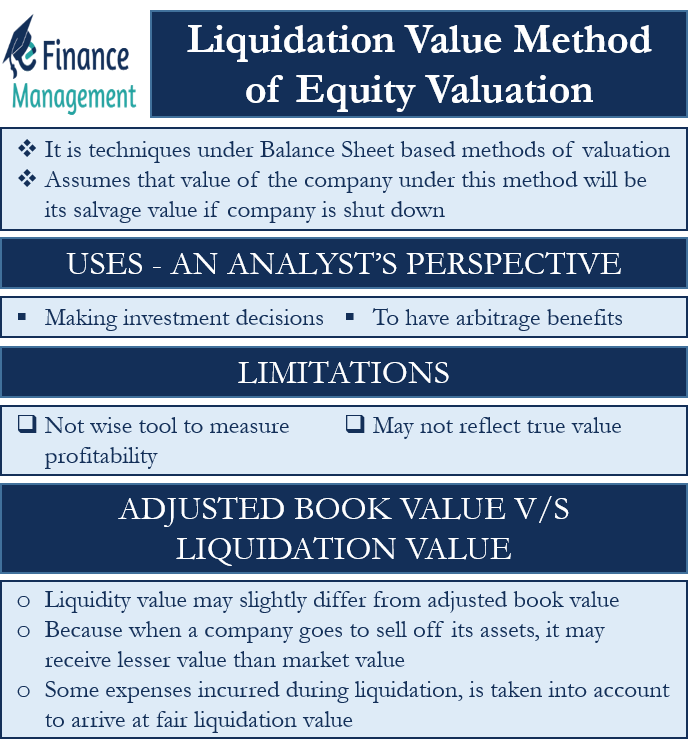

The liquidation value method of equity valuation is one of the techniques under Balance Sheet based methods of valuation, which assumes that the value of the company under this method will be its salvage value if the company is shut down.

The net worth or book value of the company reflects its accounting value, while the liquidation value tends to arrive at the company’s residual value, assuming that the company sells off all its assets (at market realizable value) and pays off all the liabilities that it has taken.

Let us now draw a comparison between book value, adjusted book value, and liquidation value with the help of an example.

Example Comparing Book Value V/S Adjusted Book Value V/S Liquidation Value

Sample Balance Sheet

| Liabilities | $ (Mio) | Assets | $ (Mio) |

| Equity Share Capital | 1500 | Fixed Assets | 3000 |

| Preference Share Capital | 600 | Inventories | 1350 |

| Reserves and Surplus | 300 | Cash and Bank Balance | 150 |

| Long Term Debt | 900 | Debtors | 300 |

| Short Term Debt | 300 | ||

| Creditors | 1200 | ||

| Total | 4800 | Total | 4800 |

The book value here will be $2400 Mio as per the below calculation:

| Book Value Calculation | $ Mio |

| Total Assets | 4800 |

| Less Long-Term Debt | 900 |

| Less Short Term Debt | 300 |

| Less Creditors | 1200 |

| Book Value | 2400 |

Assuming the market value of fixed assets is 50% higher than the accounting value, the adjusted book value here will be $3900 Mio, which is higher than the book value of $ 2400 Mio, which we calculated earlier.

| Adjusted Book Value Calculation | $ Mio |

| Total assets (now higher) | 6300 |

| Less Long-Term Debt | 900 |

| Less Short Term Debt | 300 |

| Less Creditors | 1200 |

| Adjusted Book Value | 3900 |

Liquidity value may slightly differ from the adjusted book value, given the fact that when a company goes to sell off its assets, it may receive a lesser value than the market value. Inventory might have piled up, and since the business needs to be closed down, inventory may even fetch a lower value. Furthermore, some expenses might be incurred during liquidation, which can also be taken into account to arrive at a fair liquidation value.

Assuming a distress selling loss of 20% on inventory and liquidation cost (including legal cost) of $20 Mio, the value of the firm may reduce by $290 Mio as below:

| Liquidation Value Calculation | $ Mio |

| Distress selling loss of inventory (20% of 1350) | 270 |

| Add liquidation cost | 20 |

| Total Reduced Realization | 290 |

So we deduct this amount of total reduced realization from the adjusted book value, which comes to

$ 3900 Mio Less $ 290 Mio = $ 3710 Mio.

Let us now look at the influence on investment decisions from an analyst’s perspective.

Liquidation Value Method Uses – An Analyst’s Perspective

The liquidation value method can be used for making investment decisions. Suppose the company is profitable and the industry is growing too. In that case, the company’s liquidation value will normally be much lower than the share price since the share price factors growth aspect, which liquidation value does not.

For companies going through a decline phase or if the industry is dying, the share price may be lower than the liquidation value; this would logically mean that the company should shut business. To have arbitrage benefits, smart corporate raiders are usually on the lookout for these companies. Since the liquidation value is higher than the market share price, they can buy out the company stock at a lower price and then sell off the company to make a risk-free arbitrage profit.

Limitations of Liquidation Value Method

Summing up the concept, liquidation value reflects the base price for the company. However, this may not be a wise tool to measure a profitable company as it ignores the future growth potential. Nonetheless, this method can be considered to evaluate a dying company as a potential takeover and sell down for profit-making.

Also Read: Replacement Value Method of Equity Valuation

For companies with a proprietorship or partnership model, there may be a high dependence of profitability on the partners. It may be because of the key partners (their skill, ability, knowledge, network, etc.) that the business enjoys profitability, and their liquidation value may not reflect true value unless we value the impact of these key personnel on business profitability. This leads to a need to calculate the goodwill impact built up by the key personnel to arrive at a fair liquidation value. So this valuation model is suitable only for such special cases where liquidation is the motive. However, it is to be noted that this method is far more realistic than the book value method of equity valuation.