What is Capital Budgeting?

The term Capital Budgeting is a combination of two words ‘capital’ and ‘budgeting.’ The capital here refers to big expenditures that a firm makes, such as buying assets, research and development expenses, and more. And, the term ‘Budgeting’ means setting targets to maximize profitability. So, capital budgeting refers to the process of analyzing big expenditures to get maximum return on investments.

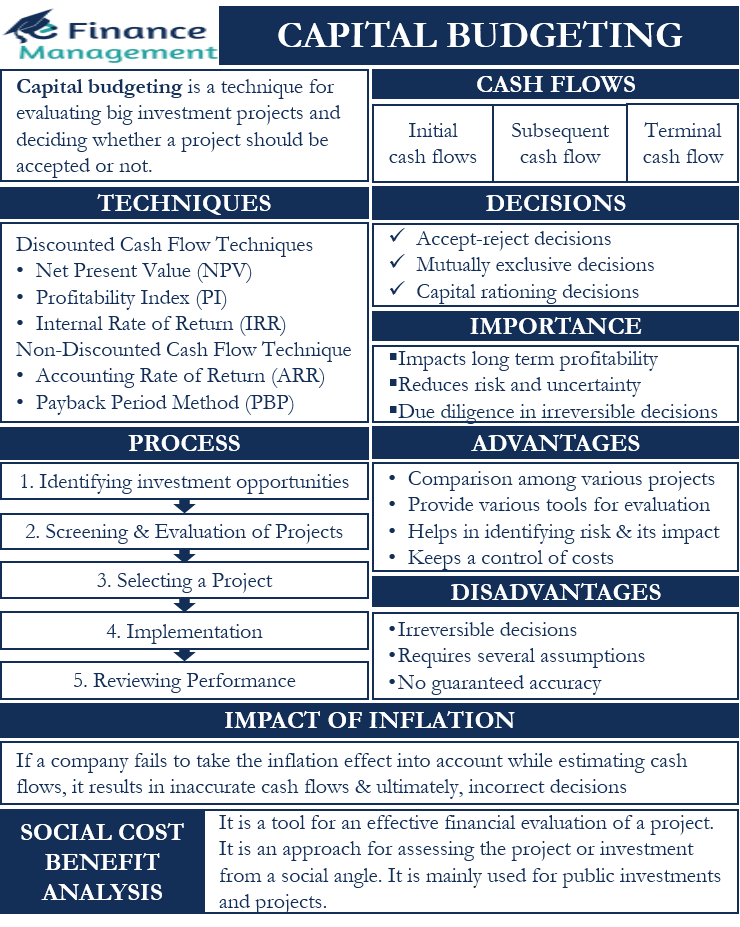

Capital budgeting is a technique for evaluating big investment projects. It helps an entity decide whether or not a project would offer the expected returns in the long term. Also, it helps a company to choose the best project when it faces a choice between two or more products.

Several techniques are available under capital budgeting that allows a company to analyze the profitability or return on investment.

The entrepreneurs utilize capital budgeting techniques in deciding whether to invest in a particular asset or not. It has to be performed very carefully because a huge sum of money is invested in fixed assets such as machinery, plant, etc. The analysis is based on two things: first, the stream of expected cash flows generated by utilizing the assets, and second, initial or future outlays expected for acquiring the asset.

Capital Budgeting Techniques

These are also known as investment appraisal techniques. It involves the use of two types of techniques. The first is ‘Discounted Cash Flow Techniques,’ which involves discounting the cash flows. And the second is ‘Non-Discounted Cash Flow Techniques’ which doesn’t involve discounting the cash flows. Let’s take a look at each technique that falls under the above two types of capital budgeting techniques:

Also Read: Importance of Capital Budgeting

Discounted Cash Flow Techniques

Discounted cash flow criteria have three techniques for evaluating an investment.

Net Present Value (NPV)

In this technique or method, the present value of all the future cash flows, whether negative (expenses) or positive (revenues), are calculated using an appropriate discounting rate and added. The initial outlay is deducted from this sum to find out the profit in present terms. If the figure is positive, the techniques show a green signal to the project and vice versa. This figure is called the net present value (NPV).

