Profitability Index (PI) is a capital budgeting technique to evaluate investment projects’ viability or profitability. Discounted cash flow technique is used in arriving at the profitability index. It is also known as a benefit-cost ratio. Calculation of PI is possible with a simple formula with inputs such as – discount rate, cash inflows, and outflows. PI greater than or equal to 1 is interpreted as a good and acceptable criterion.

Profitability Index Definition

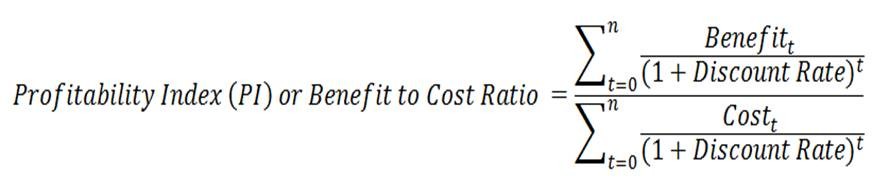

The Profitability Index is a ratio of discounted cash inflow to the discounted cash outflow. Discounted cash inflow is our benefit in the project and the initial investment is our cost, which is why we also call it a benefit to cost ratio.

Profitability Index Method

The method used for arriving at the profitability index of a proposed project is explained stepwise below:

a) Find the expected cash inflows of the project

b) Find the cash outflows of the project (Initial Investment + any other cash outflow)

c) Decide an appropriate discount rate

d) Discount the expected cash inflows using the discount rate

e) Discount the future cash outflows and add to the initial investment

f) Divide step (d) by step (e)

How to Calculate the Profitability Index

The calculation of PI is easily possible once we have the cash inflows and outflows with the appropriate discount rate are in place.

Profitability Index Formula

The formula indicates the benefits in the numerator and costs in the denominator. The formula for calculating the Profitability Index is as follows:

Example of Profitability Index (PI)

Let us take an example of the profitability index for more clarity.

Let’s assume the cash flows of a project as mentioned year-wise in the second column of the below table. The negative cash flows are the costs, and the positive ones are the benefits. In the third column, they are discounted at a 10% rate. All the discounted benefits are added to make $ 16,832 and discounted costs to make $15,450.

| Year | Cash Flows | Discounted | Benefits | Costs |

| (CF) | CF @ 10% | |||

| 0 | -10000 | -10000 | 10000 | |

| 1 | 5000 | 4545 | 4545 | |

| 2 | 5000 | 4132 | 4132 | |

| 3 | -5000 | -3757 | 3757 | |

| 4 | 4000 | 2732 | 2732 | |

| 5 | 4000 | 2484 | 2484 | |

| 6 | -3000 | -1693 | 1693 | |

| 7 | 3000 | 1539 | 1539 | |

| 8 | 3000 | 1400 | 1400 | |

| Total | 6000 | 1382 | 16832 | 15450 |

| NPV | 16832 – 15450 = 1382 | |||

| Profitability Index | 16832/15450= 1.09 | |||

The benefit to cost ratio or the PI can be found by dividing benefits by costs (16832/15450 = 1.09)

You can also refer to our PI Calculator or Cost-Benefit Ratio Calculator.

Acceptance Criteria or Interpretation

A PI of anything equal to or greater than 1 is considered good. It means that the project is worth executing. PI greater than 1 indicates that the project is paying something more than the required rate of return of the investor. In our example, the project should be accepted as it is greater than 1, i.e., 1.09.

Also Read: Profitability Index Calculator

Profitability Index (PI) and Net Present Value (NPV)

The PI is closely linked with the net present value. Both will present the same results as far as acceptance and rejection are concerned. It is because almost the same calculation is followed in both. In PI, we divide our benefits by our costs, whereas, in NPV, we deduct our costs from the benefits. PI will give a relative value and contrarily

Profitability Index – Advantages and Disadvantages

The advantage of the profitability method is that it considers the time value of money and presents the relative profitability of the project. Relative profitability allows the comparison of two investments irrespective of their investment amount. A higher PI would indicate a better IRR, and a lower PI would have a lower IRR.

The main disadvantage of the PI method is also its relative indications. Two projects having a vast difference in investment and dollar return can have the same PI. Therefore, the NPV method remains the best one in such a situation.

Read Advantages and Disadvantages of Profitability Index for more details.

this was helpful thank you very much

I also learnt that using PI to appraise a project is better during Capital Rationing; where there’s limited funds. Since it leads to the same decision as NPV, and we all know and agree that the latter is the most appropriate method of evaluating projects. Is this correct?

Yes, Boluwatife,

NPV is a better method in comparison to others. Just have a look at the following posts.

Why Net Present Value is the Best Measure for Investment Appraisal?

Advantages and Disadvantages of NPV

In the formula for the BCR the benefit was discounted. Why was the cost not discounted?

Please assist

Hi Isaika,

Thanks for reading and sharing your observation.

Request you to check again. We have discounted in the mentioned formula as well as in the example shared for understanding. If still, there is a confusion, let us know. We will be happy to help.