Internal Rate of Return (IRR) is a superior technique for evaluating big projects and investment proposals widely used by management of the company, banks, financial institutions, etc., for their various purposes. The calculation of an IRR is a little tricky. It is advantageous in terms of its simplicity, and it has certain disadvantages in the form of limitations under certain special conditions.

Internal Rate of Return (IRR) Definition

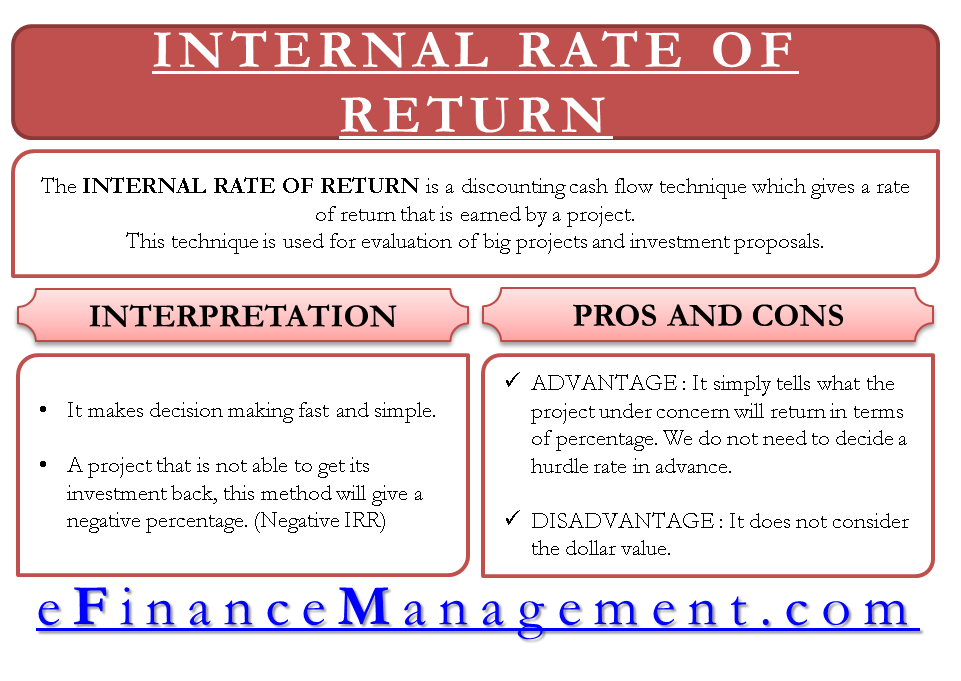

The internal rate of return is a discounting cash flow technique that gives a rate of return earned by a project. We can define the internal rate of return as the discounting rate, which makes a total of initial cash outlay and discounted cash inflows equal to zero. In other words, it is that discounting rate at which the net present value is equal to zero. This rate at which NPV is zero is also known as the crossover rate.

Internal Rate Return (IRR) Explanation with Example

An explanation of the internal rate of return with an example would probably create a better and correct picture in mind.

Suppose a company is investing in a simple project which will fetch five thousand dollars in the next three years, and the initial investment in the project is, say, ten thousand dollars. The internal rate of return is 23.38%. It makes decision-making very simple. We just need to compare these percentage returns to the ones which we can get by investing somewhere.

Calculation of Internal Rate of Return using a Formula / Equation

We have stated the IRR of 23.38% above in our example. We will understand IRR calculation using the same example and find out the stated IRR. Formula / Equation of IRR is stated below:

Also Read: Internal Rate of Return Calculator

Initial Cash Outlay + Present Value of all Future Cash Inflows = 0

- -10,000 + 5000 / (1 + IRR)1 + 5000 / (1 + IRR)2 + 5000 / (1 + IRR)3 = 0

Finding out the IRR from the above equation is not a simple equation-solving exercise. We need to use either trial and error method or interpolation method to determine the required IRR, making the equation equal to zero. Trial and error is a method in which you keep trying arbitrary values to equate the equation, whereas the interpolation method is more scientific. We find two extreme values that give the equation values greater than zero and less than zero. See below.

| Year | Cash Flows | At 18% | At 25% |

| 0 | -10000 | -10000 | -10000 |

| 1 | 5000 | 4237.29 | 4000 |

| 2 | 5000 | 3590.92 | 3200 |

| 3 | 5000 | 3043.15 | 2560 |

| Total | 871.36 | -240 |

IRR = 25 – (25-18) * 240 / (871.36 + 240) Or,

IRR = 18 + (25-18) * 871.36 / (871.36 + 240)

You can also use our IRR Calculator.

They will answer 23.49%, which is almost the same as 23.38%. We can find quite an exact percentage by using a formula in Microsoft Excel. The formula used is “IRR.”

Interpretation of IRR and Project Acceptance Criterion

IRR makes decision-making very simple. We just need to compare the IRR percentage to the one we can get by investing somewhere or some other benchmarks decided by the management of the evaluator. For a project that cannot get its investment back, this method will give a negative percentage. This is commonly called a Negative IRR.

Advantage and Disadvantages of Internal Rate of Return Method of Evaluating the Projects

The major advantage of the IRR method of evaluating the project is that it simply tells what percentage the project under concern will return. Now the evaluator only needs to decide with which rate to compare it with. We do not need to decide on a hurdle rate in advance. A mistake in determining the hurdle rate will not affect the result of this method.

The major disadvantage of the internal rate of return is its problem in analyzing a non-conventional project where the cash flow stream has various positive and negative cash flows in different years. In this situation, it will give Multiple Internal Rates of Return (IRR). This problem of multiple IRRs can be solved by modified IRR (a solution for multiple IRR). Another problem is that it does not consider the dollar value. The business of a roadside vendor who hardly earns his leaving will have a higher IRR than a huge and stable business. The vendor must be earning, say, 1000 dollars a year, whereas the profit of that big business may be in the millions.

Refer to Advantages and Disadvantages of Internal Rate of Return (IRR) for a detailed article.

If, NPV is positive at both interest rate, how do we adjust the rate of return?

Hi Sonia,

Which Both interest rate are you talking about?

See if the following post helps your query

Modified Internal Rate of Return (MIRR) – The Solution to Multiple IRR

In case both NPV positive then you need to start with another rate.

using trial and errors method, suppose first time you consider 15% and get NPV 1000 then after you consider 20% rate and find NPV@20% is 250.

You required one Negative NPV and One positive NPV, but here both NPV is positive. So you required to calculate further using 25%. Suppose you get NPV using 25% is – 100. Compare 20% and 25% for calculation of IRR.

Thanks for replying Ali.

This method we call interpolation method whereby you can reach very near to the correct answer.

HI SIR , WHAT IS TRAIL & ERROR METHOD & WHAT PV FACTOR USE FOR SOLVING PROBLEMS

Hi Pankaj,

In trial and error wherein you keep trying arbitrary values for an IRR and try to equate the equation = 0.