The Benefit to Cost Ratio or Profitability Index (PI)

It presents the analysis in a proportion or ratio format. Here, just like in the NPV method, the present value of future cash flows is calculated, and a ratio of this sum to the initial outlay is seen. If this ratio is more than 1, the project should be accepted, and if it is less than 1, it should be rejected.

Internal Rate of Return (IRR)

This method has a severe connection with NPV. Under NPV, the discounting rate is assumed to have been known to the evaluator. On the contrary, the discount rate is not known in this method of (IRR). It is found by equating the NPV equal to 0 with an unknown variable as the discounting rate. This discounting rate is found using the extrapolating and interpolating methods, and it is known as the IRR. It is compared with the cost of capital. If the IRR is greater than the cost of capital, the project should be accepted and vice versa.

Non-Discounted Cash Flow Techniques

Non-discounting cash flow criteria have two techniques for the appraisal of such investments.

Accounting Rate of Return

In this, we divide the total return from an investment by the average investment value. Another name for this technique is the return on investment. We can get all the data to execute this technique from the accounting statements.

Also Read: Process of Capital Budgeting

Payback Period Method

It is the oldest and simplest method of capital budgeting. It calculates the time it takes an investment to recover the initial cash outflow from an investment.

Read Investment Appraisal Techniques for in-depth learning of all these methods.

Importance of Capital Budgeting

The following points will help us to bring out the importance of capital budgeting:

- Capital budgeting decisions have a significant impact on the long-term profitability of a business. Similarly, it also impacts the company’s cost and growth.

- Most companies usually have limited financial resources. So, capital budgeting helps a company to make the most of its limited financial resources.

- Generally, the decisions of capital nature are irreversible. Thus, it becomes very important for a company to take such decisions carefully by using all their due diligence. And, capital budgeting helps a company to deploy that due diligence.

- It helps a company keep control of costs. Specifically, the cost of capital plays a crucial role in keeping control of costs.

- The capital budgeting process supports the flow of information for appropriate decision-making.

- The presence of capital budgeting decisions encourages a company to make long-term investments so as maximize the shareholders’ wealth.

- Capital budgeting helps in reducing risk and uncertainty. It considers the risk-adjusted discounting rate to provide some certainty about cash flows.

- It assists the management in understanding the complications and challenges of long-term proposals.

Read more @ Importance of Capital Budgeting for a detailed article.

Capital Budgeting Process

The capital budgeting process involves the following steps:

Identification and Generating Investment Opportunities

A company could find new opportunities in its existing product line or come up with an entirely new product or product line. Similarly, a company can generate opportunities to increase its production or lower its costs.

Screening and Evaluation of Projects

Once the company identifies the opportunities, the next step is to screen and evaluate that project. The most important criteria when evaluating a project is to judge whether or not the project would help to maximize its market value. Also, one needs to take into account benefits and costs to evaluate the project.

Selecting a Project

After evaluating all the projects, the company needs to select a project that will meet its objectives. This is where we use capital budgeting techniques. It suggests if the project is worth acceptance or not.

Implementation

After a company finalizes a project, it needs to implement the project. The implementation here means putting it into a concrete project. The management monitors the impact of implementing the project. In this stage, the company will come across real challenges in implementing the project.

Reviewing the Performance

In this, the management needs to compare the actual and estimated results of the project. This helps the company to identify the variances and take corrective actions.

For a detailed article, refer to Process of Capital Budgeting

Advantages of Capital Budgeting

Below are the advantages of capital budgeting:

- Assists in deciding investments opportunities.

- It helps in comparing more than one project using the same metrics.

- It makes available an array of techniques and tools to evaluate projects.

- Since it assists management in taking better decisions, it eventually helps to boost stakeholders’ value.

- Gives control over expenditures.

- It assists management in understanding the risks and their impact.

- Helps management to overcome over or under-investment.

Disadvantages of Capital Budgeting

Following are the disadvantages of capital budgeting:

- Their biggest drawback is that these decisions are not reversible.

- Many of the parameters in capital budgeting techniques are subjective.

- We need to make several assumptions to arrive at a decision. This may sometimes result in inaccurate results.

