What is Market-to-Book Ratio (M/B)?

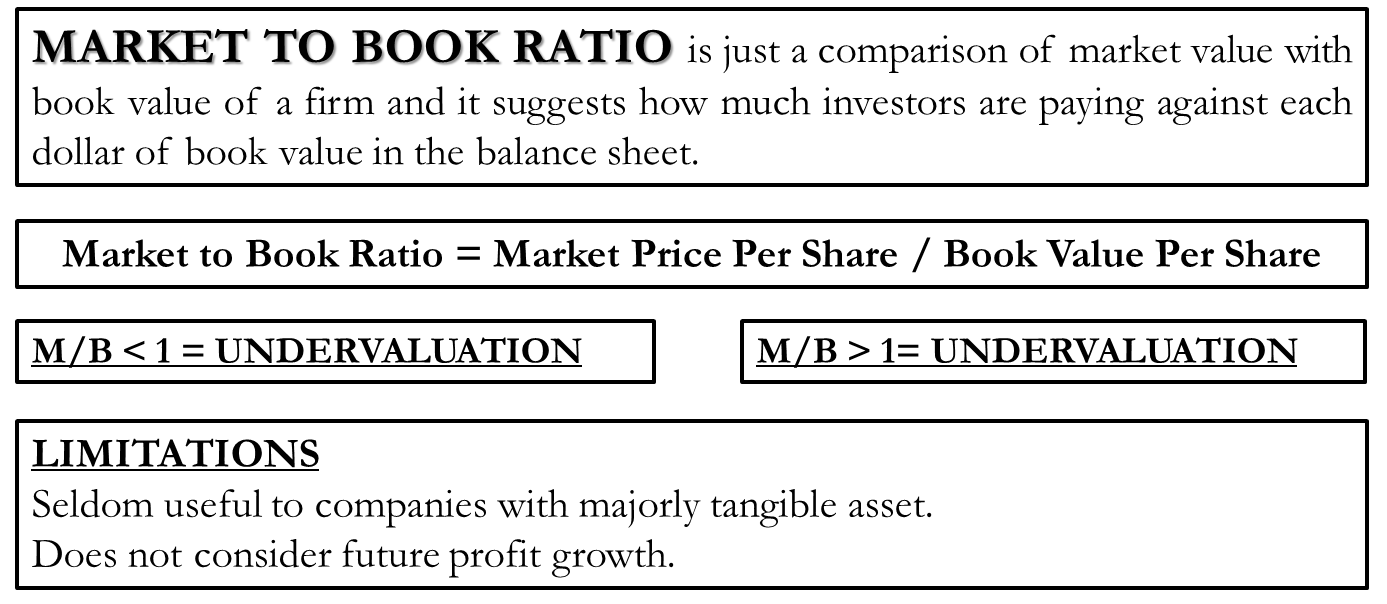

The market-to-book ratio is simply a comparison of market value with the book value of a given firm. In other words, it suggests how much investors are paying against each dollar of book value on the balance sheet. Also known as a price-to-book value, this ratio tries to establish a relationship between the book values expressed in the balance sheet and the actual market price of the stock. Arithmetically, it is the ratio of market value to book value.

What are Market Value and Book Value?

Market value is the value derived by multiplying the stock price by the number of outstanding shares. In simple words, we can also call it market capitalization. On the other side, book value is a value derived from a company’s latest available balance sheet. It is as good as the net asset value of a company, which can be easily ascertained by taking all the assets less depreciation and liabilities.

Calculate using Formula

The market-to-book value ratio can be calculated by using the following formula:

Market-to-Book Ratio Formula

Market price per share/book value per share

OR

Market capitalization / book value

Either of the above formulae can be used for calculating the ratio. The first formula needs per share information, whereas the second one requires the total values of the elements.

How to calculate the Book Values and Market Values for the Formula?

For calculating book values to derive this ratio, an investor can use the following formula:

Book Value = Total Assets – Total Liabilities – Preferred Stock – Intangible Assets

or Book Value = Shareholder’s Equity (Broadly, Equity Share Capital + Reserves and Surpluses)

Market Value = Market Price per share * No. of Equity Shares Outstanding.

Example

Assume there is a company X whose publicly traded stock price is $20, and it has 100,000 outstanding equity shares. The book value of the company is $1,500,000.

