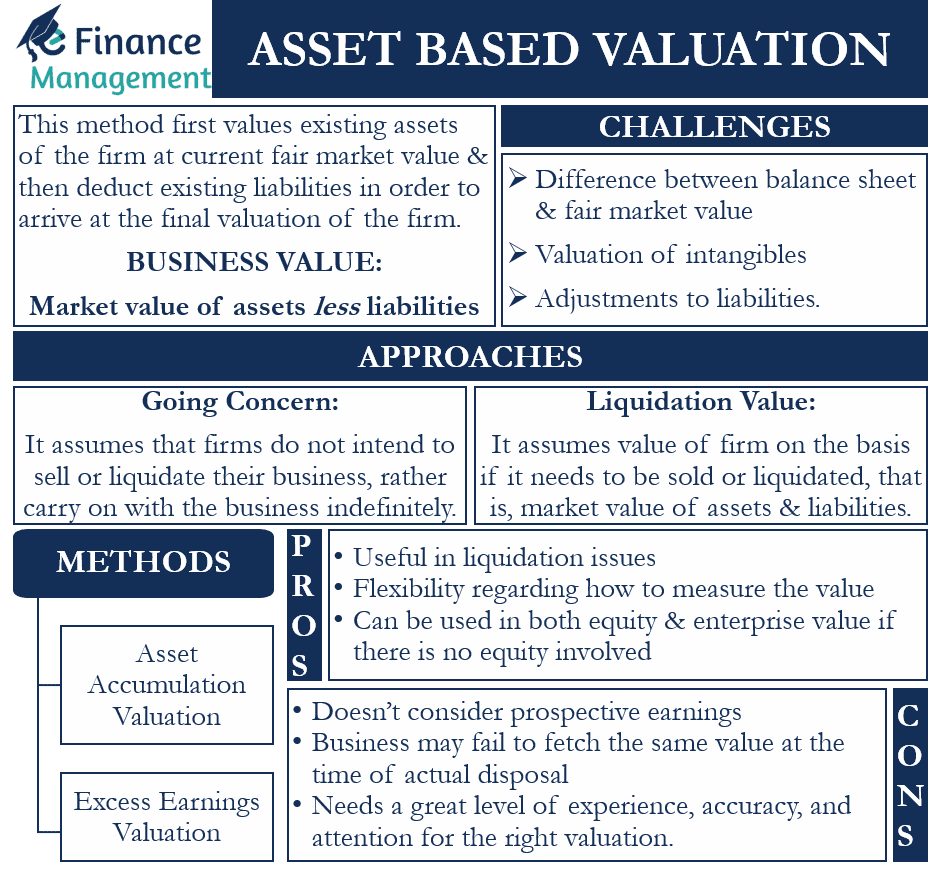

Valuation of a firm is an important aspect of the business and financial world. And Asset Based Valuation is one of the ways to value a firm. This method first values the existing assets of the firm at the current fair market value. Then the existing liabilities of the firm are deducted to arrive at the final valuation of the firm. In a nutshell, we can say that asset-based valuation represents the cost of recreating the same business now. Or it can be the replacement value of the firm.

For instance, assume a firm owns a land. Over time, the value of land would rise, and this would raise the valuation of the company if it is using the Asset Based Valuation.

Thus, the focus of this method is on the net value of the assets. That the firm currently carries. And that is the difference between the total assets and its total liabilities.

It is one of the most popular methods of valuation. Because it considers the total value of the assets of a company, including tangibles and intangibles, also, such a valuation could prove extremely crucial when management wants to sell a company. Because this valuation will give the management and the outsiders an idea of what value the firm should command. Or at what value the firm should be selling around.

Also Read: Liquidation Value Method of Equity Valuation

Asset-Based Valuation – Approaches

This valuation method requires an accountant or analyst to follow one of the below two approaches:

Going Concern

In this approach, first, the value of the assets of the firm is listed at the net value. That is the value net of depreciation, impairment, etc., as reflected in the balance sheet of the firm. After that, the existing outside liabilities of the firm are reduced to arrive at the final net asset value of the firm. Such an approach is primarily for the firms that do not intend to sell or liquidate their business. Instead, plan to carry on with the business indefinitely. Therefore this calculation is straight from the annual reports, and no modification is made to that.

