What is the Average Accounting Rate of Return (ARR)?

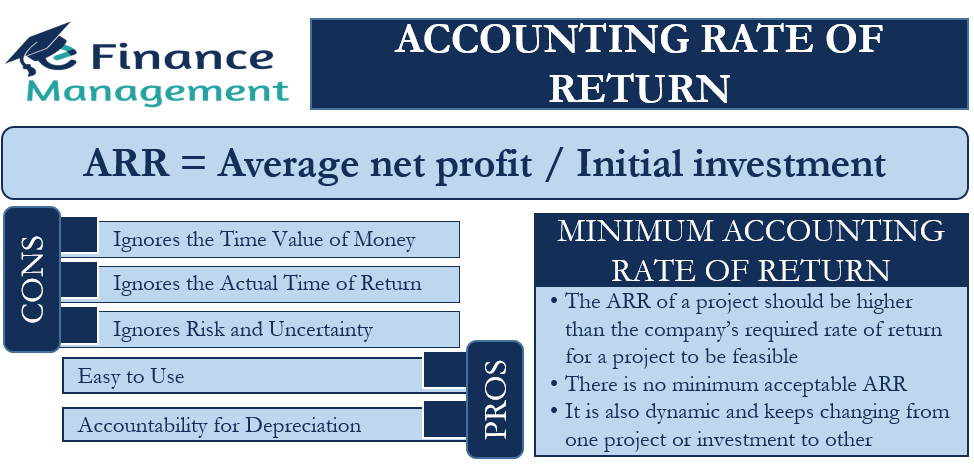

The average accounting rate of return is the simplest investment appraisal technique. It is a simple ratio of average net income to average net investment expressed in percentage. Let’s see the advantages and disadvantages of accounting rate of return.

Advantages of the Accounting Rate of Return

Easy to Use

The ARR is very simple to calculate. It does not involve any complex and elaborate calculations. Moreover, it is very easy to understand and use in any given situation. This provides an instant idea to the management on whether to accept or reject any investment proposition based on the ARR worked out. They need to just compare it with the RRR for making the decision. The interpretation is so simple that even a layman can easily understand it.

Accountability for Depreciation

The ARR concept considers even non-cash expenditures such as depreciation and amortization. Hence, it tells the returns from any capital asset investment in the true sense.

Disadvantages of the Accounting Rate of Return

While the concept of ARR is very easy to use, there are a number of disadvantages of this method too.

Ignores the Time Value of Money

This is one of the biggest drawbacks of the ARR. A very important concept of the financial world “time value of money” is completely ignored in this method of prioritizing. According to the concept, a sum of money in hand is more valuable than the same sum of money after some period of time. This is so because an investor can invest the money in hand at present and earn interest or revenue from it. Thus under this method even if the profits are higher in the initial years or in the later years makes no difference. Because average return would put both the investments at par, thus the project giving earlier profits should have been preferred in general. But that priority is not accorded to the project under this method.

Ignores the Cash Flow

The concept and calculation of ARR are based upon the net profits after meeting all the cash and non-cash expenditures. And in the process, it completely ignores the cash flow. The calculation of ARR is not affected by how early or late an investment provides returns. For example, an investment may provide nil or very limited returns in its early life. It may give good returns in the later years. Hence, the investment will provide usable funds only in its later years. However, the ARR will be the same even if the situation is reversed and it offers better returns in the initial years. Logically the second case will be better and preferable for any sane investor. ARR totally ignores the time value of money.

Ignores Risk and Uncertainty

The concept of ARR does not consider the risk and uncertainty that will come along with any investment. It treats all of them likewise. The risk in any project can vary on the basis of its duration, nature of work, work environment, etc. Any investor will like to minimize their risks, even if the returns from an investment go down a little. ARR ignores such factors and just tells which project is better on the sole basis of the returns from it.

Multiple Time Frame for Investments

This method is not useful for evaluating projects where the capital investment in the project takes place at different times over the years. It only calculates the overall profits and average return irrespective of when and what quantum of investments have been made.

Summary

The accounting rate of return is undoubtedly a simple and useful metric to evaluate, compare and choose the best among a number of capital expenditure options and projects. Every investor’s sole aim is to maximize their profitability. ARR totally takes care of it and helps to pick the best option with the highest returns.

Also Read: Annualized return on investment

However, it does ignore a number of important metrics such as the time value of money, risk in comparison to the returns, the overall compatibility of a project in the company environment and its operations, etc. Therefore, we should use ARR only as one of the tools for evaluating an investment or a project and not just the only tool. Also, it will work better with investment options that are short-term in nature so as to minimize the impact of delayed cash flow and the time value of money. So we can conclude that the accounting rate of return comes with both advantages and disadvantages.

To learn more visit ARR methods and calculation.