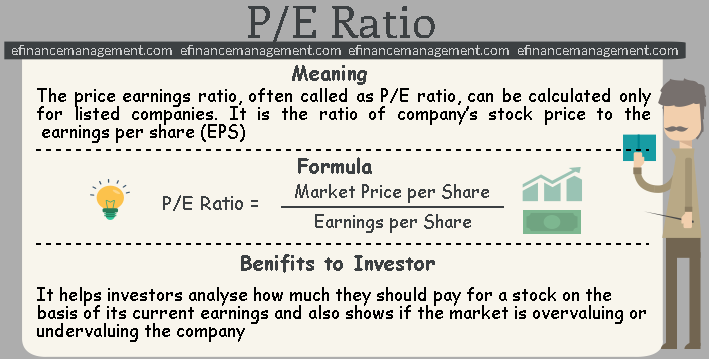

P/E Ratio Meaning

The price-earnings ratio, often called the P/E ratio is a market value ratio of a company’s stock price to the company’s earnings per share. It is a market prospect ratio that is useful in valuing companies. In simple words, the P/E ratio is obtained by comparing the market price per share with its relative dollar of earnings per share. The relationship between the two essential parts of this ratio, i.e., the Market value of the stock and its relative earnings, shows what the market is willing to pay for a stock based on its current earnings. Thus, it is also known as the price multiple or the earnings multiple.

P/E Ratio Valuation

As the P/E ratio is the most common measure of how expensive a stock is, it is essential to understand the basis & importance of its valuation.

The two most important components which form the basis of this valuation are:

- Market value per share and

- Earnings per share

Along with the above factors, this ratio can also significantly fluctuate depending upon the economic and market conditions.

The following paragraphs will help you understand the importance of such analysis through the P/E ratio formula and calculation.

P/E Ratio Formula

The basic formula to calculate the price-earnings ratio is fairly standard and is as under:

P/E Ratio = Market Price per Share / Earnings per Share

Market Price per Share: Market price per share is the price of each share in the open market or how much it would cost to buy a share of stock.

Earnings per Share (EPS): Earnings per share are the total earnings of a company for the year divided by the total number of shares outstanding at the end of the year.

P/E Ratio Calculation

Let us calculate the price-earnings ratio on the basis of the above formula.

Suppose the market price per share of QPR Ltd. is Rs.100, and the earnings per share are Rs.25, then the price-earning ratio shall be as follows:

Also Read: Negative P/E Ratio

P/E Ratio = Rs.100 (Market Price) / Rs.25 (Earnings)

= 4

This means that the Market price is 4 times the company’s earnings.

There is another term, ‘earning yield,’ which is the exact inverse of the P/E ratio.

P/E Ratio Calculator

Benefits to Investors

Ratio analysis is crucial for investment decisions, as it helps the investors know the real worth of their investment. The P/E ratio is useful in accessing the relative attractiveness of a potential investment. It helps investors analyze how much they should pay for a stock on the basis of its current earnings and shows if the market is overvaluing or undervaluing the company. It helps in predicting future earnings per share through which the investors evaluate what a stock’s fair market value should be.

Must read CAPE Ratio

P/E Ratio Analysis

Generally, the pe ratio indicates how many times earnings the investors are willing to pay for the share. The P/E ratio analysis shows the direct relationship between the market price of a company’s share and its earnings. Hence, if a company’s earnings per share rise, it leads to a rise in its market price, while lower earnings per share indicate a fall in its market price. Thus, these two factors mainly define the real performance and growth of a company.

Similarly, a company with a high pe ratio is often considered to be a growth stock. This indicates higher earnings growth and positive performance in the future, and investors are usually willing to pay more for this company’s shares. It is important to note that companies with high P/E ratios are more likely to be considered risky investments than those with lower ones. It is because of the reason that a high P/E ratio signifies high expectations. From another angle, if the P/E is higher than its peers, it may be overpriced. New investors may be reluctant about entering into it.

While on the other hand, a company with a lower pe ratio indicates poor current and future earnings growth, the stock is undervalued, etc. Investing in such a company could prove to be a poor investment. If the company’s P/E ratio is low, the market may be discounting some bad news about the company. News that affects the future growth prospects of the company. If the company faces a temporary reduction in trading price owing to market fluctuation, it can be an investment opportunity. If the fundamentals of the company are good, accompanied by a low P/E ratio, it is an opportunity. It is based on the fact that the P/E Ratio of a company tends to move toward the industry average P/E Ratio.

Also Read: Market Value Ratios

This ratio is useful only in comparing companies in the same industry. Any such comparisons amongst companies of different industries would provide an incorrect result and thus, would mislead the investors.

Also read: Negative P/E Ratio

Example

Let us understand this by an example. Suppose there are two companies- A Ltd. (belonging to the textile industry) and B Ltd. (belonging to the pharmaceutical industry) with price-earnings ratios 4 and 5, respectively. Also, there is one more company C Ltd. (belonging to the textile industry), with a price-earnings ratio of 4.5.

While analyzing the price-earnings ratios, one can compare A Ltd. with C Ltd. since they belong to the same industry, and their valuation and growth rates will more or less be alike. One should not or cannot compare either of the two with B Ltd. as it would provide inappropriate results.

Conclusion

The P/E ratio is prominent for the investment valuation indicators. It is because it indicates the expected price of a share based on its earnings. And therefore, the investment community makes extensive use of this valuation metric.

Read more about Market Value Ratios.

Quiz on Price to Earnings (P/E) Ratio

This quiz will help you to take a quick test of what you have read here.

This web site truly has all the information I wanted concerning this subject and didn’t know who to ask.

An interesting discussion is value comment. I believe that you should write extra on this topic, it may not be a taboo subject however typically individuals are not sufficient to talk on such topics. To the next Cheers.

I wanted to thank you for this very good read!! I certainly enjoyed every little bit of it. I’ve got you bookmarked to look at new things you post.

Excellent blog here! Also, your site loads up very fast! What web host are you using? Can I get your affiliate link to your host? I wish my website loaded up as fast as yours lol

good one

The information is vital to my reading and I give thumbs up five star for these amazing explanation. I suggest you share more of these type on your website for further details and I look forward to read more about accounting.

Hi Mark,

We are updating new posts on our website on a daily basis. You can keep coming back for new topics.

Thanks for visiting our site.

Sanjay