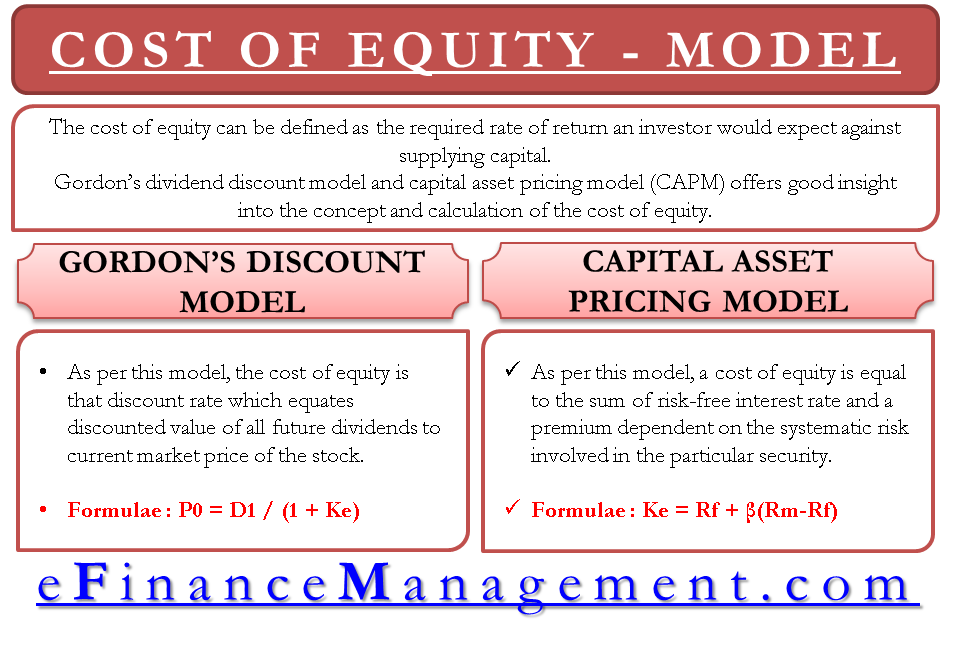

The cost of equity can be defined as the required rate of return an investor would expect against supplying capital. The Expected rate of return has a direct relationship to risk. The higher the risk, the higher would be the expected returns. Gordon’s dividend discount model and capital asset pricing model (CAPM) offer good insight into the concept and calculation of the cost of equity. Let us see more about the models for calculating the cost of equity.

The cost of any security is the return that a company pays for using the capital. Like interest cost, at a specified percentage, is the cost of debt capital. Similarly, a dividend, at a specific rate, paid to preference shareholders is the cost of a preference dividend. If we think similarly, what is the return to equity shareholders? Return is in the form of dividends. But, dividend payment by any company is not fixed at a specified rate. It is not even mandatory by law, unlike other securities – debt and preference shares.

Models For Calculating Cost of Equity

Fundamentally, there is no direct measure of the cost of equity. In the absence of that, it isn’t easy to measure the cost of equity. There are various models to help us find the cost of equity-based on various assumptions. Let’s look at the most prominent models for estimating the cost of equity.

Gordon’s Dividend Discount Model

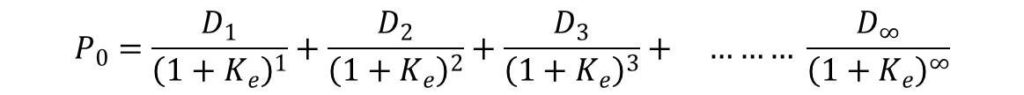

This model is also known as the discount capitalization model. As per this model, the cost of equity is the discount rate that equates the discounted value of all the future dividends to the stock’s current market price. It assumes that the present value of all the future dividends reflects in the market price of the stock. In the form of a formula/ equation, it is represented as below:

Also Read: Cost of Equity (CAPM Model) Calculator

In the above equation, P0 is the current market price, D is the dividend year-wise, and Ke is the cost of equity.

The equation will be simplified if the growth of dividends is constant. Let us suppose the growth to be ‘g.’

Capital Asset Pricing Model (CAPM)

This model is very well-known and widely used in the industry. As per this model, a cost of equity equals the sum of a risk-free interest rate and a premium dependent on the systematic risk involved in the particular security. This model directly focuses on the relationship between the risk and the required return. The following formula/equation expresses the views of cost of equity using CAPM:

Cost of Equity = Rf + β*(Rm-Rf)

Here is the cost of equity, is the risk-free rate, is the expected return for the market portfolio and is beta.

Beta (β): Beta represents a systematic risk in the equation. Systematic risk is that risk that is not avoidable by diversification.

Expected Return of the Market Portfolio (Rm): It is the average return of all the market securities. Some market securities pay higher and some others lower than the market portfolio’s expected return.

Here, the second part of the equation is the deciding factor. The cost of equity depends on the beta. If the beta is 1, the security’s required rate of return would be equal to Rm. If the beta is less than 1, it would be lower than Rm and vice versa.

Read Cost Of Capital to learn more about cost of other sources of capital.