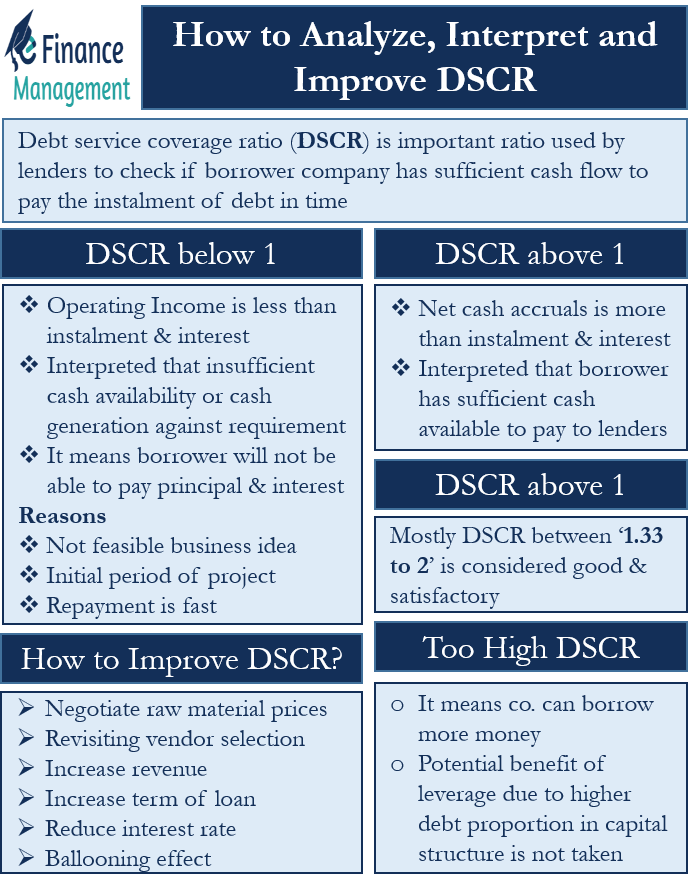

The debt service coverage ratio (DSCR) is a very important ratio used extensively by lenders to check if the borrower company has sufficient cash flow to pay the installment of the debt in time. Many times, the decision to extend a term loan depends on this ratio.

A company in need of a long-term loan prepares projections for future periods to establish and ascertain the viability and feasibility of the project. The lenders are interested in the period for which they are extending a loan. For example, a term loan is to be sanctioned for 10 years. The DSCR for each of these 10 years will be calculated, and all of them should be more than ‘1’ at least. And the overall average DSCR should be more than 1.33:1.

Read Debt Service Coverage Ratio for details.

How to Analyze / Interpret the Debt Service Coverage Ratio (DSCR)?

For a particular financial year, the Debt service coverage ratio result is an absolute number. This number has different implications if it is below or above ‘1’.

DSCR below 1

First, let us understand why DSCR will be below ‘1’. It is simply because the numerator (Operating Income) is less than the denominator (installment and interest). It can be interpreted as insufficient cash availability or cash generation against the requirement. A lender is only interested and comfortable in extending the loan if the repayment of principal and interest of the proposed loan is reasonably possible. Here, when the Debt service coverage ratio is less than ‘1’, the borrower will not be able to pay that. This is why it is not a desirable situation.

Also Read: Debt Service Coverage Ratio (DSCR)

Reasons for DSCR below ‘1’ could be that the business idea is not feasible, and it is not possible to make a profit out of it. This could also be that in the initial period of the project, the DSCR is less than 1.

Another reason could be the term of the loan. If the loan term is too small, the repayment is fast, and the installment amount would be big, driving DSCR down. Considering the viability and business model of the company, the lenders can make changes in the schedule of repayment. It can increase the term of the loan or can give a ballooning effect to the installments. Adjusted and average DSCR is used when such kind of situations persists.

