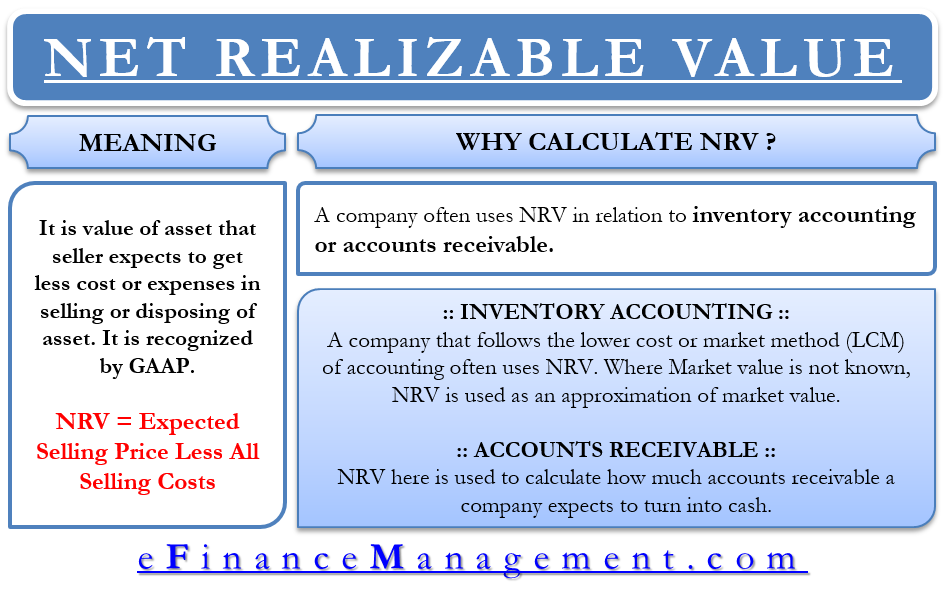

The Net Realizable Value or NRV is the value of an asset that a seller expects to get less the cost or expenses in selling or disposing of the asset. A company normally uses NRV for the purpose of inventory accounting and accounts receivable. It is recognized by GAAP (Generally Accepted Accounting Principles).

Calculating NRV is essential as it helps in preventing the overstatement of the assets’ valuation. Moreover, it complies with the conservatism approach to accounting. Under the conservatism approach, a company must use a valuation method that does not overstate the value of the assets and result in a smaller profit.

NRV Formula

One can calculate NRV by subtracting the cost of making the sale from the selling price. NRV basically gives the profit (or loss) that the company will make on selling a particular asset. Selling costs may include product demonstration costs, marketing costs, advertising costs, broker fees, etc.

NRV = Expected Selling Price Less All Selling Costs

One can easily calculate NRV by following three simple steps:

- Determine the price that the asset could fetch or the market price.

- List all costs relevant for completing the sale.

- Subtract the costs from step 2 with the market value from step 1. This will give the net realizable value of an asset.

Lets’ understand the NRV calculation with the help of an example. Suppose Company A expects to sell a machine for $8000. It will incur the following expenses in relation to the sale – paperwork $200, delivery charges $300, and broker commission of $500. In this case, the Net Realizable Value (NRV) will be $7000 ($8000 – $200 – $300 – $500).

Also Read: Net Book Value

Why Calculate NRV?

A company often uses NRV in relation to inventory accounting or accounts receivable. Though the company records these assets at cost, there are occasions when these assets fetch less than the cost. When this happens, then the company must report these at lower of cost or the net realizable value.

Inventory Accounting

A company that follows the lower cost or market method (LCM) of accounting often uses NRV. Under the LCM method, a company reports inventory in the balance sheet at a lower value than the market value or historical cost. In case, the market value of the inventory is not known, then the company can use the net realizable value as an approximation of the market value. Both IFRS and GAAP require companies to use NRV for the valuation of inventory.

Let’s understand the use of NRV in inventory accounting with the help of an example. Assume that Company A has an inventory whose cost is $10000. However, due to damage, the inventory will only sell for $7000. The selling expenses will be $1000 and includes packaging, sales commissions, and shipping.

In this case, the NRV of the inventory will be $6000 ($7000 – $1000). Now, the company will have to report the inventory at lower of cost ($10000) or the NRV ($6000). So, since NRV is lower, the company must show the inventory at $6000 in the balance sheet. In the income statement, it should report a loss of $4000 ($10000 less $6000) due to the write-down of inventory.

Also Read: Net Book Value Calculator

A company must regularly examine the inventory to ascertain whether or not it needs to adjust the costs at which it records inventory. Factors such as damage, spoilage, obsolescence or lower demand can result in situations when the company needs to lower the cost. Such timely adjustments help a company to prevent carrying forward any losses for a future period. In this way, the use of net realizable value helps a company to adhere to the conservatism approach of accounting.

Accounts Receivable

In case of accounts receivable, one uses NRV to calculate how much accounts receivable a company expects to turn into cash. An accounts receivable converts into cash when customers pay their outstanding invoices. However, an account manager must adjust the accounts receivable balance for the customers who don’t make the payment. Thus, NRV, in this case, is the receivable balance less the allowance for the doubtful accounts.

The formula for NRV in case of accounts receivable is slightly different. The usual formula for NRV is Expected Selling Price Less All Selling Costs. For accounts, receivable “allowance for doubtful accounts” replaces “All Selling Costs.”

Let’s understand the use of NRV in accounts receivable with the help of an example. Assume Company A has accounts receivable of $50000, and the Allowance for Doubtful Accounts of $10000. In this case, the NRV of accounts receivable will be $40000 ($50000 Less $10000). Any adjustment to the Allowance account comes in the income statement as a bad debt expense.

Final Words

NRV, as we now know, is a conservative approach to accounting. It helps a business to value inventory and accounts receivable at a conservative value, and thus, avoid overstating it. Moreover, it also allows the business to ascertain any negative impact on valuation. An analyst can also use NRV to check if the companies are following proper accounting method for valuing its assets.

This page is quite educative for business.

Very easy to understand the NRV great article