Value of a Firm – Definition

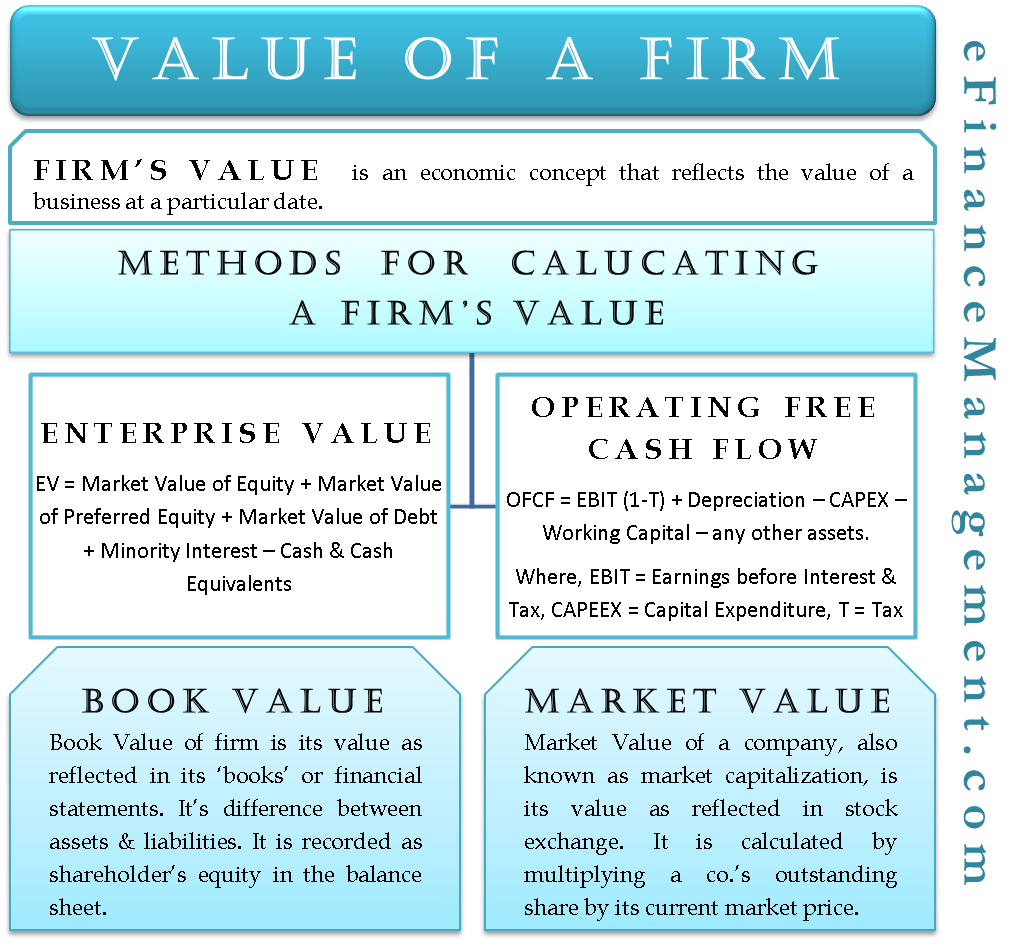

A firm’s value, also known as Firm Value (FV), Enterprise Value (EV). It is an economic concept that reflects the value of a business. It is the value that a business is worthy of at a particular date. Theoretically, it is an amount that one needs to pay to buy/take over a business entity. Like an asset, the value of a firm can be determined on the basis of either book value or market value. But generally, it refers to the market value of a company. EV is a more comprehensive substitute for market capitalization and can be calculated by following more than one approach.

Calculating a Firm’s Value

The value of a firm is basically the sum of claims of its creditors and shareholders. Therefore, one of the simplest ways to measure it is by adding the market value of its debt, equity, and minority interest. Cash and cash equivalents would then be deducted to arrive at the net value.