- Capital budgeting techniques require the estimation of future cash flows. Since the future is uncertain, the results may not always be accurate.

- Certain qualitative factors, such as employee morale, goodwill, etc. impact the management decision. However, there are no techniques to quantify them.

Cash Flows Associated With Investment

Following are the types of cash flows that are associated with investment:

Initial Cash Flow

As the word suggests, this is the cash flow that every company needs to make to start a project or business. Management usually estimates this cash outflow at the planning stage. Such an outflow usually includes fixed capital, salvage value, working capital, and more. It is the initial outlay for a project. Sometimes, a company can use the profitability of a project to estimate its initial cash flow. We can also call this cash flow the original cash flow.

Subsequent Cash Flow

The initial cash flow usually generates a series of cash inflows. These inflows could be in the form of revenue and/or profits from the project. Such cash flows can be the same each year or vary from one year to another. Subsequent cash flows can either be positive or negative.

Terminal Cash Flows

These are the cash flows that come at the end of a project. We arrive at such cash flows after deducting the taxes. We can also say these cash flows represent the net amount that a firm makes after paying the necessary amounts and selling the assets.

Capital Budgeting Decisions

Primarily there are three types of capital budgeting decisions. These are:

Accept-reject Decisions

A company accepts projects or proposals that offer a return more than the required e of return or cost of capital. And, the management rejects all other proposals. For instance, a firm is looking for a return of 10%. One project offers an 11% return while all others offer a return that is less than 10%. So, the company will accept the proposal with an 11% return and reject all others. Also, a company is likely to accept all independent projects. These are projects that don’t compete with other projects.

Mutually Exclusive Decisions

Such decisions involve projects that compete with each other. This means that accepting one project will automatically mean rejecting others. So, in such decisions, the company needs to use the best possible ways to select the best project. For example, a company is considering two ways, rail or sea, to deliver goods to a party. If a company selects rail, then it automatically means rejection of the sea route.

Also, read Types of Real Options in Capital Budgeting

Capital Rationing Decisions

Most companies have limited resources that they can invest in. In capital rationing decisions, a firm ranks the projects as per the return they expect to generate from them. Then the company rations the capital on the basis of those returns. The idea is that the project or projects with the most potential get the maximum support. For example, a company finalizes three projects with returns of 10%, 11%, and 12%. The project with a 12% return will get the most funds, followed by 11% and 10%.

Impact of Inflation

Inflation has an impact on almost everything, including capital budgeting decisions. This is because the accuracy of such decisions depends primarily on the accuracy of the cash inflows and outflows. So, if a company fails to take the inflation effect into account when estimating cash flows, it could result in inaccurate cash flows, and hence, incorrect capital budgeting decisions.

Generally, a company has two ways to adjust inflation when making capital budgeting decisions. These two ways are:

- Taking the cash flows in nominal terms. And, then discounting them using the nominal cost of capital.

- Taking both cash flows and the cost of capital in constant terms. In this, the company needs to discount the constant cash flows using the constant cost of capital.

For example, a company projects its four-year real cash flows for periods 0, 1, 2, and 3 as -$100, $35, $50, and $30. The nominal cost of capital is 15%, and the inflation is expected to be 10%.

So, the nominal cash flow for year 1 will be $38.5 ($35 × 1.10) and year 2 will be $60.5 (50,000 × (1.10)^2) and year 3 will be $39.9. Now, we need to discount these using the 15% nominal cost of capital. The present values of cash flows will be $33.50, $45.74, and $26.25, respectively.

Social Cost-Benefit Analysis

In terms of capital budgeting, SCBA (Social Cost-Benefit Analysis) is a tool for an effective financial evaluation of a project. It is an approach for assessing the project or investment from a social angle.

We can also say that SCBA is a tool to determine the value of money. It is mainly used for public investments and projects. Moreover, SCBA helps with decision-making, as well as developing programs for various parts of the organization.

Continue reading How can a Capital Budgeting Decision Go Wrong?

Quiz on Capital Budgeting

Answering the following simple questions will help in getting a quick command over the above topic.

It’s very useful for me. thanks a lot.

Nice explanations

Clearly explained.Much appreciated