Interest Rates: Meaning

The Rate at which the investors receive their returns on investment or the rate at which borrowers are to pay for their borrowings is known as Interest Rate. In other terms, it is a percentage of the principal amount that the borrower pays to the lender for using lenders’ funds. These interest rates are mostly expressed on an annual basis, but sometimes they are also expressed on a periodic basis for a shorter duration. There are many types of interest rates prevalent in the financing and investment sector.

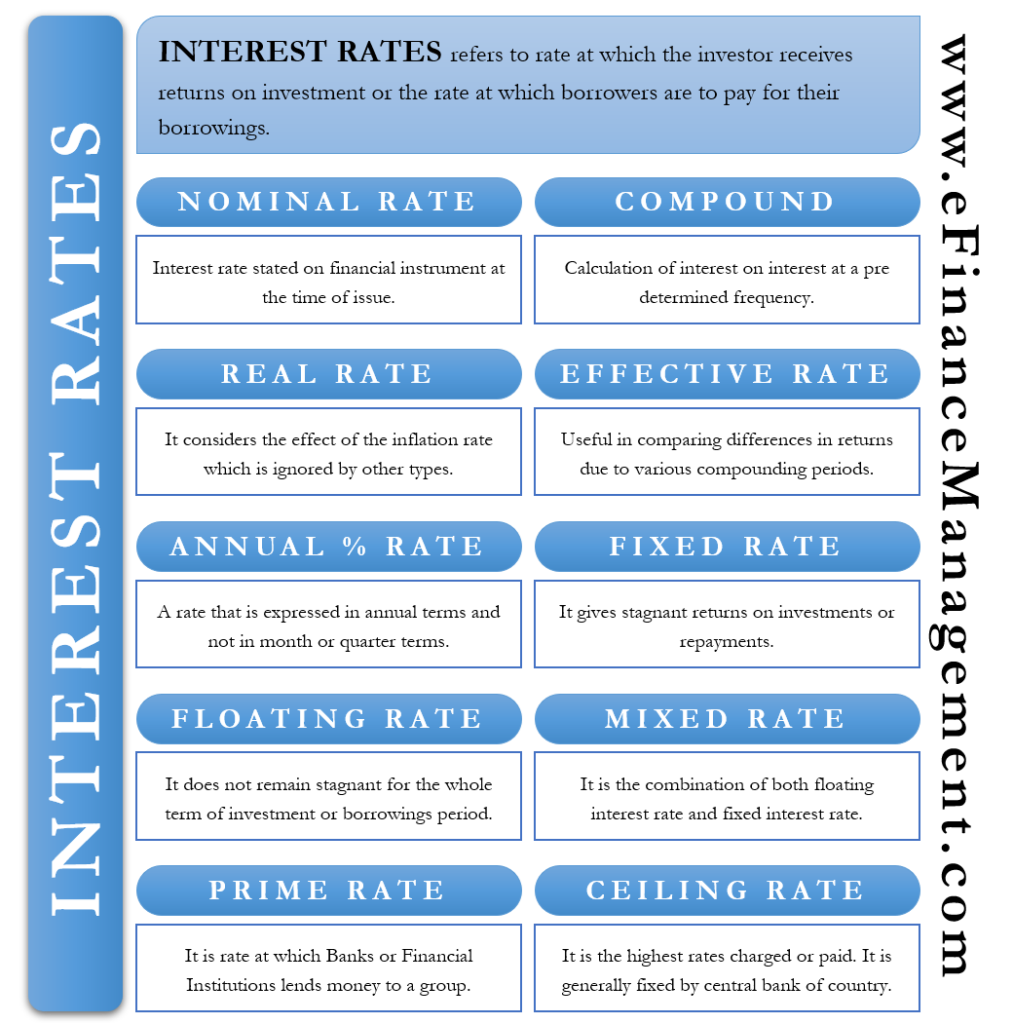

Types of Interest Rates

There are many types of Interest Rates that the borrowers and lenders encounter in their lifetime. According to nature and purpose, the interest rates vary from one another. They are as follows:-

Nominal Interest Rate

Nominal Interest Rate is the interest rate that is stated on the financial instrument at the time of issuance. It is mostly a fixed rate that calculates interest accruals or disposals. Nominal Interest Rate is beneficial for borrowers and less beneficial for lenders.