Formula for Calculating a Firm’s Value

| EV = market value of common equity + market value of preferred equity + market value of debt + minority interest – cash and investments. |

One of the reasons why the concept of EV has gained more importance than market capitalization is because the former is more inclusive. Besides equity, it includes the value of debt as well as cash reserves which have an important role to play in a corporation’s valuation. A buyer would have to pay off a firm’s debt when taking over the firm. And the same could be net off from the cash and cash equivalents available with the firm.

Another sound approach for computing the value of a firm is to determine the present value of its future operating free cash flows. The idea is to draw a comparison between two similar firms. By similar firms, we mean similar in size, same industry, etc. The firm whose present value of future operating cash flows is better than the other is more likely to attract a higher valuation from the investors. Operating Free Cash Flow (OFCF) is calculated by adjusting the tax rate, adding back depreciation, and deducting the amount of capital expenditure, working capital, and changes in other assets from earnings before interest and taxes. The formula for computing OFCF is as below –

Also Read: Enterprise Value Calculator

Formula for Computing Operating Free Cash Flow (OFCF )

| OFCF = EBIT (1-T) + Depreciation – CAPEX – working capital – any other assets |

Where,

EBIT = earnings before interest and taxes,

T = tax rate

CAPEX = capital expenditure

Calculating OFCF in such a way gives a more accurate picture of the cash-generating capabilities of a firm. Once OFCF is computed, one can use a suitable discount rate to find the present value of OFCF. On the basis of the sum of all the present value of future operating cash flows, one can decide on whether to take over a firm or not.

While the above approaches may seem cumbersome, one can also make use of business valuation calculators. Value of a Firm Calculator can help buyers and sellers determine the true value in no time. For different industries, different business valuation calculators have been developed by finance experts.

Book Value of a Firm

As the name implies, the firm’s book value is its value as reflected in its ‘books’ or financial statements. It is the difference between the assets and liabilities of a firm as per its balance sheet. It is the shareholder’s equity in the balance sheet. This is the true worth of a business when its liabilities are net off from its assets.

For example, if company ABC has total assets worth $500 million. And its total liabilities amounting to $450 million, the firm’s book value would be $50 million (by deducting the value of liabilities from that of assets). This means that if a company XYZ is to purchase company ABC, then it will have to shell $50 million out of its pocket, the actual book value of buying company ABC.

Also Read: FCFE Calculator (Free Cash Flow to Equity)

Market Value of a Firm

The market value of a company, also known as market capitalization, is its value as reflected in the stock exchange. It is calculated by multiplying a company’s outstanding share by its current market price.

For example, if the company ABC has 10 million shares outstanding and the market price of each share is $50. The market value of the company would be $500 million, assuming there are only common shares issued in the market.

Market value and the book value of the firm are two different concepts. There is quite a possibility of a huge difference between the book and the market value of a company at a given point in time.

Conclusion

What approach to calculating the value of a firm we follow depends on the firm in question. Also, whether to consider the book value or market value of a company while making a decision to buy is a policy and strategy decision. One can engage companies that exclusively deal with estimating the true value of firms.

Frequently Asked Questions (FAQs)

The value of a firm represents the worth of a business on a particular date. It is the amount payable in case of acquisition or takeover of such business. It is also known as Economic Value.

We sum up the market value of common equity, the market value of preferred equity, the market value of debt, minority interest less cash, and investments to arrive at the firm’s value.

EV holds more importance than market capitalization because it is inclusive. It also includes the value of debt and cash reserves and the value of equity.

The formula for calculating operating free cash flows is:

OFCF = EBIT (1-T) + Depreciation – CAPEX – Working Capital – Any other assets

The value obtained from the company’s books is the book value of the firm.

The market value of the firm = Company’s Outstanding Share * Current Market Price

Hello there, You’ve done a great job. I’ll certainly Digg it and personally suggest to my friends. I’m confident they will be benefited from this website.

pls help me assess the effect of valuation on firm growth

Very simple explanation. Thank you sir

Concise and inspirational