DSCR above 1

Let us understand when a DSCR will be above‘1’. If the numerator (net cash accruals) is more than the denominator (installment and interest), the logic is the same. It can be interpreted that the borrower has sufficient cash available to pay to the lenders (installments and interest thereon). In this case, the lender will lend the money because repayment is possible. Now, we can say the situation of ‘DSCR above 1’ is better than ‘DSCR below 1’. Still, we are not clear what should be the ideal situation. Let us try and understand that.

Ideal DSCR

Generally speaking, the higher the ratio better it is. Still, we need some benchmarks to decide. Below that benchmark, it is not acceptable, and above that, it is acceptable. Mostly DSCR between ‘1.33 to 2’ is considered good and satisfactory. Why do we need a DSCR of more than ‘1’ because it is calculated based on the projections? There is always a risk of projections not turning out correctly. There may be abnormal periods in between. This calls for a margin of safety. It is understood that anything above ‘1’ increases the possibility of timely payment by the borrower. Norms for ideal DSCR may vary with different countries, different types of loans, different industries, etc.

Also Read: How is DSCR Calculated?

Too High DSCR

Do we mean a DSCR of more than 2.5, 3, 4, etc., is too good? What does it mean? Too high a DSCR means the company can borrow more money, but it is not borrowing. In other words, the potential benefit of leverage due to higher debt proportion in the capital structure is not taken. Higher debt in the capital structure brings down the overall cost of capital because debt is the cheaper source of capital for a business. But it has to be seen from the industry status, cyclical nature of the industry, and so on. Since long-term loans are provided for a period of 5-15 years, hence, the cyclical nature plays an important role. The DSCR, which looks quite good at 2.5 or so, may prove inadequate in times of recession and oversupply/overcapacity situations.

How to Improve DSCR?

Regular servicing of debt indicates a good credit record for any company. This credit record creates a reputation among investors in the market. Therefore, for the smooth functioning of a business and to keep the availability of funds when required, a finance manager should focus on debt servicing on a regular basis.

Negotiate Raw Material Prices

Any reduction in expenses can increase the profit after tax and thereby have an increasing effect on DSCR. The expenses can be reduced by negotiating and revising the contracts with suppliers of materials, consumables, etc.

Revisiting the Vendor Selection

By a tender system of vendor selection, the quotation by various vendors can be compared, and the vendor with the best prices and acceptable quality can be appointed. Once the purchase process is improved, the efficiency and cost-saving due to this would be reflected in the PAT, and that, in turn, will improve the DSCR.

Increase Revenue

An Increase in revenue can help in improving the PAT and, thereby, DSCR. The increase in revenue can be achieved by increasing the volume of sales or increasing the price of the product. Or a mix of both strategies. The quantity increase can be achieved with increased orders, marketing, advertisement, etc. A higher price can be achieved by either differentiation of the product or better product quality.

Increase Term of Loan

Increasing the loan term would decrease the installment amount each year. That will reduce the denominator and thereby increase the DSCR.

Reduce the Rate of Interest

The amount of interest is a part of the denominator of the DSCR formula. If the interest rate is reduced to some extent, the interest amount will reduce, resulting in a decrease in the installment amount. That would decrease the denominator and hence would improve the DSCR.

Debt Service Reserves

These reserves are the reserve funds a company maintains to ensure full and timely payment of debt service amount. The reserve may be accumulated in the reserve fund out of the debt acquired or revenues over a period of time. Terms and conditions of some debts or bonds may compulsorily require the company to maintain such reserve. It is also another way of ensuring the borrower’s timely serving of debt service obligations.

Ballooning Effect

It is common for all new businesses that the cash flow in the initial periods is low due to lower capacity utilization. Adjusting the installment in line with the cash flow, i.e., keeping lower installments for the first few years and then increasing them in the later period, is called the ballooning effect. This makes the DSCR comfortable for both initial and later years. Otherwise, the DSCR would be too low in the initial period and too high in the later periods.

Very good