Liquidation Value

Under this approach, the basic concept is to value the firm as if it needs to be sold or liquidated. Hence, it requires a business to quickly calculate its net cash value. This net cash represents the cash that a company gets after selling its assets. And after paying all its liabilities. The value of a business under this approach is less than the value one gets under the going concern approach. Or we can say the business will usually get a depressed value. This is because of the urgency factor when estimating the liquidation value.

Asset-Based Valuation Methods

This method involves subtracting assets from liabilities to get the value of a business. Therefore, its default value equals the book value of shareholders’ equity. However, we need the fair market values of the assets and liabilities. So this results in a deviation from the shareholders’ equity value. We will discuss below the two most popular Asset-Based Valuation methods:

Asset Accumulation Valuation

This method works very similarly to the balance sheet representation. Here, we need to compile the assets and liabilities. And then assign a current fair market value to each of the items of the assets and liabilities. Therefore, again the value of the firm remains the difference between its value of assets and liabilities.

Also Read: Equity Valuation Methods

While this method sounds quite simple, but one needs to be careful when identifying assets and liabilities for valuation. Also, assigning the right fair values to the assets and liabilities is a demanding job.

Further, there are a few items that do not usually show up on the balance sheet. But we do consider them for valuation. These items are generally intangible assets, such as patents, trademarks, goodwill, etc.

Similarly, there are a few liability items that do not show on the balance sheet. But we need to consider them for valuation. Such liabilities are usually provisional liabilities, such as unresolved legal cases.

Excess Earnings Valuation

This valuation method considers income as well as assets method to come up with the value of a firm. Thus, it is a hybrid method where income and assets are both taken into consideration. One can also use this method to come up with the value of goodwill of the firm. To calculate the goodwill, we need to use the earnings as input and then apply the income method. Its usefulness for goodwill is why analysts prefer the Excess Earnings Valuation method when valuing a firm with strong goodwill.

Pros and Cons of Asset Based Valuation

Below are the pros of this valuation method:

- This method of valuation can prove extremely useful when a company is facing liquidation issues.

- One can also use this method to value firms in the investment segment.

- We can use this method for both equity value and enterprise value, but only if there is no equity involved.

- Even though this method considers the assets and liabilities for valuation, it gives flexibility in deciding the assets and liabilities to consider for valuation. Also, it provides flexibility regarding how to measure the value of each.

Below are the cons of this valuation method:

- Unlike other popular valuation methods, this method does not consider the prospective earnings of a firm.

- In reality, a business may fail to fetch the value it gets on the basis of the asset-based method when it actually goes for disposing of its assets.

- As said above, some off-balance sheet items may also need to be considered in this method. So, measuring those items could get difficult.

- This method of valuation may sound simple. But it actually needs a great level of experience, accuracy, and attention to come up with the right valuation. Therefore, in the absence of proper data and experience, many companies may not be able to get an accurate valuation.

Challenges

- One major challenge with this valuation method comes up when one needs to adjust net assets. The values on the balance sheet do not show the fair market value because it shows the assets’ value at cost price less depreciation.

- Another issue that many faces are regarding certain intangible assets for whom the balance sheet does not reflect the full value. Or the balance sheet does not show these intangibles at all.

- Moreover, there are certain intangibles (trade secrets) that a company would not want to value. But for the purpose of this valuation, the company would have to value it. Valuing such intangibles could also become a challenge for the company.

- Lastly, a firm may also face challenges when making adjustments to liabilities. Making market value adjustments to liabilities could raise or deflate the value of liabilities. And this would eventually impact the adjusted net assets calculation.

Final Words

Asset-Based Valuation is a relatively simple and straightforward method to arrive at a valuation. Analysts prefer this method because one can apply this method even in cases when a firm is suffering from liquidity issues. Also, analysts prefer this method for valuing core niches, such as the real estate industry. However, to accurately execute this method, one needs a lot of experience.