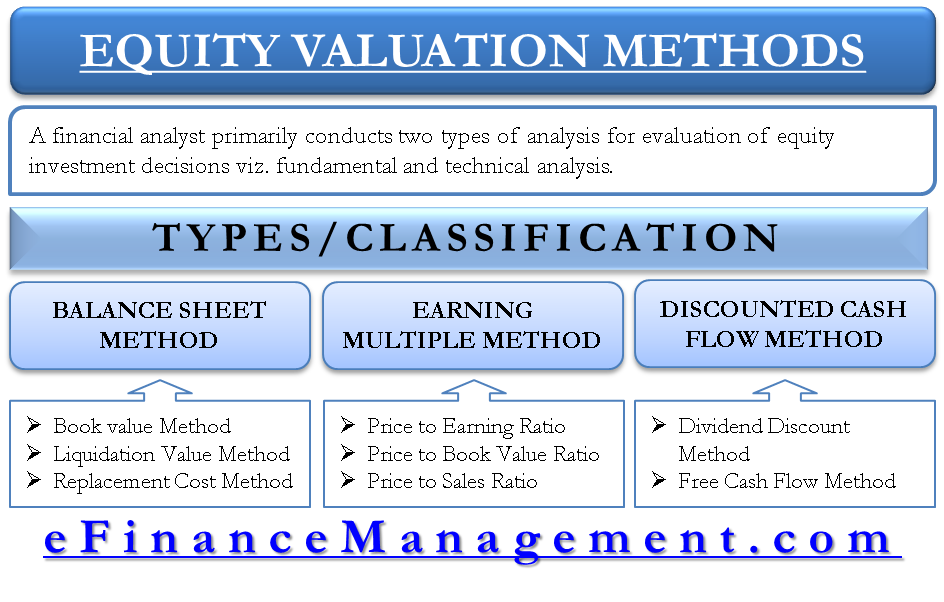

Equity valuation methods can be broadly classified into balance sheet methods, discounted cash flow methods, and relative valuation methods. Balance sheet methods comprise book value, liquidation value, and replacement value methods. Discounted cash flow methods include dividend discount models and free cash flow, models. Lastly, relative valuation methods are a price to earnings ratios, price-to-book value ratios, price to sales ratios, etc.

A financial analyst primarily conducts two types of analysis to evaluate equity investment decisions, viz. fundamental and technical analysis. All the above methods are part of the fundamental analysis undertaken by a financial analyst. The technical analysis analyses the charts and graphs of the market prices of a stock to understand the market’s sentiments. It believes in the fact that history repeats itself. Many believe that it is used to decide the entry and exit time from the market. On the other hand, fundamental equity valuations methods attempt to find the fair market value of equity shares. It involves a study of the assets, earning potential, future prospects, future cash flows, magnitude and probability of dividend payments, etc.

Classification / Types of Equity Valuation Methods

Fundamental equity valuation methods are explained in brief under the following categories.

Balance Sheet Methods / Techniques

Balance sheet methods are the methods that utilize the balance sheet information to value a company. These techniques consider everything for which accounting in the books of accounts is done.

Book Value Method

In this method, book value as per the balance sheet is considered the value of equity. Book value means the net worth of the company. Net worth is calculated as follows:

Net Worth = Equity Share capital + Preference Share Capital + Reserves & Surplus – Miscellaneous Expenditure (as per B/Sheet) – Accumulated Losses.

Liquidation Value Method

Here, In the liquidation cost method, liquidation value is considered the value of equity. The liquidation value is the value realized if the firm is liquidated today.

Liquidation Value = Net Realizable Value of All Assets – Amounts paid to All Creditors including Preference Shareholders.

Replacement Cost Method

Here, In the replacement cost method, the value of equity is the replacement value. It means the cost that would be incurred to create a duplicate firm is the firm’s value. It is assumed that the market value and replacement value will coincide in the long run. The famous ratio by James Tobin is Tobin q which tends to become 1. Tobin q is the ratio of market value to replacement cost.

Equity Value = Replacement Cost of Assets – Liabilities.

Discounted Cash Flow Methods / Techniques

Discounted cash flow methods are based on the fact that the present value of all future dividends and the future price represents the market value of equity.

Dividend Discount Model

This dividend discount model finds the present value of a company’s future dividends to derive the present market value of equity. There are various models with different assumptions of a period of dividends and growth in dividends.

- Single period Model

- Multi-period Model

- Zero Growth Model

- Constant Growth Model

- Two-Stage Growth Model

- H Model

Free Cash Flow Model

The free cash flow model is based on the free cash flows of the company. Similar to the above model, it discounts the free future cash flows of the company to arrive at an enterprise value. To find the value of equity, the value of debt is deducted from enterprise value.

Earnings Multiple or Comparables or Relative Valuation Methods / Techniques

Earnings multiple or Relative Valuation methods are also called comparable methods because they use peer’s or competitor’s values to derive the value of the equity. The importance here is deciding which factor to consider for comparison and which companies should be regarded as peers. Following are the well-known methods used for such comparison.

Price to Earnings Ratio

Please find a detailed understanding of the ratio – P/E Ratio.

Price to Book Value Ratios

Please find a detailed understanding of the ratio – Market to Book Ratio.

Price to Sales Ratio

It is the ratio of the total market value of a company’s shares (i.e., market price per share * total no. of shares outstanding) with its total revenue or sales.

Read a detailed article on the Advantages and Disadvantages of Equity Valuation.

i find this content meaningful in simple language , I need to check how these fundamentals are applied for an equity analysis