Also Read: Market to Book Ratio Calculator

Market-to-book value ratio = 20* 1 00 000 / 1,500,000 = 2,000,000/1,500,000 = 1.33

Here, the market perceives a market value of 1.33 times the book value of company X.

For calculation, you can use our Market to Book Ratio Calculator.

Analysis & Interpretation

Understanding the market-to-book value ratio is important when it is less than 1 and greater than 1. A simple analysis can reflect undervaluation when it is less than 1 and overvaluation when it is greater than 1. Let’s check below for a more in-depth understanding and interpretation of the ratio.

Market-to-Book Ratio Less Than 1

Undervaluation – An Investment Opportunity

A normal investor would look at this as an investment opportunity. The basic assumption behind this is that most businesses have a higher market value than their book values. The assumption is also true for a majority, and the reason is simple. The books of accounts record assets at their purchase price. A business having purchased an asset, say a piece of land or a building 20 years ago, must have much higher market realizable values due to the appreciation in real estate prices. In the balance sheet, the balance is shown at the purchase price, so the book value is nowhere close to the real fair market value of the business. Apart from these, there are intangible assets that the business has created over the course of time. Most businesses have not valued them in their books.

Overvaluation – Misrepresented Books

If we drill deep down, a ratio less than 1 means that the market does not perceive value as equal to book value. In a less-than-ideal investment scenario, an investor might smell some problem with the corporation. He may think that the value of assets presented in the balance sheet may not be realizable in the open market in the case of liquidation. Perhaps, in the case of liquidation, selling off the assets will not realize a value equal to the company’s book value. This may generally happen when some technologies become obsolete. A machine whose technology is no longer useful in the market will seldom find any buyers. Books may have any purchase value assigned to them.

Market-to-Book Ratio Greater Than 1

Overvaluation – Book Values are Dynamic

In general, for an M/B greater than 1, you can interpret it as overvaluation, but only when the book values are dynamic. By this, we mean that the book value inculcates the true fair market values of all the assets and has included the values for intangible assets, etc.

Also Read: Book Value of Equity

Undervaluation – Book Values just an Accounting Figure

We do not recommend using only this ratio to judge the overvaluation of the business. Below are the reasons that undercut the reliability of book values for any major analysis.

- Book values normally ignore intangible assets’ fair value.

- Book values represent historical values. The current fair value of the assets may be much different from the balances on the balance sheet, as explained above.

- These values also do not consider future growth potential in earnings.

Given those reasons, book values can just be seen as an accounting figure. Even a market-to-book value ratio just greater than 1 may not mean overvaluation. It may even mean an undervaluation of the business. It may possibly be worth 10 times the book value. For example, Apple had this ratio ranging around 9 as of October 2018, and Amazon ranged at around 20.

Before making any decision based on this ratio, we recommend comparing this ratio with that of other industry peers. Also, we recommend using other financial analysis ratios and the B/M ratio.

Limitations

Like any other financial metric, the market-to-book ratio also suffers from some limitations. The primary issue is that it ignores a company’s intangible assets, such as goodwill, brand equity, patents, etc. In today’s business world, it is well accepted that intangible assets have real value. There are also ways to bring them to the balance sheet, but every corporation has not necessarily already done this. It also ignores the prospective earnings growth of a business.

Therefore, this ratio is seldom meaningful where a corporation has majorly intangible assets, such as software, know-how, knowledge-based companies, etc.

Uses

This ratio is primarily useful for existing and prospective investors simply because it is in their interest to know whether a company is under or overvalued. It best suits in valuing a company in the fields of insurance, finance, real estate investment trust, etc.

Price-to-Book Ratio

Price-to-Book Ratio is just another name for the market-to-book ratio. There is no difference between the ratios in terms of their formula, analysis, or interpretation.

Read about other types of Market Value Ratios.

Quiz on Market to Book Ratio

Market to Book Ratio

This is a very good article and provide a best information

Cheers, I really think I will be back to your website.

Hello there! I just would like to give you a huge thumbs up for your great info you have right here on this post. I am coming back to your web site for more soon.

I kinda got into this web. I found it to be interesting and loaded with unique points of view.

Please correct the mistake.

you have mentioned M/B1 as undervalaution