The replacement value method considers ‘the amount required to replace the existing company’ as the valuation of a company. In other words, if one is to create a similar company in the same industry, all costs required to do so will form part of the firm’s value. This is also called “Substantial Value.”

Also, it is an example of an asset-based valuation method. Let us now understand this topic with the help of an example.

Replacement Value Method Example

Let us first take an example to understand the replacement value method.

Sample Balance Sheet (Table I)

| Liabilities | $ (Mio) | Assets | $ (Mio) |

| Equity Share Capital | 1500 | Fixed Assets | 3000 |

| Preference Share Capital | 600 | Inventories | 1350 |

| Reserves and Surplus | 300 | Cash and Bank Balance | 150 |

| Long-term Debt | 900 | Debtors | 300 |

| Short-term Debt | 300 | ||

| Creditors | 1200 | ||

| Total | 4800 | Total | 4800 |

| Book Value Calculation | $ Mio |

| Total Assets | 4800 |

| Less: Long-Term Debt | 900 |

| Less: Short Term Debt | 300 |

| Less: Creditors | 1200 |

| Book Value | 2400 |

As per the table above, the book value comes out to be $ 2400 Mio.

In the same case, let us calculate the replacement cost, given the following assumptions:

- 20% of the fixed assets are unused.

- The market value of the assets is 50% higher than the accounting value carried in the balance sheet.

The replacement cost adjusted balance sheet will now have fixed assets value as follows:

| Fixed Assets | $ Mio |

| Original carrying cost | 3000 |

| Less: Unused Assets (20%) | 600 |

| Balance Fixed Assets | 2400 |

| After revaluation (at 150%) | 3600 |

The asset value has therefore increased by $ 600 Mio, i.e. ($ 3600 Mio less $ 3000 Mio)

Replacement Cost Adjusted Balance Sheet (Table II)

| Liabilities | $ (Mio) | Assets | $ (Mio) |

| Equity Share Capital | 1500 | Fixed Assets | 3600 |

| Preference Share Capital | 600 | Inventories | 1350 |

| Reserves and Surplus | 300 | Cash and Bank Balance | 150 |

| Adjustment | 600 | Debtors | 300 |

| Long-term Debt | 900 | ||

| Short-term Debt | 300 | ||

| Creditors | 1200 | ||

| Total | 5400 | Total | 5400 |

Replacement Cost Value Calculation using the following Formula

(Table III)

| Replacement Cost Value Calculation | $ Mio |

| Total Assets (now higher) | 5400 |

| Less Long-Term Debt | 900 |

| Less Short Term Debt | 300 |

| Less Creditors | 1200 |

| Replacement Cost Value or Net Substantial Value | 3000 |

Hence, as per the replacement value method, the company’s value is $3000 Mio (refer to Table III). Let us now look at different types of substantial value using the same example.

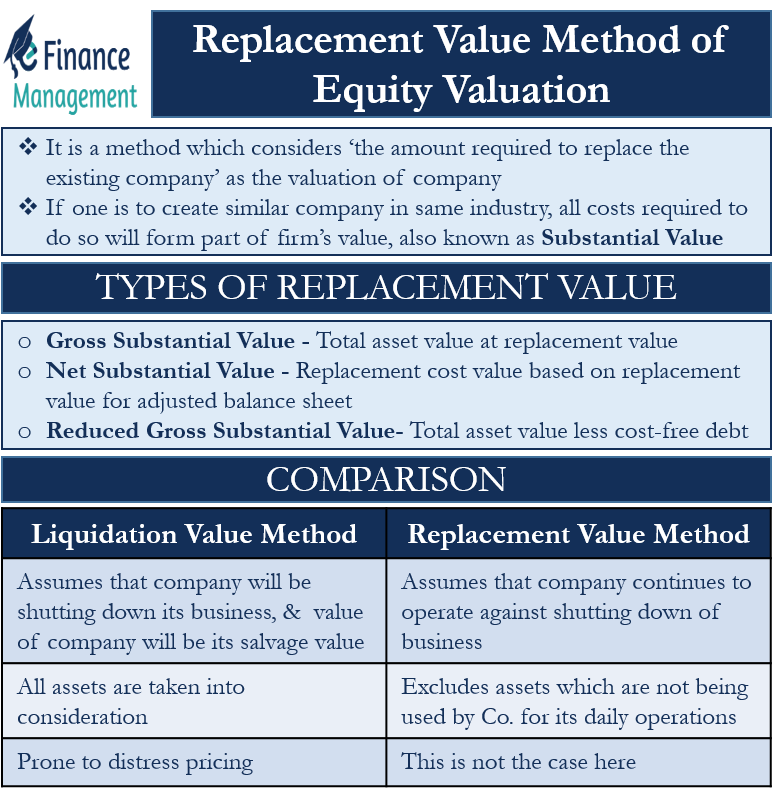

Types of Substantial Value / Replacement Value

Gross Substantial Value

It is the total asset value at replacement value which in our example will be $ 5400 Mio (see “Table I” assets side total)

Net Substantial Value

It is the replacement cost value based on the replacement value for the adjusted balance sheet, which in our example will be $ 3000 Mio (See Table III)

Reduced Gross Substantial Value

It is the total asset value less cost-free debt (Here, creditors) which in our example will be $ 5400 Mio less $ 1200 Mio (creditors) = $ 4200 Mio.

We shall now compare and understand the Liquidation Value Method v/s Replacement Cost Method (substantial value).

Comparison between Liquidation and Replacement Value Method

- The replacement cost method of equity valuation assumes that the company continues to operate against shutting down of business. Whereas the liquidation value method of equity valuation assumes that the company will be shutting down its business, and hence the value of the company under this method will be its salvage value.

- In the case of the replacement cost method, generally, replacement cost excludes those assets which are not being used by the company for its daily operations, while in the case of the liquidation value method, all assets are taken into consideration.

- The liquidation value method may be prone to distress pricing, which is not the case with the replacement cost method.

Conclusion

The replacement value method is the more refined way of calculating the company’s value; however, it comes with the drawback of incorrect estimation. The use of the replacement value method will be incomplete if we do not compare it with the Q ratio, which is also called Tobin’s Q. Using the Q ratio based on replacement cost adds value to the investment decision process.

Read more about various other Equity Valuation Methods.

Hey! This is Akhil Singh.

I wanna know if there is some good reading stuff on the calculation of Reproduction Cost of a company any file or any book (preferred) would be of great help.

No limits on the number of recommendations.