The other name for Nominal Interest Rate is Simple Interest Rate or Regular Interest Rate.

Example

Mr. A has taken a loan of $100000 for a period of one year, bearing a nominal interest rate of 7.5% per annum. Mr. A, in the above example, has to repay the interest of $7500 for the loan amount at the end of one year together with the loan amount of $100000.

Also Read: Compound Interest

Compound Interest Rate

The basic meaning of the Compound Interest Rate is charging or receiving interest on interest at a pre-decided period or frequency. In the case of Nominal Interest Rate, Interest calculation happens only on the principal amount. In contrast to this, Compound Interest not only calculates interest on the Principal amount but also on the interest accrued. Compound Interest, in comparison to Simple Interest, gives more returns. Because the interest accrued is also treated as Principal, and that interest also earns further interest thereon. A compound interest rate is beneficial for the lender and less beneficial for the borrower because he has to pay more than simple interest rate borrowings.

This principle is based on the assumption that the borrower owes interest on the principal amount and owes interest on the accumulated interest amount.

The frequency or period of interest calculation could be any time period as may be agreed, daily, weekly, fortnightly, monthly, quarterly, half-yearly, or yearly.

Example

A borrowing of $100 with a 5% compound interest rate and accrued interest amount of $10 will reap a total compound interest of $5.5. Here $5, compound interest is of the principal amount of $100, and $0.5 is of accrued interest amount of $10.

In the case of Simple Interest, only $5 would have been the interest payable, as there is no interest on interest.

Real Interest Rate

One of the biggest drawbacks of the Nominal Interest Rate is that it completely ignores the impact of inflation on investments and borrowing. The inflation rate decreases the actual value of money due to a reduction in purchasing power capacity. As a result, sometimes, the Nominal Interest Rate is misleading as it completely ignores the effect and movement of the inflation rate in the economy.

Real Interest Rate considers the effect of the inflation rate giving actual or real interest rate. For the calculation of the Real Interest Rate deduction of, the effect of the inflation rate happens from the nominal interest rate. In comparison to Nominal Interest Rate, Real Interest Rate is more authentic in nature. Depending on the situation, the Real Interest Rate can be positive, it can be negative, or even zero (0). If it is negative or 0, it is in the investor’s best interest to avoid such investments.

Formula

Real Interest Rate = Nominal Interest Rate – Inflation Rate

Example

The Nominal Interest Rate is 10% per annum, and the inflation rate is 1% per annum. As a result Real Interest Rate will be 9% (10% – 1%) per annum.

Effective Interest Rate

Effective Interest Rate is popularly useful in comparing differences in returns due to various compounding periods. It helps the investor to calculate annual returns if the compounding is month-wise, quarter-wise, daily, fortnightly, or for any other period.

The other name for Effective Interest Rate is Annual Equivalent Rate (AER).

Example

Let’s understand AER with an example.

Nominal Interest is 6% annually. If the compounding takes place quarterly, then AER would be 6.114%. If the compounding takes place monthly, then Effective Interest Rate would be 6.1392%. AER would be 6.1524% if the compounding takes place daily. These rates help in calculating differential returns.

Annual Percentage Rate (APR)

As the name suggests, the Annual Percentage Rate (APR) is the rate expressed in annual terms. APR is not for a month or quarter or for any particular period, but it is a rate realized or charged for the whole year. The calculation of this rate takes place on the total cost (including fees, commission, or additional charges) of the loan amount.

Major financial instruments which use APR are Credit Cards, Loans, mortgages, and other lending products. Standard APR stays constant for almost all borrowers. Changes in the Annual Percentage Rate are visible when the borrower’s credit history is not stable in nature.

