In capital budgeting, one may use any among the various methods: NPV or IRR vs PBP vs PI. It is to decide about the feasibility and commercial viability of a project under consideration. However, such methods do not consider the value of any operating (real) options that may come with the project. Also, these traditional methods do not consider any flexibility that a company may add to the project. This is where real options come in. They give businesses more options to evaluate the effectiveness of the project. There are different types of Real Options in the Capital Budgeting process.

Real Options

To take care of these practical aspects and situations, Capital Budgeting offers various Real Options that businesses can use.

Example

One simple example of the real options is: where a business has an option to end a project before completion. Provided it is of the firm belief that the earnings of the project will not be as per the expectations. This would help the business cut further losses and minimize the overall losses.

Fundamental Principle

The real options in capital budgeting work on the same fundamentals as the financial options. So, it is important that you know what options are before understanding the real options in capital budgeting. In simple words, options represent a right but not an obligation. And the same concept applies to the real options as well.

Another name for real options is strategic options.

Value Add

- Basically, these options are the opportunities that are part of the investment projects. And offer additional value to the usual capital budgeting decisions.

- Also, the real options enable businesses to change their cash flows as well as risk profile to make the project more acceptable and profitable.

- Moreover, the presence of these options gives businesses more chances or opportunities to make the project successful. Or, we can say these options help prevent the wastage of resources (if the project fails).

- Additionally, these options could help make the project even better and more successful than what was initially planned.

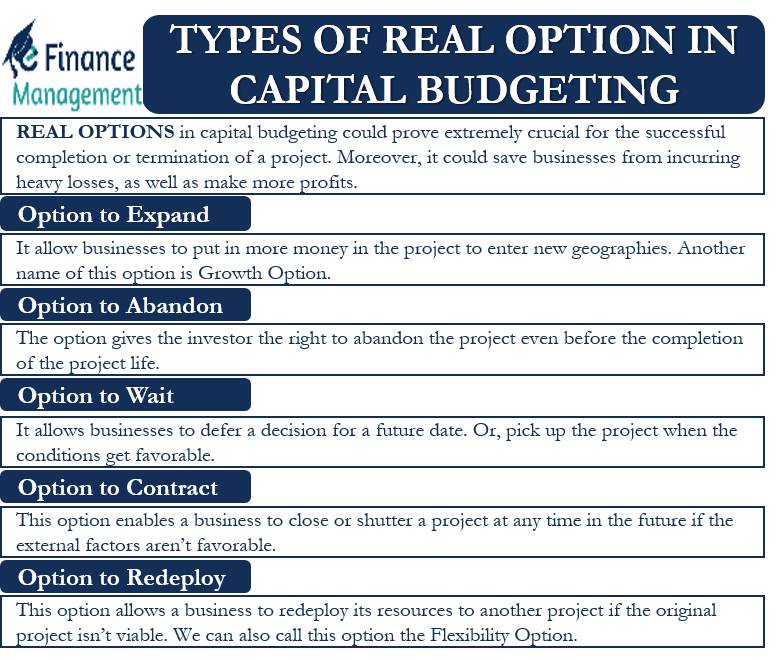

Now that we know what real options are let us look at the types of real options in capital budgeting.

Types of real Options in Capital Budgeting

There are five main types of real options in capital budgeting. Following are the types of real options in Capital Budgeting:

Option to Expand

Such an option allows businesses to invest more in the future to further expand their operations. Or, we can say that it allows businesses to put in more money into the project to enter new geographies. Another name for this option is Growth Option.

Also Read: Capital Budgeting

Usually, in this option, the initial project may not be worth investing in as it would have a small or negative NPV. But, the option to expand further makes this project somewhat attractive. This is because additional investment gives the project an opportunity to improve NPV in the future.

If there is an option to expand, the project is worth investing only and only when the project earns more than the additional investment needed to complete the expansion.

Option to Abandon

As the word implies, the abandonment option allows the investor to cease or abandon the project to realize its salvage value. The option gives the investor the right to abandon the project even before the completion of the project life. Such an option is very useful as it helps to minimize the losses if the project does not go as per the expectations.

Moreover, this option gives the holder the right to sell the remaining project or cash flows at the salvage or scrap value. Such an option works like American Put Options. Generally, the holder sells or abandons the project if the PV of the remaining cash flows is less than the liquidation value.

Such a type of option is very crucial for capital-intensive projects like airlines, nuclear plants, and more.

Option to Wait

Such an option allows businesses to defer a decision for a future date. Or pick up the project when the conditions get favorable. For instance, a manufacturing firm may delay its decision to buy a new plant by later this year or the next year. Another name for such an option is the Timing Option or Option to Delay.

Generally, a company rejects a project if its NPV or IRR is less than the cost of capital. However, it is possible that a project that is less valuable today gets more valuable later. This is where the option to wait comes in handy, as it does not scrap the project but rather keeps it on the back burner till the conditions improve or turn favorable.

Option to Contract

This option enables a business to close or shut a project at any time in the future if the external factors are not favorable. For instance, a foreign company may decide to end its business in a country if it is facing political instability.

Option to Redeploy

As the word suggests, this option allows a business to redeploy its resources to another project if the original project is not viable or remains no more viable. Or where another lucrative opportunity has come up. We can also call this option the Flexibility Option. It is only logical for a business to use this option if the PV from the cash flows of a new project is more than the cost that the business would incur to redeploy its resources to a new project. Such an option is extremely crucial for agricultural and utility projects.

Final Words

Real options in capital budgeting could prove extremely crucial for the successful completion or termination of a project at the right juncture. Moreover, it could save businesses from incurring heavy losses and make more profits. Businesses can choose from the above types of real options in capital budgeting depending on the requirements of the project and their financial goals.