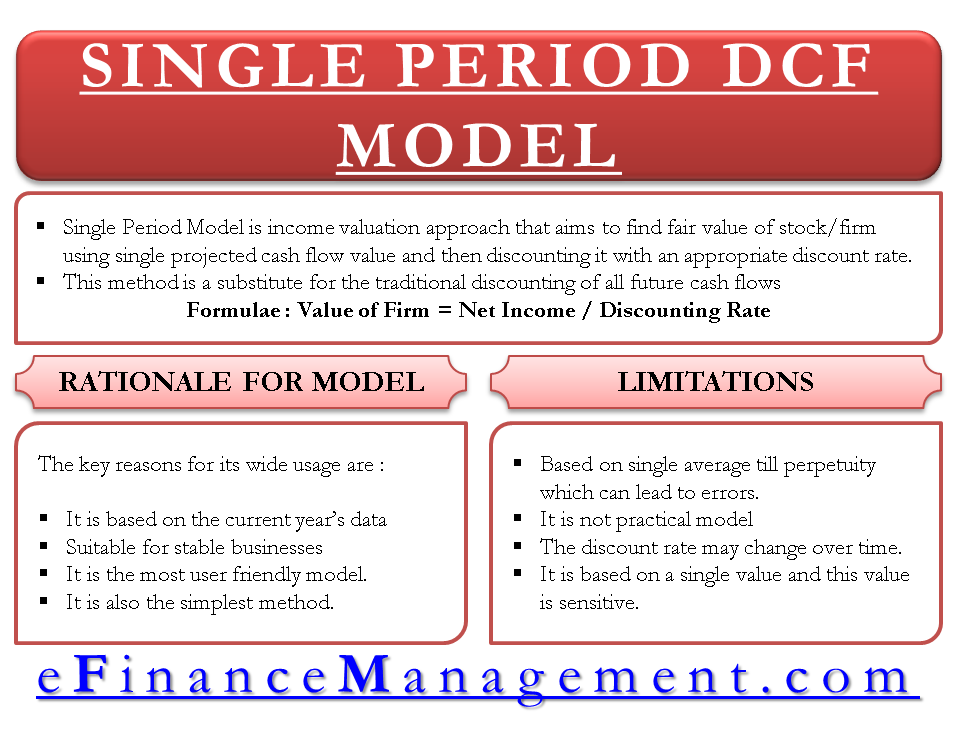

Single Period Model, one of the discounted cash flow models, is an income valuation approach that aims to find the fair value of a stock/firm using a single projected cash flow value and then discounting it with an appropriate discount rate. Taking all future cash flow streams into one single period and discounting is also referred to as “Earnings Capitalisation.”

This method substitutes the traditional discounting of all future cash flows. However, since it is a “single period” model, we need a single sum of an amount as the cash flow for all future years or a single sum for 1 year holding period.

Formula for Calculating Value of a Firm/Company Using Single Period Model

Value of a firm or company = Net Income / Discounting Rate

Let us understand this approach using the example given below:

Single Period Model Example

Example 1

To estimate the firm’s value, company or project, stabilized net operating income is divided by an appropriate discount rate. Assuming a stable earning (net of expenses) of USD 300,000 per annum and a discount rate of 12%, the value of the firm can be calculated as follows:

Value = Net Income / Discounting Rate

= $ 300,000 / 0.12

= $ 2,500,000

If a growth number needs to be adjusted to the model, assuming a constant growth of 5%, the value of the firm can now be calculated as follows:

Value = Net Income / Discounting Rate

= $ 300,000 / (0.12 -0.05)

Now,

= $ 300,000 / 0.07

= $ 4,285,714

When the discount rate and growth rate are assumed to remain constant from a day of valuation till perpetuity, the single-period model will yield the same results as the multi-period model.

Example 2

The same approach under the dividend discount model can be used for calculating the fair value of a stock with a holding period of 1 year. Assuming a $ 5 dividend is expected after 1 year, and the stock price is expected to be $ 20 after a year, the value of the stock can be calculated assuming a discounting rate of 12% as follows:

Value = D1/ (1+r) + P1/ (1+r)

Where,

D1 is the expected dividend after 1 year

P1 is the expected price after 1 year of the holding period

r is the required rate of return (discounting rate)

Value of the stock = $ 5 / (1.12) + $ 20 / (1.12)

= $ 4.46 + $ 17.86

= $ 22.32

Rationale for Using Single Period Model

This model is one of the simplest models to understand and calculate the value of a firm/company/project and is still being used; however, certain limitations exist. The key reasons for the wide usage of this model are as follows:

Based on Current Year Data

Under the single-period model, we do not need to forecast future cash flows, and current year data available is enough to value the company under consideration.

Also Read: Discounted Cash Flow Model

Suitable for Stable Businesses

This model is best suited for companies where earnings are stable and easily predictable. In such a case, it becomes easy to assume an average earning amount that shall be received for the remaining life of the company.

User-Friendly and Simple Model

Since an assumption can be made that earnings and expenses will grow at the same rate as the long-term growth rate for cash flows, one need not estimate earnings and expenses separately. This makes this model extremely user-friendly as one can take the current financial data from annual reports and attach a constant growth rate to it.

Though the model enjoys simplicity and ease of use, it limits its usage due to some limitations which need to be considered for a thorough understanding of the model.

Limitations of the Single-Period Model

Based on Single Average

It assumes a single average and stable net cash flow/income till perpetuity which can lead to substantial errors in valuation if the company under consideration is cyclic or is in the growing stage or decline phase or any other case where profitability or cash flows keep fluctuating.

Not Practical

The single period model assumes revenues and expenses increase at the same rate and hence considers a constantly grown rate for net income. However, in reality, expenditure may, in some cases, reduce over time due to economies of scale. In some cases, expenditure may increase faster than revenues as companies may incur additional capital expansion or advertisement expenditures. Since the rate at which revenues and expenses may not always, in all circumstances, grow at the same rate, this model may face errors in valuation due to the impractical approach.

Different Discount Rate

The discount rate (also known as the capitalization rate) may change over time. The discount rate calculated using the Capital Asset Pricing Model (CAPM), which pertains to equity, may not be the discount rate applicable to the net income in the real world scenario.

Sensitivity

Since only one value is estimated and then discounted, the said value is more sensitive than the multi-period model in estimation.

Conclusion

The single period method of valuation is best suited in cases of stable net income flows or cases where it is extremely difficult to forecast future series of cash flows or in cases where the holding period of the investment is 1 year. However, selecting the appropriate discount rate may remain a challenging task and would entail estimation errors.

For limitations faced with single period error, the improved model, which involves using multiple cash flow forecasting and discounting them, is used to reduce the estimation error. The said model is also known as Multi-Period Discounted Cash Flow Model.