Equity Valuation – Meaning

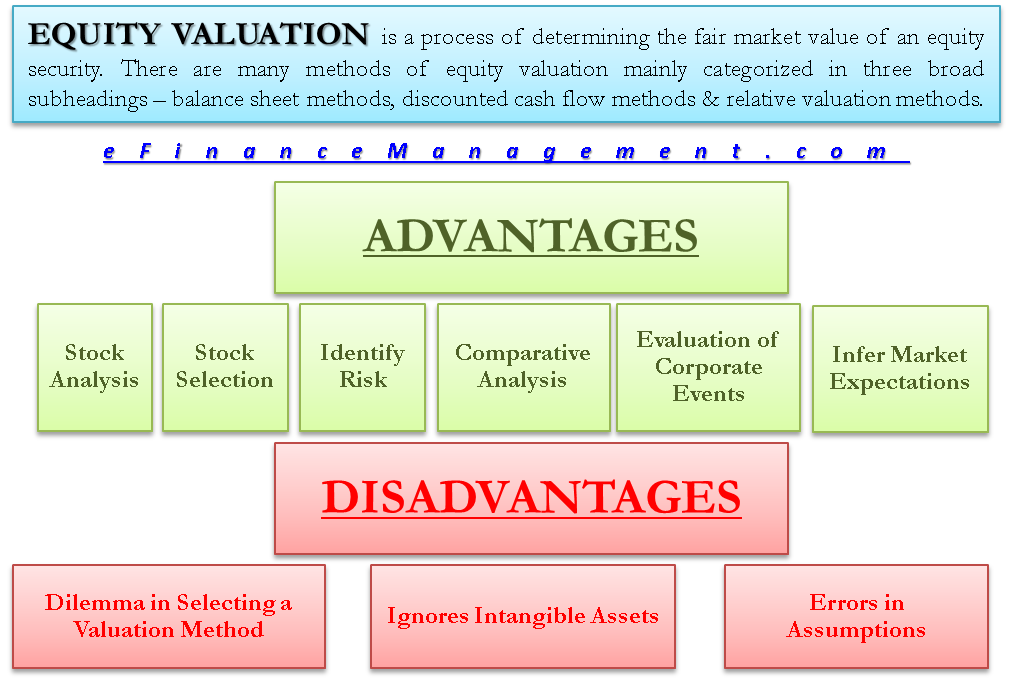

Equity valuation is a process of determining the fair market value of equity security. There are many methods of equity valuation mainly categorized in three broad subheadings – balance sheet methods discounted cash flow methods & relative valuation methods. There are many advantages and disadvantages of equity valuation, which are as follows:

Advantages of Equity Valuation

Helps in Stock Analysis

As we know, there are many methods of equity valuation, such as balance sheet methods, discounted cash flow methods, and relative valuation methods. Each method values an equity stock in a different way. For example, balance sheet valuation methods reflect how strong a company’s financials are, whereas discounted cash flow method reflects how strong is company’s earning potential. Both these method helps to analyze a stock from different perspectives. Analysts can use any method as per the information he wants to analyze, or they can use multiple methods to get a holistic view. Thus we can conclude that an equity valuation is a good tool for in-depth stock analysis.

Helps in Stock Selection

Equity valuation, by different methods, calculates the value of the stock, which is considered fair market value. The fair market value may be above or below the actual market value. The stocks whose fair price is greater than the actual market price are considered undervalued and a good investment. Equity valuation helps find undervalued stocks and thereby helps investors pick the right stocks to make an optimum portfolio.

Helps Identify Risk

Equity valuation, especially when done through the balance sheet method, helps identify the risk areas of the company. These may include questions such as whether the debt is too high? Whether liquidity is too low? Etc. When such factors are identified, investors and analysts can take precautions to avoid stocks that are a red signal for the portfolio.

Also Read: Equity Valuation Methods

Aids Comparative Analysis

When relative valuation methods are used to determine the value of a stock, it becomes easy for the analyst to compare stocks within the sector and industry. For example, suppose the price-to-earnings ratio is used for valuing the stock of company ABC. In that case, it becomes easy for the analyst to compare the price-earnings ratio of company ABC to the price-earnings ratio of its competitors. There are even benchmark price-earnings ratios available for the sector. The analyst has to compare company ABC’s price-earnings ratio to the sector benchmark. This further helps analysts and investors make informed investing decisions.

Evaluation of Corporate Events

Investment bankers, corporate analysts, and investment analysts use equity valuation tools to assess the impact of corporate events, including mergers, acquisitions, divestitures, spin-offs, management buyouts (MBOs), and leveraged recapitalizations. Such events may affect a company’s future cash flows and thus the value of its equity. Especially in mergers and acquisitions, buyers often use the company’s own common stock as currency for the purchase. Investors need to know whether that stock’s price is reasonable or not. Furthermore, valuation is a key factor in assessing the fairness of a merger’s terms.

Inferring Market Expectations

There are times when the market is bearish & then there are times when the market is clearly bullish. Sometimes though, market signals may not be so clear, and investors might have confusion about the market direction. This is when equity valuation comes to the rescue. The idea is to arrive at the fair value of each stock and compare it with the prevailing market rates. If the market is overvaluing most stocks, then investors view the market positively, and the expectation from the market is good. On the other hand, if the market undervalues most stocks, it is a negative signal.

As we have seen about the advantages of equity valuation, let us see its disadvantages.

Disadvantages of Equity Valuation

Dilemma in Selecting a Valuation Method

There are multiple methods of valuing equity, and each method has a different perspective. It sometimes becomes difficult for an analyst to determine which method is suitable. It gets even more difficult if each method results in a different value, and analysts must decide which value to follow. For example, a growing start-up may not have a good equity value as per the book value method because it is financially unstable, but it might have a very good equity value as per discounted cash flow method because it is in the high growth stage and might have very good future cash flows. The question is, which valuation to consider? Which value is more reliable? This is a matter of subjective judgment of the analysts & investors.

Also Read: Market Value Ratios

Ignores Intangible Assets

None of the equity valuation methods consider intangible assets of the company, such as brand loyalty, customer retention, and ownership of intangible assets. These assets are invaluable to any company, and the value of these assets will increase in the future. By not considering these assets, we ignore an important asset class of a company. This results in flawed equity valuation & wrong investment decisions.

Errors in Assumption

When valuing a company’s equity, analysts make many assumptions, such as the company will reinvest its earnings or the company will have x amount of cash flow each year. But these assumptions may be wrong. The company may not re-invest its income or may not earn the estimated cash flow. Even if such simple assumptions go wrong, it can affect the value of its equity and lead to wrong decisions.

Thus before using equity valuation methods to analyze stocks, it is important to consider all its benefits and drawbacks to make informed investment decisions.

Thanks your work is very comprehensive

It’s hard to find knowledgeable people for this subject, but you seem like you know what you are talking about! Thanks

Thanks for the compliment.