Meaning of Divisional or Project Weighted Average Cost of Capital

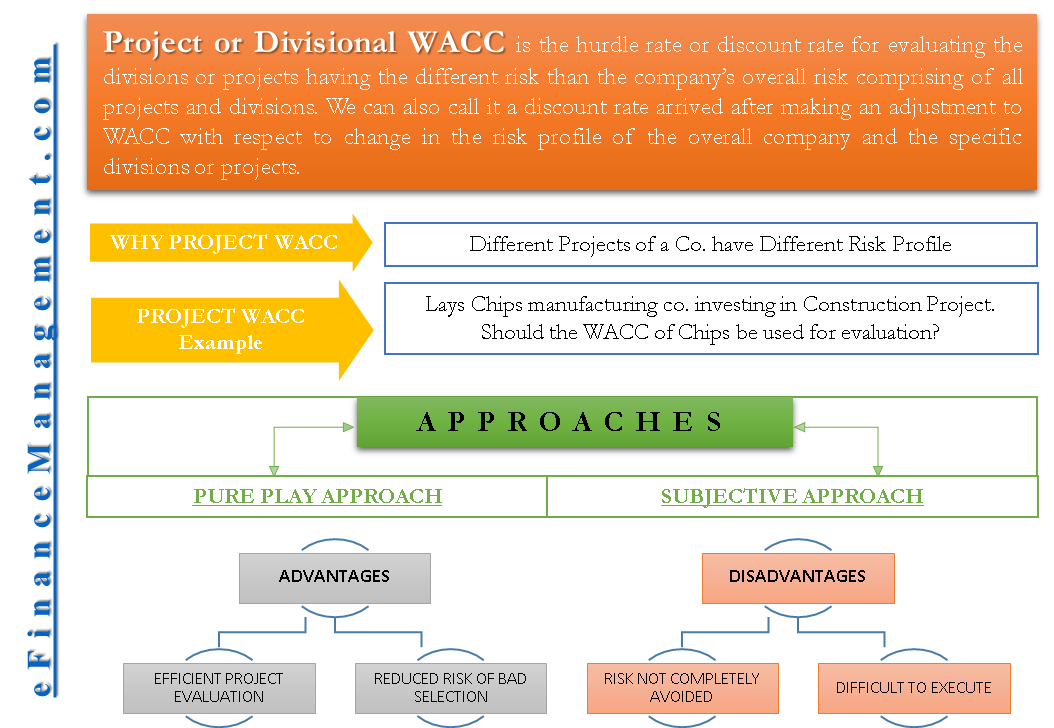

Divisional or Project Weighted Average Cost of Capital (WACC) is the hurdle rate or discount rate for evaluating the divisions or projects having a different risk than the company’s overall risk comprising all projects and divisions. We can also call it a discount rate arrived after adjusting WACC with respect to changes in the risk profile of the overall company and the specific divisions or projects.

What is WACC?

WACC is an overall cost of capital of the company calculated as a weighted average of cost of each component of the capital where the weights are the market value of each capital. It works as a benchmark rate for evaluating new projects. If the project IRR is less than WACC, the project will be rejected and vice versa.

Why Project or Divisional WACC Evolved?

WACC as a concept needed further improvement because it does not consider the risk factor of individual projects. On the other hand, we know that risk and return are directly correlated. Higher the risk higher should be the required return. As a rule, we were using the company’s overall WACC for all the projects irrespective of their individual risk profile. This will result in accepting high-risk projects with IRR higher than WACC and rejecting even the risk-free projects having IRR little less than WACC. Let’s understand with an example.

Project/Divisional WACC Example

Suppose a potato chips manufacturing company like ‘Lays’ wishes to enter into a new construction project. Can it apply the same WACC of potato chips business to evaluate a construction project? The obvious answer should be ‘NO.’ Similarly, a company is having two independent divisions – mobile manufacturing and mobile software division. Can we apply the same WACC to evaluate their performances? No, we should not.

Therefore, overall co’s WACC can be used as an evaluating benchmark only where the new projects have the same risk profile. If the risk is higher, the WACC should be increased for evaluation and vice versa. How much adjustment in the WACC do we need? By 1%, 2% or 10%. We don’t know. The concept of divisional and project WACC will help us with this problem.

Approaches to Divisional or Project Weighted Average Cost of Capital

There are two approaches to overcome this problem.

The Pure Play Approach

As per this approach, first of all, find a listed company in the business of construction. Calculate the WACC of this company and utilize it for evaluating the construction project of the Lays. Further, the construction company should be the carbon copy of the proposed project of Lays. If the proposed project is of constructing bridges, the concerned company should also be in the same area of operations. This approach is possible only when such an identical company exists. In an absence of that, the divisional cost of capital is difficult to calculate. In that situation, let’s read the other approach for the solution.

The Subjective Approach

As per this approach, we can categorize our projects or divisions into, say, low risk, moderate risk, and high risk and adjust the WACC by some percentage. It can be something like the below table.

| Categories | Project / Division | Adjustment | WACC | Adjusted WACC |

| Low Risk | B, E | -3% | 15% | 12% |

| Moderate Risk | C, A | 0% | 15% | 15% |

| High Risk | D, F, G | 3% | 15% | 18% |

These subjective adjustments are also not fail-safe. They are better than using the overall Co.’s WACC for all projects. All it can do is that it can reduce the chances or risk of selecting a bad project.

Also Read: Market vs. Book Value WACC

Advantages of Divisional WACC

The prime advantage of divisional or project WACC is that it can make the process of selecting projects more efficient and effective. Although it cannot completely eradicate the possibility of error in selecting projects, it can reduce the risk to a great extent.

Disadvantages of Divisional WACC

It also has a risk of a wrong decision of accepting and rejecting a project. For example, D, F, and G are in a high-risk category but all three are not having the same risk. Suppose D is less risky than G, but this approach will only evaluate both projects with 18% hurdle rate. To further streamline the process, we can increase the categories from 3 to 5. Introduce one category between low and moderate and another category between moderate and high.

Conclusions

Ideally, each project should be objectively analyzed and the risk and cost should be determined. But, it is practically not possible because of the limitation of data. On the top, the cost and time of conducting such a research also do not guarantee the perfect solution. Under that situation, such workarounds are the only practical solutions with their inbuilt pros and cons.