2020, we will pass two entries – one for the depreciation and the other for the interest expense. The annual depreciation amount will be $20,624 ($164,995/8). The journal entries will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Depreciation Expense Account Dr. | $20,624 | |

| To Right-of-use (ROU) asset | $20,624 |

Another entry will be for the interest expense. As said above, the lessee needs to determine the interest expense based on the Amortization Schedule ($14,332 for the first year, in this case). So, the journal entry will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Interest Expense Account Dr. | $14,332 | |

| To Interest Payable Account | $14,332 |

Now, at the start of next year, i.e., January 1, 2020, the lessee will only pass the journal entry for the lease payment. However, this lease payment will also include the interest payment that was due last year. So, the journal entry will be:

| Particulars | Dr. Amt. | Cr. Amt. |

|---|---|---|

| Interest Payable Account Dr. | $14,332 | |

| Lease Liability Account Dr. | $14,168 | |

| To Cash | $28,500 |

All other entries will be the same as last year.

Final Words

It will not be wrong to say that the accounting for an equipment lease (financial or capital lease) is similar to accounting for any fixed asset. There are, however, a few obvious differences, such as the treatment of lease payments, interest expense, and how we derive the initial asset cost.

Refer to Equipment Lease Agreement to know more.