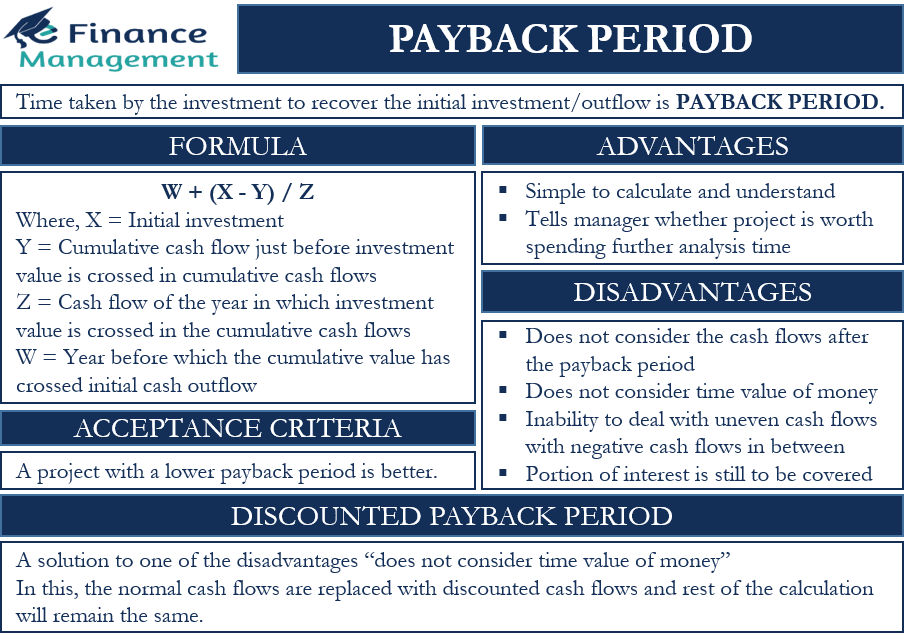

The payback period (PBP) is an investment appraisal technique that tells the amount of time taken by the investment to recover the initial investment or principal. The calculation of the PBP is very simple, and its interpretation too. The advantage is its simplicity, whereas there is two major disadvantage of this method. It does not consider cash flows after this period. It also ignores the time value of money.

Definition of Payback Period Method

The payback period is one of the simplest capital budgeting techniques. It calculates the number of years a project takes in recovering the initial investment based on the future expected cash inflows.

How to Calculate Payback Period?

All that is needed to calculate the PBP is simply nothing more than preparing a table and then applying a simple formula/equation.

Let us understand the steps for finding the payback period with the help of an example.

Payback Period Example

Suppose a project with initial cash investment of $1,000,000 with a cash flow pattern from 1 to 5 years – 120,000.00, 150,000.00, 300,000.00, 500,000.00 and 500,000.00.

We will first arrange the data in a table with year-wise cash flows and an additional column of cumulative cash flows, as shown below.

| Year | Cash Flow | Cumulative Cash Flows |

| 0 | (X) -1,000,000.00 | |

| 1 | 120,000.00 | 120,000.00 |

| 2 | 1,50,000.00 | 270,000.00 |

| 3 (W) | 300,000.00 | (Y) 570,000.00 |

| 4 | (Z) 500,000.00 | 1,070,000.00 |

| 5 | 500,000.00 | 1,570,000.00 |

From the above table, we can easily make out that the PBP is greater than 3 but less than 4 years since the cumulative cash flow value crosses the initial investment amount in year 4.

Also Read: Payback Period Calculator

Payback Period Formula

To find out the exact payback period, we can use the following formula / equation:

Payback Period = W + (X – Y) / Z where,

3 + (1000000 – 570000) / 500000

=> 3 + 430000 / 500000

= 3 + 0.86 = 3.86 Years

W is the year before the investment value is crossed in cumulative cash flows, i.e., 3 in our case.

X is the initial investment or the initial cash outlay

Y is the cumulative cash flow just before the investment value is crossed in cumulative cash flows

Z is the cash flow of the year in which the cumulative cash flows cross the investment value.

You can also use our Payback Period Calculator.

Acceptance Criteria / Evaluation / Interpretation of Payback Period

The acceptance criterion is simply the benchmark that a firm sets. Some firms may not find it comfortable to invest in very long-term projects and wish to enter where they can see results in, say, medium to long term. Similarly, others may take the longer-term risk.

To evaluate a project on the basis of this, we can interpret a project with a lower payback period to be better as the investor is standing safely with his money back. Who would not like to get the principal back as early as possible?

Advantages and Disadvantages

The most important advantage of this method is that it is very simple to calculate and understand. If the manager requires a rough idea about the time frame for which the money would be blocked, he need not sit with a pen, paper, or a computer. It can be calculated at our fingertips. It can at least tell the manager whether the project is worth spending additional analysis time or not.

There are two disadvantages to this method. One, it does not consider the cash flows after the PBP. Because of this, we cannot believe two projects with the same PBP as equally good. This method will give the same rating to two projects with the same initial cash flow of 100 million, where the cash inflow of one is 50 million in the first two years, and the other is 50 million for three years.

Also Read: Discounted Payback Period

Second, it does not consider the time value of money. So, it avoids the basic rule of finance, i.e., ‘a dollar today is worth more than a dollar a year later.’ In PBP, we calculate the years for recovering the total investment. In a true sense, only the principle is covered; the portion of interest is still to be covered.

Other drawbacks include its inability to deal with uneven cash flows and negative cash flows. It may result in dual results.

Read Advantages and Disadvantages of Payback Period for a more detailed article.

Discounted Payback Period

It’s a solution to one of the disadvantages mentioned above, which says it does not consider the time value of money. The discounted payback period is slightly different from the normal payback period calculations. We need to replace the normal cash flows with discounted cash flows, and the rest of the calculation will remain the same. It is also referred to as the net present value (NPV) payback period.

Very Educative

so good

Financial management simplified