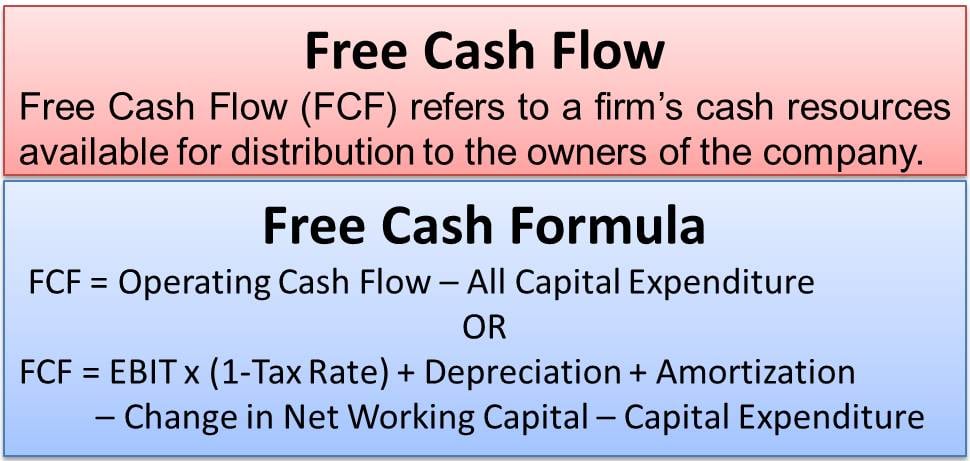

Definition of Free Cash Flow

Free Cash Flow (FCF) or Free Cash Flow to Firm (FCFF) forms a part of the working capital analysis of a firm. Working Capital refers to the cash available to invest in the normal operations of an entity’s business. The Operating Profit of a firm is used to make capital expenditures to expand the asset base. After making such capital expenditures, the residual amount is available for distribution to all the owners of the entity, i.e., shareholders.

Description of Free Cash Flow

An entity’s financial performance depends on the Free Cash Flow. It represents how a company can manage to enhance its shareholders’ value after boosting asset expansion. FCF ultimately accounts for all the cash a company generates after deducting its capital expenditures. Such as the purchase of property and equipment. The excess cash helps settle debts, research, and development, expand the business and pay dividends to the entity’s shareholders.

Free Cash Flow is relatively a more transparent metric than PE Ratio. Because it is not as easy to manipulate cash flow. Public companies find FCF as an extremely beneficial indicator for the company’s performance.

FCF is an important investment guide for the shareholders of a company because it represents how much the company gives back. It also helps in the growth of its investors. A company with steady growth in FCF is a good indicator of financial health.

Also Read: FCFE Calculator (Free Cash Flow to Equity)

However, at times entities may have a negative cash flow. This may not be a bad sign if a company uses all its excess cash to invest in new capital expenditures. In such cases, it is advisable to study the returns made on such huge investments, which might give a better payoff if they are high.

Free Cash Flow Calculation

We can calculate free cash flow using the cash flow statement.

- FCF = Operating Cash Flow – All Capital Expenditure

- FCF = EBIT x (1-Tax Rate) + Depreciation + Amortization – Change in Net Working Capital – Capital Expenditure

Where,

Change in Net Working Capital = Current Assets – Current Liabilities

Free Cash Flow Example

Let’s take an example of a hypothetical company ABC.

The company is expected to be an excellent investment due to its promising rise in FCF in the near future.

In the Fiscal year 2017, the company earned a record profit of $ 4.8 Billion. Its operating profit margin increased from 18% to 21%, which is expected to rise through 2017.

ABC’s capital expenditure for 2017 was 2.2 Billion, and in 2018 it is expected to go to 3 Billion. Expecting higher revenues and profits the next year, the FCF of company ABC will probably be more than double in 2018.

Refer to Free Cash Flow to Firm Calculator and Free Cash Flow to Equity Calculator.

Conclusion

FCF is considered to be a good way to know any given entity’s financial performance in a year. Investors prefer it due to the fact that cash flows are difficult to fake compared to other metrics where window dressing is possible to show a better condition than in reality. For an investor, personal growth and returns are important aspects. Hence, the Equity Price to FCF ratio is a common method used by investors to understand if a company is worth its investment or not. It also helps in arriving at enterprise value. It is a very popular method of equity valuation.

Also Read: Free Cash Flow to Firm Calculator

The only issue with FCF is that it can be measured and interpreted differently by different persons, creating an element of confusion. A company generally mentions the method of calculation of FCF, which is followed for the company’s profit estimation every year on a similar basis to avoid mix-ups and distortion.