Meaning of Discounted Cash Flow

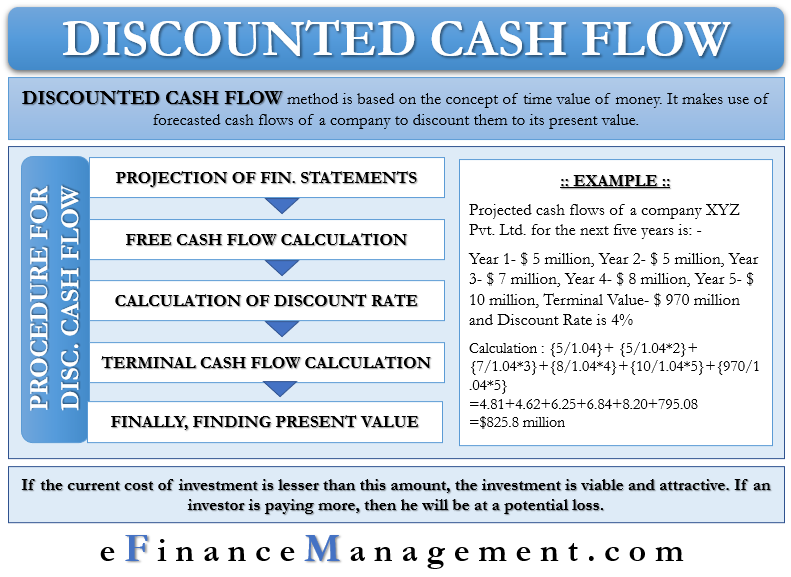

Discounted cash flow analysis uses forecasted cash flows of a company to discount them to its present value. It makes an assumption of money the company can generate in the coming years at an achievable growth rate and uses these figures to derive how much an investment is worth today. The method is of use to know the present worth of an asset in cases of mergers and acquisitions and other investments such as a stock, bond, real estate, etc. It denotes the value of a business or security at present.

An investor will know how much his investment is worth at present with a given required rate of return on the investment. Thus, he can compare the current price of the investment with the value arrived at through discounted cash flow analysis and judge the feasibility of the investment.

This analysis is based on the time value of money. Money is more worthy today than it will be in the future. Any amount of money in hand at present is of more value than the same amount of money after some time due to interest charges and inflation. Therefore, an investor is more concerned with the present value of the future cash flows, adjusted for interest charges and inflation rate.

Procedure for Calculation of Discounted Cash Flow

Correct Projection of the Financial Statements

The first thing to decide for the discounted cash flow calculation is the time period for which the cash flow is to be forecasted. It may depend on the lifecycle stage in which a business operates and how old the company is. It is essential as the growth rate may vary for companies with their respective stage of life-span.

Also Read: Discounted Cash Flow Model

Also, sales income over the next few years has to be correctly predicted to prepare the income statement. It will pave the way for the calculation of after-tax profits and the increase in networking capital in the following years.

The forecasted Balance sheet will also need to be prepared for the period under consideration as the three financial statements are interdependent. It will help us to make the cash-flow statement.

Free Cash Flow Calculation

Free cash flow is the excess cash available with a company after meeting its operating expenses and routine capital expenditure. It shows the strength of a company to generate cash to be able to repay its debt or make further investments to increase shareholder value.

Free cash flow will also be forecasted for the future years and will be discounted to their present values using a discount rate.

Discount rate

There are many methods to arrive at a discount rate to calculate the present value. The most commonly accepted method is to use the weighted average cost of capital (WACC). The correct cost of equity and debt has to be taken into account carefully to calculate the correct WACC.

Also Read: Terminal Value

Terminal Value

Terminal value is also known as “horizon value” or “continuing value.” It is used to calculate the present value of the projected future cash flows beyond the projection period of 5-7 years. Perpetuity growth models such as the Gordon growth model are commonly used to calculate the terminal value of the future cash flows.

The calculation for terminal value is done as follows:

{FCF * (1+g)}/ (d-g)

Here, FCF= Free cash flow for the last forecast period

g= Terminal growth rate or the rate at which the company is expected to grow forever. We generally take it to be around the rate of inflation. It should be lesser than the growth rate of the economy.

d= weighted average cost of capital or the discount rate

Finding the Present Value

The next step in the discounted cash flow analysis is to calculate the present value of the projected cash flows as well as the terminal value.

The formula for the calculation is:

{Cash Flow for year 1/ 1+r} + {Cash Flow for year 2/ 1+r}……+ {Cash Flow for year n/ 1+r}

Here, r is the discount rate.

Example of the Calculation of Present Value

Let us suppose that the projected cash flows of a company XYZ Pvt. Ltd. for the next five years are:

Year 1- $ 5 million

Y 2- $ 5 million

Y 3- $ 7 million

Year 4- $ 8 million

Year 5- $ 10 million

Terminal Value- $ 970 million

The WACC, or the discount rate for the company, is 4%.

Calculation- {5/1.04}+ {5/1.04*2}+ {7/1.04*3}+{8/1.04*4}+{10/1.04*5}+{970/1.04*5}

=4.81+4.62+6.25+6.84+8.20+795.08

=$825.8 million

Interpretation

The present value of the company, as per the discounted cash flow analysis, is US$825.8 million. If the current cost of investment is lesser than this amount, the investment is viable and attractive. If an investor is paying more, then he will be at a potential loss.

Limitations of Discounted Cash Flow Analysis

Based on Numerous Assumptions

The key and significant limitation of the discounted cash flow analysis is that it is based on many assumptions. The Income statement, Balance sheet, and future cash flows are all assumed for the coming years. Market conditions may become volatile, the management may change, or there might be a natural calamity during this long period, which may completely change our assumptions. Thus in such cases, the DCF analysis may prove to be ineffective and may lead to a wrong decision.

Growth Rate and the Discount Rate

The growth rate and the discount rate are the key parameters used to calculate the DCF analysis. These rates are again assumed to be constant for calculation purposes. This may or may not be the case in the actual world. In fact, these rates are bound to change with a change in government policies or changes in market conditions, or changes in the economic environment leading to a change in the cost of capital to the company. Thus, the DCF analysis may again prove incorrect.

Conclusion

DCF value, or Present Value, is one of the critical financial indicators used to understand and decide the feasibility of future investment options. Or to choose amongst the alternative investing options. Of course, other indicators should also be referred to before making a final decision.

Read more on Present Value of Uneven Cash Flows.