These are some basic types of Interest Rates, which are non-exhaustive in nature.

Other Types of Interest Rates

There are also other types of interest rates that are important to consider here. They are as follows:-

Fixed Interest Rates, Floating Interest Rates, and Mixed Interest Rates

On the basis of the stagnancy of the interest rate, there are majorly three types of interest rates, i.e., Fixed Interest Rates, Floating Interest Rates, and Mixed Interest Rates.

Fixed Interest Rates

As the name suggests, a fixed interest rate gives stagnant returns on investments or repayments. They are fixed rates charged or realized on the invested or borrowed amount over a fixed period of time. The calculation of this type of interest rate is very basic in nature and is easy to understand for both the borrower and the investor. Fixed Interest Rate has nothing to do with market-rate fluctuations in the economy. The biggest advantage of this rate is that the interest payments and quantum are fixed, and there is no change in the interest amount for every due period. Cash flow planning becomes easier for both the investor and the borrower. The other name for Fixed Interest Rate is Flat Interest Rate.

Floating Interest Rates

Completely opposite of the Fixed Interest Rate is the Floating Interest Rate. It does not remain stagnant for the whole term of investment or borrowing period. Mostly Floating Interest Rates fluctuate according to some base rate linked to it. The floating rate replicates the increase and decrease of the linked base rate. Sometimes Financial Institutions, or Banks, or corporates use this rate to avoid receiving or paying interest lesser or more than the prevailing market rate. It is beneficial for the borrower when the interest rates are continuously reducing. While floating interest rates are beneficial for the investors when the interest rates are set to rise in the economy.

The other name for Floating Interest Rate is Variable Interest Rate.

Mixed Interest Rates

As the name suggests, a mixed Interest Rate is the combination of both a floating interest rate and a fixed interest rate. A certain portion of the Interest Rate is constant in nature, while the rest of the portion is variable in nature. It is comparatively less risky and serves the purpose of the fixed and floating interest rates. Although, a mixed interest rate is not preferable in long-term loans or long-term investments.

Long Term Interest Rates, Medium Term Interest Rates, and Short Term Interest Rates

On the basis of the duration of investment or borrowings, the classification of interest rates takes place. Charging of Long Term Rate takes place for more than 5 years period. Charging of Medium Term Rate is from a period of 1 year to 5 years. Imposing of Short Term Interest Rate takes place for a period of less than a year. This period can be a day, a week, a month, or any period less than a year. The other name of the Short Term Interest Rate is the Periodic Interest Rate.

Prime Rate

Prime Rate is the rate at which Banks or Financial Institutions lend money to a specific group of customers. It is the lowest lending rate only for the preferential customers of the Bank or Financial Institutions. Prime Rate is the lowest and the best rate a borrower could ever ask for. Charging of Prime Rate mostly takes place on financial instruments like credit cards, mortgages, loans, etc. Mostly Prime Rate is uniform across all Banks or Financial Institutions.

The other name of Prime Rate is Prime Lending Rate or Prime.

Ceiling Interest Rates

As the name suggests, Ceiling Interest Rates are the highest rates charged or paid. The Central Bank of the country and/or Central Government of the country fixes this ceiling interest rate. The highest limit set can vary from one instrument to another.

Conclusion

Financial Services Industry works on various types of interest rates. These types of interest rates are useful for retail investors, institutional investors, banks, governments, financial institutions, corporates, and many other participants. All these interest rates have different characteristics and serve different purposes. They all are equally important.

RELATED POSTS

- Simple Interest – Meaning, Calculation and more

- Interest Rate is a Sum of Real Risk-Free Rate and Compensation for 4 Types of Risks

- Periodic Interest Rate: Meaning, Examples, Advantages, Excel Calculation, and More

- Effective Interest Rate – Meaning, Formula, Importance And More

- How is the Interest Rate related to the Required Rate of Return, Discount Rates, and Opportunity Cost?

- Difference between Growing Perpetuity and Growing Annuity